What happened at Zillow? “Drinking your own Kool-Aid,” for one

What happened at Zillow? “Drinking your own Kool-Aid,” for one

Trending

NYC’s new development sales picked up speed in October

Last month saw 449 contracts signed, up from 337 in September

New development sales picked up steam last month.

There were 449 deals inked at condominiums throughout the city, up from 337 in October, according to a monthly analysis of new development sales contracts by Marketproof, a real estate analytics company.

Last month also marked a significant uptick from the same month’s volume of contracts in 2020 and 2019. This October’s volume was a 102 percent increase compared to 2020 and a 79 percent increase compared to 2019.

The majority of deals took place in Manhattan, as per usual, with 224 contracts, an increase of 122 percent compared to last year and up 167 percent compared to the borough’s contracts in Oct. 2019.

200 East 83rd Street in the Upper East Side (Robert A.M. Stern Architects)

The number of luxury deals, properties asking $4 million or more, increased as well, largely due to a sizable number of contracts being reported at 200 East 83rd Street, an Upper East Side condo developed by Naftali Group and Rockefeller Group that launched sales last month. The project reported 35 contracts asking between $3.6 million and $11.5 million.

Read more

What happened at Zillow? “Drinking your own Kool-Aid,” for one

What happened at Zillow? “Drinking your own Kool-Aid,” for one

Fueled by 20% discounts, sales of Manhattan luxury co-ops heat up

Fueled by 20% discounts, sales of Manhattan luxury co-ops heat up

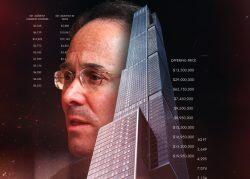

Why Gary Barnett is selling Central Park Tower at 25% off

Why Gary Barnett is selling Central Park Tower at 25% off

As a result, the median asking price in Manhattan new development jumped to $3.6 million, up from 71 percent last October and up 52 percent from in 2019.

Kael Goodman, CEO of Marketproof and author of the report, said the increase in asking prices “continues that trend of the higher priced stuff moving well,” which he attributed to discounts.

“Developers always have to make a choice between price and sales velocity. And by and large the choice in these recent months has been for sales velocity,” said Goodman. “That means there has been discounting.”

Central Park Tower, where The Real Deal previously reported units have sold at an average discount of 25 percent per square foot, is one such example.

Brooklyn saw 184 contracts reported, up from 120 in September. The month’s volume was up 119 percent from the year prior and up 142 percent from in 2019. Queens had 40, down slightly from September’s 43.

The best-selling projects were Naftali and Rockefeller’s 200 East 83rd Street condo, followed by Chris Xu’s Skyline Tower in Queens with 19 contracts and Northlink Capital’ 510 Driggs Avenue in Brooklyn with 13 deals.