Sam Zell’s Equity Residential reports recovery in rental occupancy

Sam Zell’s Equity Residential reports recovery in rental occupancy

Trending

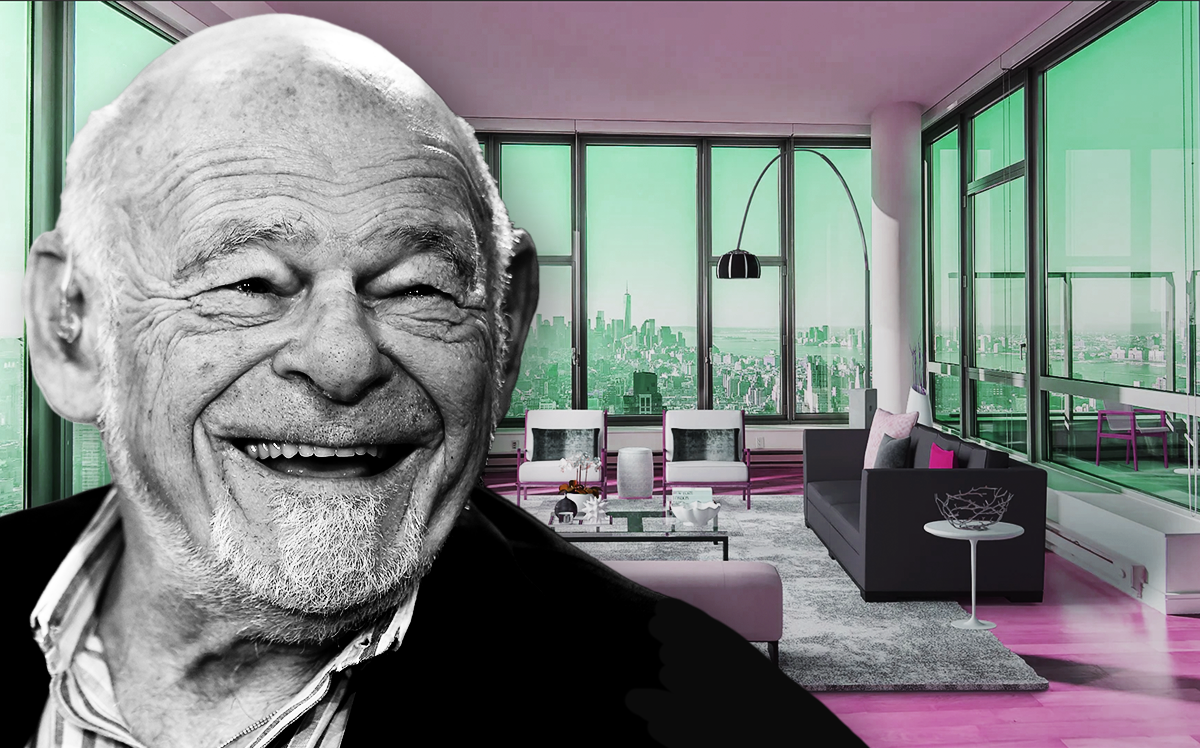

Sam Zell’s luxury rentals regain pricing power

Rents, occupancy of Equity Residential’s 80,000 apartments now higher than before Covid

There has been no uniform shape for recovery from the pandemic-driven downturn.

In the case of Sam Zell’s Equity Residential, it’s V-shaped, at least for its pricing power at its nearly 80,000 luxury rental apartments, mostly in California and on the East Coast.

The pandemic pushed the apartments’ monthly rent — that is, the weighted average of 12 months’ base rent including concessions — down $520 from March to December of 2020. But the figure has since risen by $637 to just above $2,900, the firm’s chief operating officer, Michael Manelis, said during an earnings call Wednesday.

“[The growth] demonstrates a V-shaped recovery and shows that we have more than fully recovered what we had lost in price,” Manelis said. “Concessions, which have been a main topic of discussion for the last 18 months, are now being used on a very limited basis.”

Zell, a billionaire investor, is the founder and chairman of Equity Group Investments, which includes the residential arm.

Equity Residential’s pricing rebound mirrors a larger trend in the nation’s rental market, where rents are rising because young professionals are coming back to cities and families priced out of the housing market have turned to rentals.

Read more

Sam Zell’s Equity Residential reports recovery in rental occupancy

Sam Zell’s Equity Residential reports recovery in rental occupancy

Landlords smell “good cause” in Hochul’s new tenant protections

Landlords smell “good cause” in Hochul’s new tenant protections

Single-family rentals soaring in hot housing market

Single-family rentals soaring in hot housing market

A robust recovery, however, has not quite materialized on the company’s balance sheet. The firm’s revenue in the third quarter was $623.2 million, up 0.1 percent from a year ago and 4.2 percent from the second quarter. Funds from operations were $296.9 million, up by 1.3 percent from a year ago and down about 2 percent from the second quarter.

The recovery is more apparent in occupancy rates. Equity Residential’s portfolio-wide occupancy, which had dipped to 94.2 percent in September 2020, has rebounded to 96.6 percent, above the 2019 level.

With fewer units to lease than it had a year ago, the firm is now focusing more on renewal negotiations to keep “deal seekers” who signed discounted leases last year. Though negotiations have been “difficult,” Manelis said, those tenants are renewing at a similar rate to that of longer-tenured residents.

In all, about 62 percent of residents with expiring leases renewed in September, and in October, the rate is on track to be nearly 65 percent — “much better than the 55 percent historical norm that we thought we were going to stabilize,” said Manelis. He added that on average, new leases signed in September are priced 7.7 percent higher than old leases.

During the third quarter, the company continued its diversification strategy by selling five older apartment buildings in California totaling about 1,000 units for $612 million, and buying eight newer properties in Austin, Dallas and Atlanta, with about 2,100 units, for $740 million.

Alexander Goldfarb, an analyst with Piper Sendler, asked CEO Mark Parrell on the call whether New York’s proposed good cause eviction bill, if it becomes law, would affect Equity Residential’s strategy in the state, where the company owns about 9,300 apartments. The bill would limit landlords’ ability to replace tenants and raise rents.

“It doesn’t make us want to own more in New York City, and in New York state,” Parrell said, calling the bill a “bad policy.”

“We’re disappointed if it indeed is the direction it’s going,” he said. “And we’ll work through our [trade] association to suggest other, better alternatives.”