Fetner to finally break ground on 23-story UWS apartment building

Fetner to finally break ground on 23-story UWS apartment building

Trending

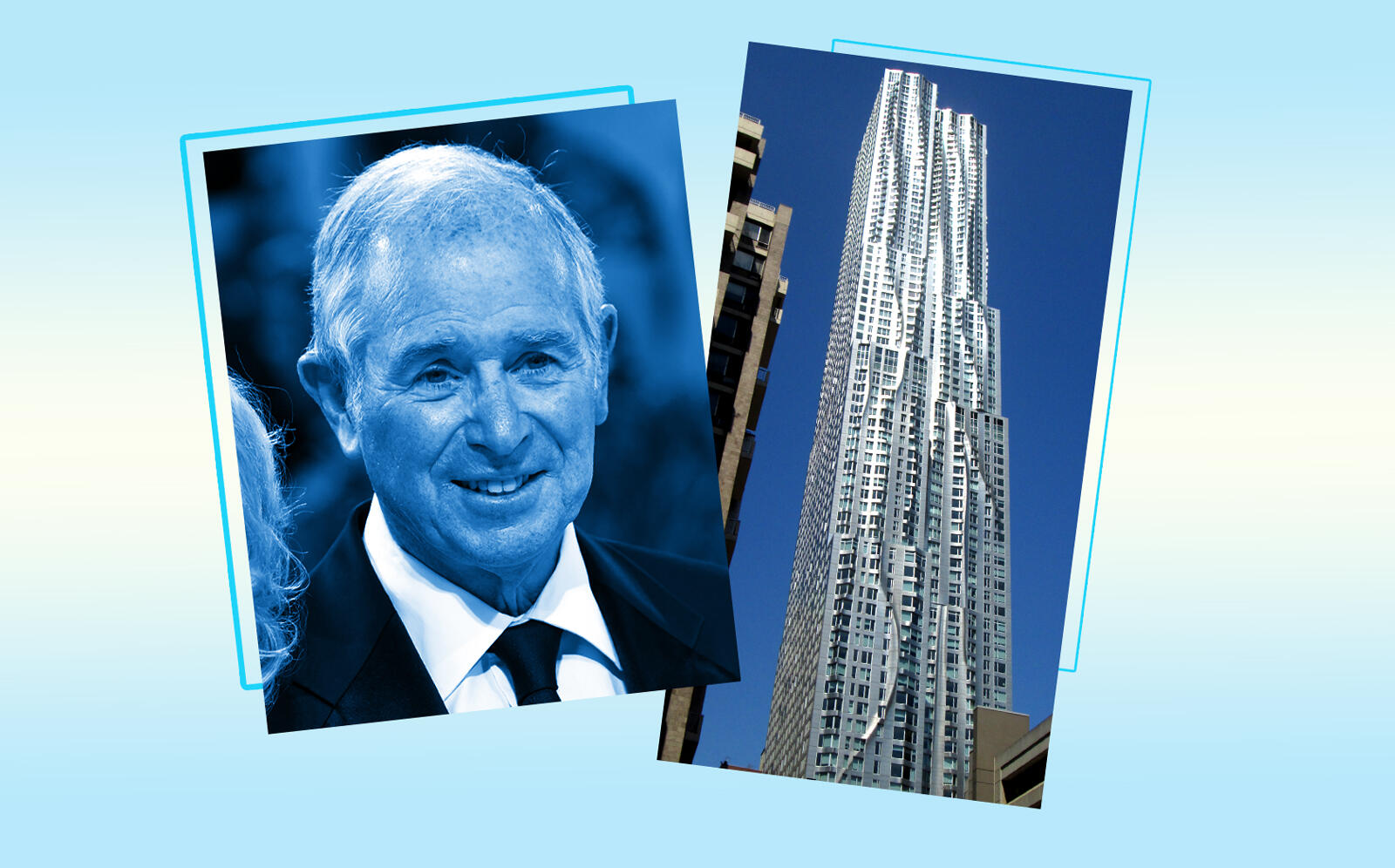

Blackstone close to $930M purchase of Lower Manhattan apartment building

Brookfield and Nuveen sought north of $850M for 8 Spruce Street

Blackstone continues to make big bets on New York City real estate, with its latest reportedly placing it on the verge of a major multifamily purchase.

The firm is close to acquiring the luxury apartment rentals at 8 Spruce Street in Lower Manhattan from Brookfield Asset Management and Nuveen for $930 million, people familiar with the matter told Bloomberg.

The Real Deal reported in November Brookfield and Nuveen were seeking north of $850 million to sell the 76-story building, a Frank Gehry-designed rental tower with a unique undulating surface. The listing was one of the biggest of its kind since the onset of the pandemic and a litmus test for the city’s multifamily rental market.

Gehry initially designed the building for Forest City Ratner, which started construction amid the Great Recession in 2008. Construction was then halted until the developer was able to restructure its debt.

The 899-unit tower opened in 2011, marking the tallest residential building on the continent. Brookfield gained control of the tower in 2018 after acquiring Forest City.

The pandemic has not been as friendly to the building, however. As renters fled Manhattan, its occupancy dropped to about 75 percent. That has since recovered to 94 percent, a positive sign for the building amid surging rents across the sector.

Read more

Fetner to finally break ground on 23-story UWS apartment building

Fetner to finally break ground on 23-story UWS apartment building

Multifamily sales show market’s split personality

Multifamily sales show market’s split personality

A team from Eastdil Secured including Will Silverman and Gary Phillips is marketing the property.

In addition to potentially notching one of the biggest multifamily market sales of the pandemic, Blackstone is also reportedly close to a major deal to acquire a 49 percent stake in the One Manhattan West office tower. The deal would value the Brookfield-owned office building at more than $2.85 billion.

The New York City multifamily market is showing signs of fracturing between uptown and downtown, as evidenced by two sales recorded in the first week of December.

Shel Capital and Bluestone Investments acquired a four-building portfolio in the East Village for $51.5 million, signs of a surging market. Meanwhile, 1965 Lafayette Avenue in the Bronx sold for $43 million. The purchase prices aren’t drastically different, but the East Village portfolio purchase was worth almost six times as much per square foot.

[Bloomberg] — Holden Walter-Warner