Startup that offers alternative to home equity lending raises $122M

Startup that offers alternative to home equity lending raises $122M

Trending

Fintech firm completes first-ever Home Equity Investment-backed securitization

Redwood Trust, Inc. co-sponsored Point’s delivery of $146M in securities

Fintech startup Point and finance company Redwood Trust, Inc. have teamed up to deliver what they claim is a historic transaction backed only by residential Home Equity Investment (HEI) agreements.

The two companies announced the deal as the first time a securitization is only being backed by HEI agreements. The transaction closed on Sept. 23, issuing close to $146 million in asset-backed securities.

Point, which claims on its website to “pay you today for a share of your home’s future appreciation,” originated all of the involved HEIs and plans to continue servicing them. About $120 million in unrated senior class A-1 securities and $26 million in unrated senior class A-2 securities comprise the securitization.

This is not the first time HEIs have been used for securitization, Inman reports, although they have been used as part of previous deals. Unlock Technologies and Saluda Grade Asset Management said in August they were the first to close securitization based partly on HEIs.

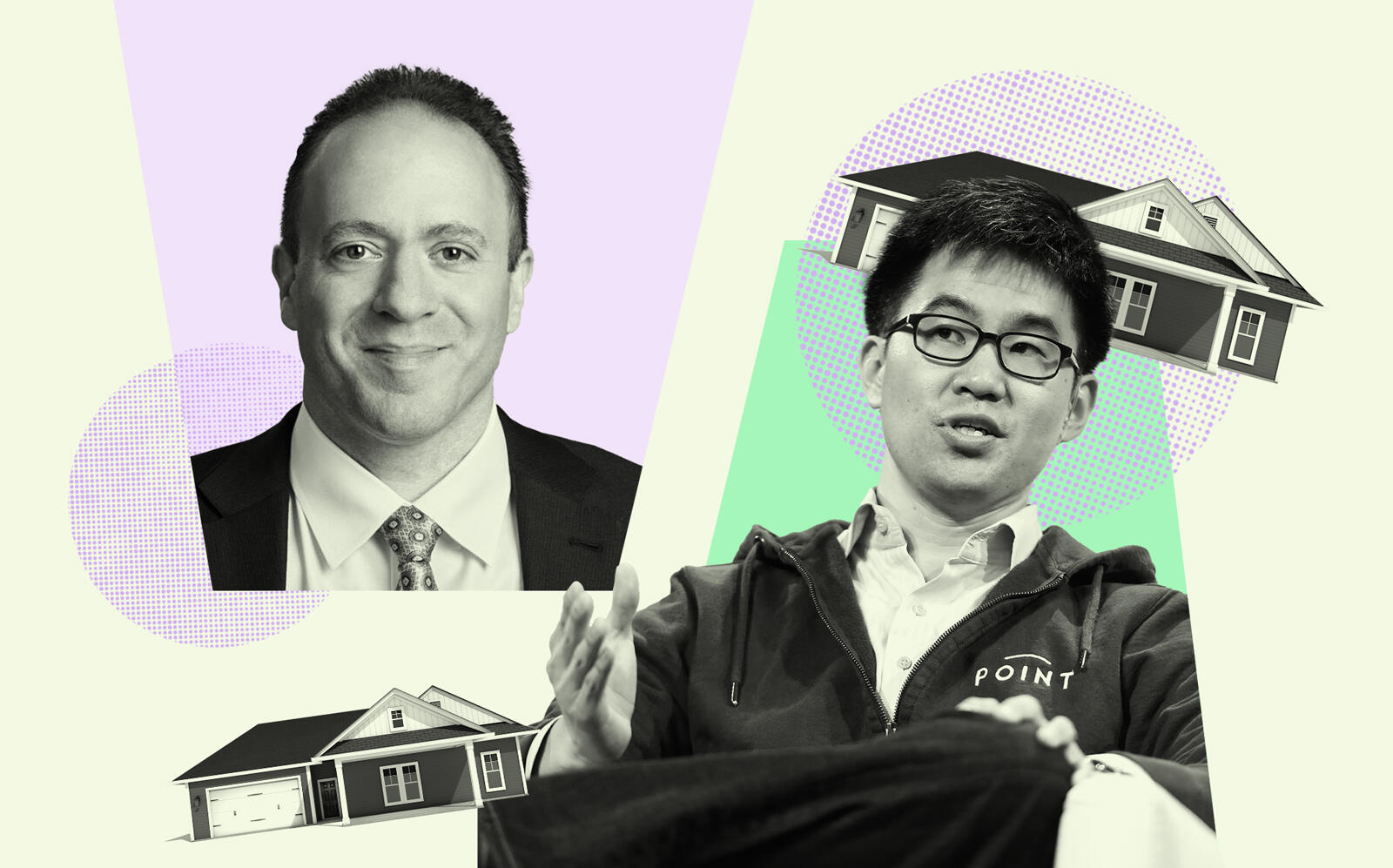

In statements announcing the transaction, Point CEO Eddie Lim and Bo Stern, an executive for Redwood Trust, lauded the deal as providing liquidity to new and existing investors.

HEIs grant investment companies a minority stake in properties, in turn enabling homeowners to cash out on part of its equity. Inman noted homeowners don’t have to make a monthly payment on HEIs, instead paying back the advance and part of the home’s appreciation at the end of an agreement.

HEIs are sometimes seen as an alternative to home equity lines of credit. The interest in the agreements comes as lenders grow increasingly stingy about granting lines of credit, despite soaring home values in the wake of the pandemic and the U.S. financial market’s crisis in 2008.

In 2019, Point raised $22 million in Series B funding and received $100 million from Kingsbridge Wealth Management for home investments. The company launched its operations at the beginning of 2015.

Read more

Startup that offers alternative to home equity lending raises $122M

Startup that offers alternative to home equity lending raises $122M

More Americans are choosing not to tap into their home equity

More Americans are choosing not to tap into their home equity