A drop in the bucket: Hochul allots $25M for tenants facing eviction

A drop in the bucket: Hochul allots $25M for tenants facing eviction

Trending

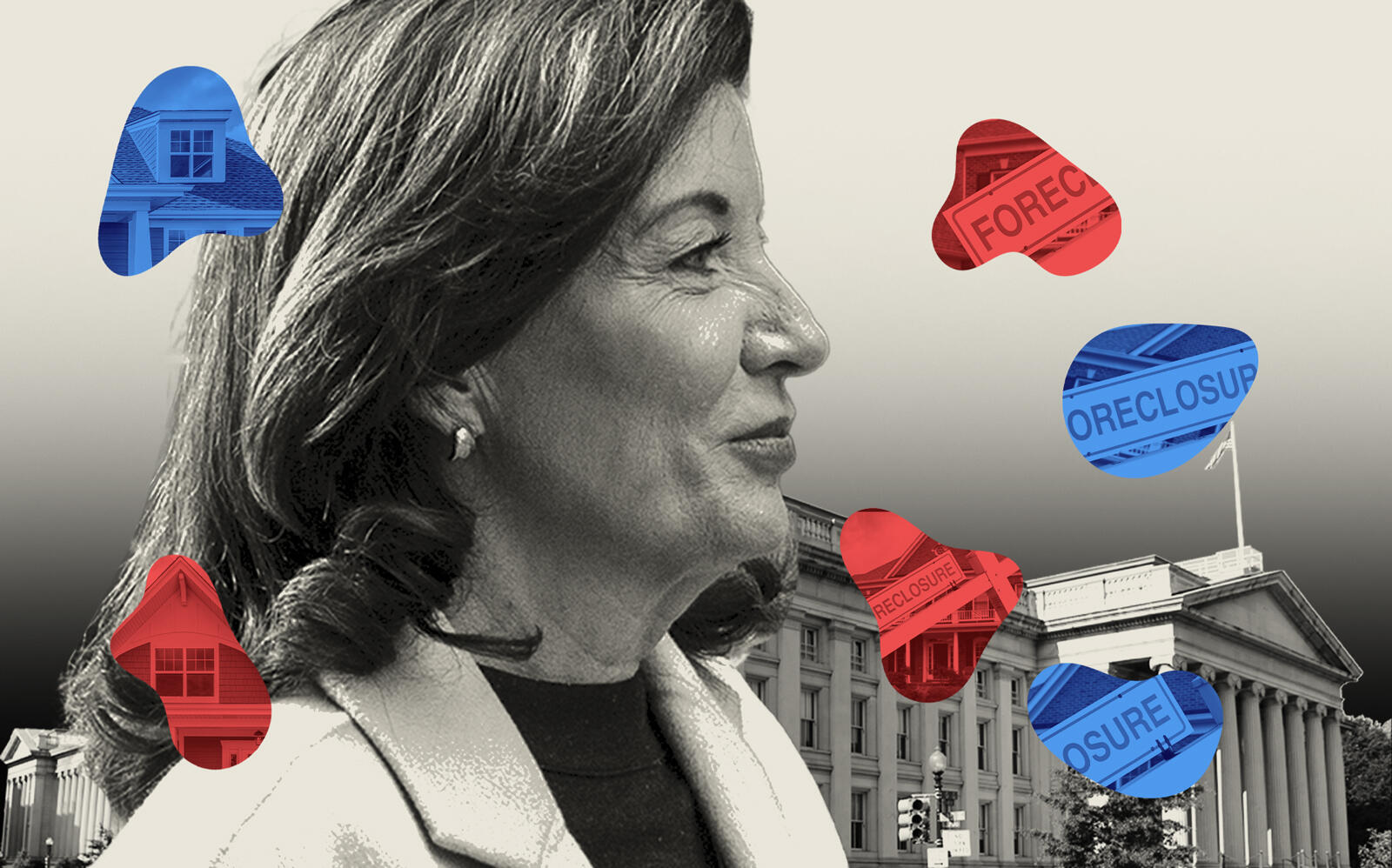

NY homeowners behind on mortgages get $539M from feds

Foreclosure-prevention funding is just 9% of New Yorkers’ estimated delinquency

Mick Jagger sang, “You can’t always get what you want, but if you try sometimes, you get what you need.” On foreclosure aid, however, Gov. Kathy Hochul got what she wanted, not what New York needed.

New York on Thursday became the first state in the nation to receive U.S. Treasury approval for Homeowner Assistance Fund aid. Nearly $539 million — the amount Gov. Kathy Hochul requested — will be distributed to homeowners at the greatest risk of foreclosure or displacement. The money is part of a $10 billion federal program in the American Rescue Plan.

However, the funding will cover only about 9 percent of New Yorkers’ delinquent payments. Homeowners statewide have run up about $5.85 billion in mortgage arrears since the start of the pandemic.

Read more

A drop in the bucket: Hochul allots $25M for tenants facing eviction

A drop in the bucket: Hochul allots $25M for tenants facing eviction

State pulls the plug on rent relief

State pulls the plug on rent relief

The governor announced the funding award a week after pulling the plug on New York’s portal for emergency rental assistance, shutting out potentially hundreds of thousands of landlords and tenants because rent aid was running out.

The state has earmarked virtually all of the $2.4 billion in available funding to applicants and has requested another $996 million from the Treasury Department.

Hochul this week announced $25 million would go to organizations providing legal help to low-income tenants facing eviction. However, the funding will only cover about one in 11 cases outside of New York City, which has a more robust legal services program in place.

A statewide foreclosure moratorium, along with an eviction moratorium, is in place, but is due to expire Jan. 15.

“As we focus on our post-pandemic economic recovery, we need to do everything in our power to help New Yorkers stay in their homes,” Hochul said in a statement.

Hochul’s office plans to unveil a statewide outreach campaign to provide information to at-risk homeowners so they are ready to apply as soon as the application window opens. Distressed homeowners have received less attention than tenants during the pandemic, as rising home values have made it possible for many to refinance their mortgages.