Lease roundup: Blue Zones to run Legacy Hotel & Residences health and wellness hub at Miami Worldcenter & more

Lease roundup: Blue Zones to run Legacy Hotel & Residences health and wellness hub at Miami Worldcenter & more

Trending

Miami Worldcenter developer nabs $340M financing for mixed-use tower, marking third largest construction loan ever in Florida

Silverstein providing loan to build 50-story tower with condos, hotel and medical center

The flow of money from New York to South Florida continues.

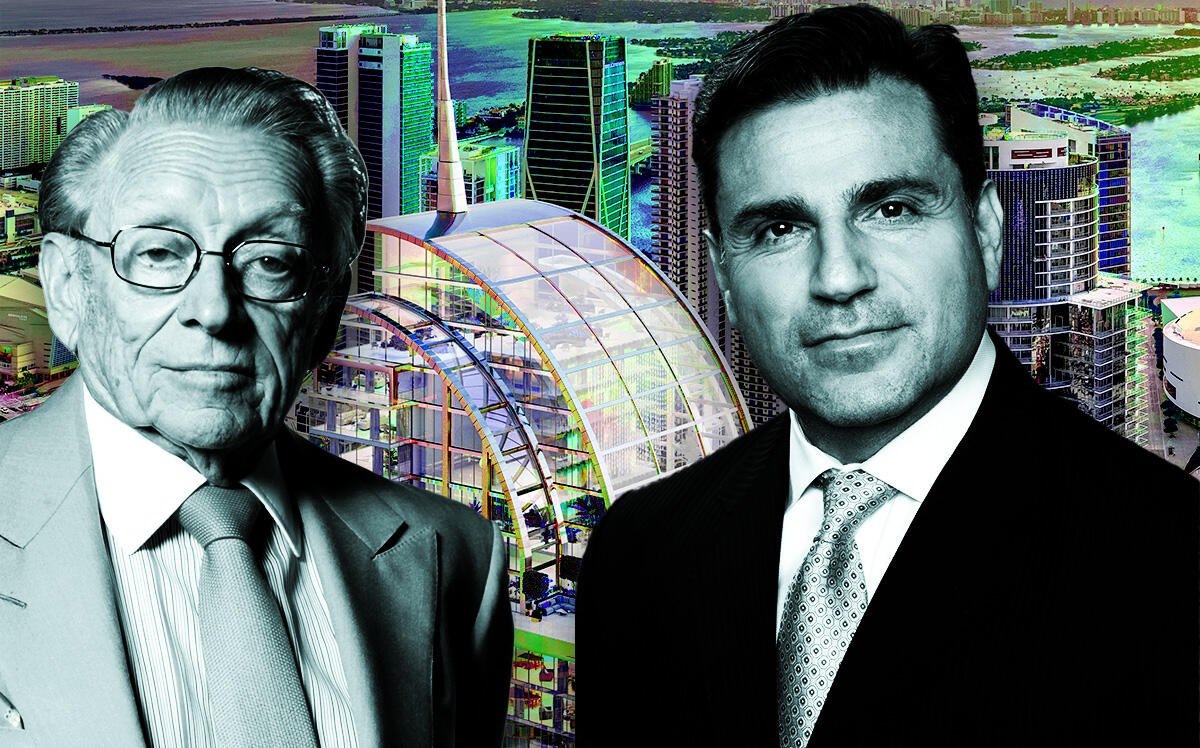

Silverstein Capital Partners provided Dan Kodsi’s Royal Palm Companies with a $340 million construction loan for Legacy Hotel & Residences, a mixed-use condo and hotel tower planned for Miami Worldcenter in downtown Miami.

The financing marks the third largest construction loan ever in Florida, following two others for projects in Miami-Dade County, according to a press release. The two others were: a $558 million loan for the construction of the Estates at Acqualina in Sunny Isles Beach and a $345 million loan for Five Park in Miami Beach.

Read more

Lease roundup: Blue Zones to run Legacy Hotel & Residences health and wellness hub at Miami Worldcenter & more

Lease roundup: Blue Zones to run Legacy Hotel & Residences health and wellness hub at Miami Worldcenter & more

Miami Beach developers nab $345M construction loan for 500 Alton

Miami Beach developers nab $345M construction loan for 500 Alton

It is also New York City-based Silverstein’s first loan in South Florida. Silverstein Capital Partners is an affiliate of Larry Silverstein’s Silverstein Properties, which led the redevelopment of the World Trade Center after 9/11.

