Midtown South leads Manhattan’s office market recovery: report

Midtown South leads Manhattan’s office market recovery: report

Trending

Madison Capital, Lubert-Adler selling 71 Fifth Avenue

Leasehold interest could fetch up to $150M for Flatiron building: report

Madison Capital is ready to move on from 71 Fifth Avenue, five years after the developer entered into a contract to buy the ground lease on the property.

Madison Capital and Lubert-Adler Partners are looking to sell the leasehold interest on the Flatiron District building, according to the Commercial Observer. The CBRE team of Doug Middleton, William Shanahan and Jack Stillwagon are marketing the leasehold interest sale.

Market sources told the Commercial Observer the property could fetch as much as $150 million, citing other leasing interests in the neighborhood.

The buyer of the leasehold interest is facing 94 years remaining on the term. The long-term investment is slightly shorter than when Madison Capital bought the building’s ground lease in 2016.

The company agreed to pay nearly $85 million upfront and $3.5 million in annual rent after signing a hard contract to acquire the fee position of the 11-story building. Family firm Samco Properties and the family of Mark Lapidus, former global real estate chief of WeWork, own the land underneath the property.

Read more

Midtown South leads Manhattan’s office market recovery: report

Midtown South leads Manhattan’s office market recovery: report

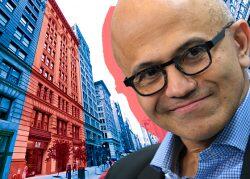

Microsoft snags 150K sf for Manhattan offices

Microsoft snags 150K sf for Manhattan offices

The property is 91 percent leased and tenants have an eight-year weighted-average lease term, according to the Commercial Observer. The building also recently underwent a $17 million renovation, modernizing five elevators and making improvements to the lobby and facade.

Before Lapidus and WeWork parted ways, the co-working giant signed a four-year, 45,000-square-foot lease at the building. Despite Lapidus’ departure from the company, WeWork’s location in the space appears to still be active.

As Manhattan’s pandemic-stricken office market struggles to recover, leases in the Flatiron District have provided some promising signs in recent months. A few blocks away from 71 Fifth Avenue, Microsoft recently agreed to lease 150,000 square feet at Bromley Companies’ 122 Fifth Avenue. That building is under renovation and it’s not clear when Microsoft plans on moving in.

[CO] — Holden Walter-Warner