Opportunity Zone investigation won’t derail developer investment, experts say

Opportunity Zone investigation won’t derail developer investment, experts say

Trending

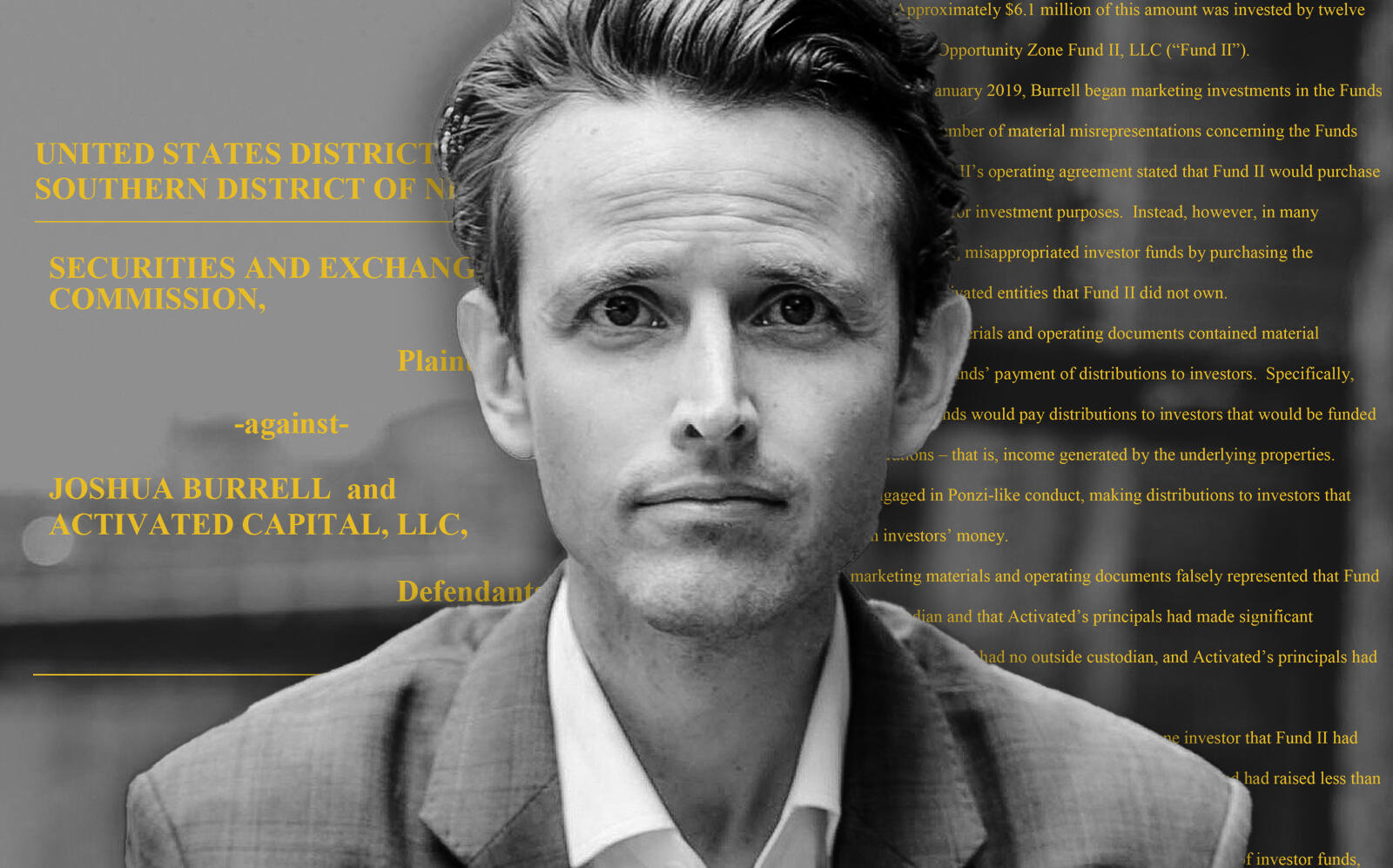

Manhattan investor charged in Opportunity Zone fraud

Joshua Burrell allegedly committed securities fraud, wire fraud and aggravated identity theft

A real estate fund manager in Manhattan was indicted Tuesday, charged with securities and wire fraud and aggravated identity theft linked to Opportunity Zone projects.

Joshua Burrell, managing partner of Activated Capital, was to be arraigned in federal court, according to Bisnow.

The Justice Department alleges Burrell was unable to generate the steady 8 percent returns he had led his investors to expect, so he made annual distributions in part with $470,000 they had sent him to put into Opportunity Zone projects.

Burrell allegedly used fake bank documents to inflate the balance in the funds and falsified documents, making it seem like more properties were owned by the funds than really were. Specifically, authorities said Burrell made it appear that an affiliate of the company owned nine Detroit properties that it did not.

Read more

Opportunity Zone investigation won’t derail developer investment, experts say

Opportunity Zone investigation won’t derail developer investment, experts say

The high price of opportunity zones

The high price of opportunity zones

The Securities and Exchange Commission, meanwhile, charged Burrell with securities fraud on Monday. The SEC said that the company raised $6.3 million for Opportunity Zone investments, but misrepresented the firm’s dealings to investors. Burrell allegedly lied about utilizing his own equity and misappropriated $100,000 in funds, the SEC said.

According to Bisnow, the fund was largely focused in the Midwest and Southeast. Burrell claims on his LinkedIn profile to have previously worked for Midas Capital and Lazard Asset Management.

The 38-year-old faces a maximum of 20 years in prison for each count of securities fraud and wire fraud, according to the Justice Department. He also faces a two-year sentence for the aggravated identity theft count, which would run consecutively to other sentences.

The Opportunity Zone program, created by the Trump administration tax cuts passed in 2017, faced scrutiny almost from the outset. The Treasury Department launched an investigation into the program in January 2020. Although Opportunity Zones were purported to bolster investment in low-income neighborhoods, developers have used the program to build luxury projects in affluent areas.

[Bisnow] — Holden Walter-Warner