Legacy Hotel & Residences launched sales in late 2019. Amid the pandemic, it is now fully presold with a $160 million expected condo sellout. It is under construction and expected to be delivered in 2024.

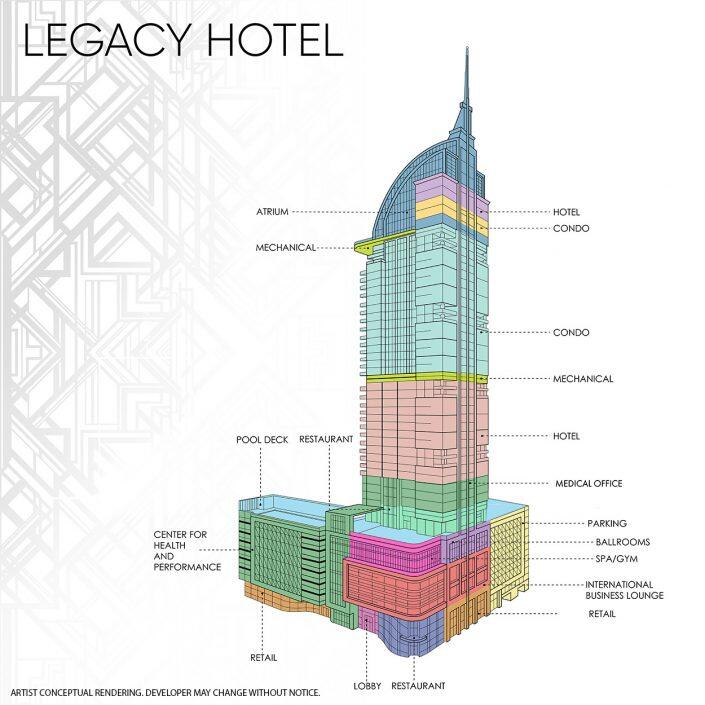

The 50-story tower is planned for 942 Northeast First Avenue within the 27-acre Miami Worldcenter master-planned development. It will have 310 condos on top of a 219-key hotel and a 10-story, $100 million Blue Zones Medical and Wellbeing Center.

(Source: Quinn PR)

Michael May, president of Silverstein Capital Partners, said in a statement that the loan fits the firm’s strategy of financing “complicated developments with creative financial structuring.”

Martin Schwartz and Anthony de Yurre of Bilzin Sumberg, who represented the developer, said in a joint statement that projects with strong developers and significant presales “will continue to be in high demand” for lenders and investors looking to take advantage of the hot South Florida market.

Royal Palm Companies broke ground on Legacy in August after the developer presold the residential component. OneWorld Properties, led by Peggy Olin, handled sales and marketing. Olin was also responsible for the sellout of Paramount Miami Worldcenter, Kodsi’s condo tower that was completed in 2019.

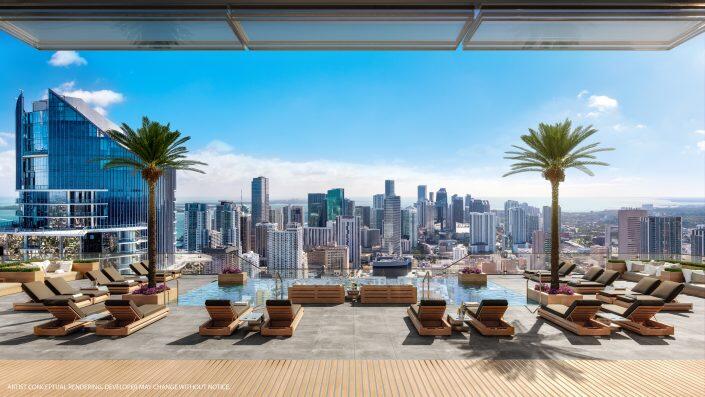

Legacy will also have ground-floor retail, five restaurants and bars, a 1-acre hotel pool deck, a seven-story rooftop atrium and a cantilevered pool 500 feet up. Buyers will be able to rent their units without rental restrictions, and Accor will manage and operate the tower.

The building was designed by Kobi Karp Architects, Design Agency and ID & Design International. Perkins + Will is designing the Blue Zone Center.

Miami Worldcenter Associates, led by Art Falcone and Nitin Motwani, has been selling off pieces of the larger assemblage to developers over the years. Earlier this year, it sold a 1-acre development site that is zoned for nearly 850 residential units and 1.2 million square feet to Coral Gables investment firm Abbhi Capital for $20 million.