Fortis’ Olympia Dumbo snags $284M refi

Fortis’ Olympia Dumbo snags $284M refi

Trending

The Jay Group makes multifamily play in DoBro

Developer lands $130M loan, pays $40M for 101 Fleet Place

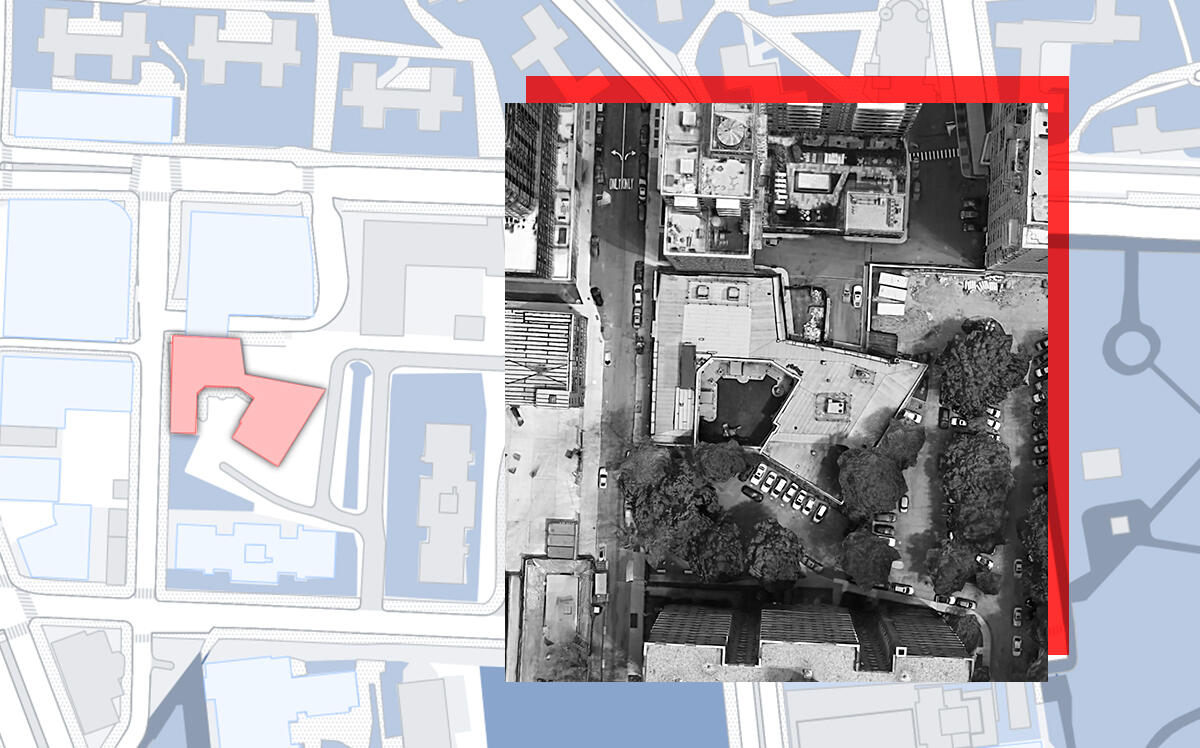

UPDATED Dec. 27, 2021, 10:42 a.m.: The Jay Group is making quick moves to develop a multifamily building in Downtown Brooklyn, simultaneously acquiring a site and putting construction financing into place.

The developer is paying about $40 million to acquire 101 Fleet Place from Leser Group, according to the Commercial Observer. The developer received a $130 million loan from G4 Capital Partners, with $22 million earmarked for the acquisition of the site.

The remaining $108 million in the loan will be funneled toward the construction of a multifamily property, sources told the Observer. The project is expected to include more than 300 units across more than 300,000 square feet and construction is set to begin next year. The Jay Group didn’t clarify its plans for the site.

Property records subsequently showed the purchase price to be $42.75 million and that Isaac Chetrit took an 11 percent stake.

Read more

Fortis’ Olympia Dumbo snags $284M refi

Fortis’ Olympia Dumbo snags $284M refi

Rabsky lands $450M loan for DoBro towers

Rabsky lands $450M loan for DoBro towers

The financing arrangement was negotiated by Galaxy Capital’s Henry Bodek.

According to the Observer, Leser Group aimed to put an office development at the site, going as far as filing zoning map amendments in 2019.

The Jay Group was recently on the other end of a multifamily transaction, with the September sale of a 141-unit rental and retail building at 56 West 125th Street in Harlem to HUBBNYC for $105 million. It had only recently finished developing the 17-story building after buying the development site in 2018 for $26.5 million and securing a 35-year property tax break.

G4 Capital Partners extended money for other Brooklyn projects in recent weeks. Last month, it provided a $284 million loan for Fortis Property Group’s 76-unit luxury project Olympia Dumbo. That loan was also arranged by Bodek of Galaxy Capital.

Downtown Brooklyn is buzzing with multifamily developments. In September, the Rabsky Group and Spencer Equity scored $450 million in debt from Madison Realty Capital for its mixed-use project in the neighborhood. The development will stand 35 stories tall and include 1,098 units across two connected towers, as well as retail space.

[CO] — Holden Walter-Warner