What tenants are paying at HNA’s 245 Park Avenue

What tenants are paying at HNA’s 245 Park Avenue

Trending

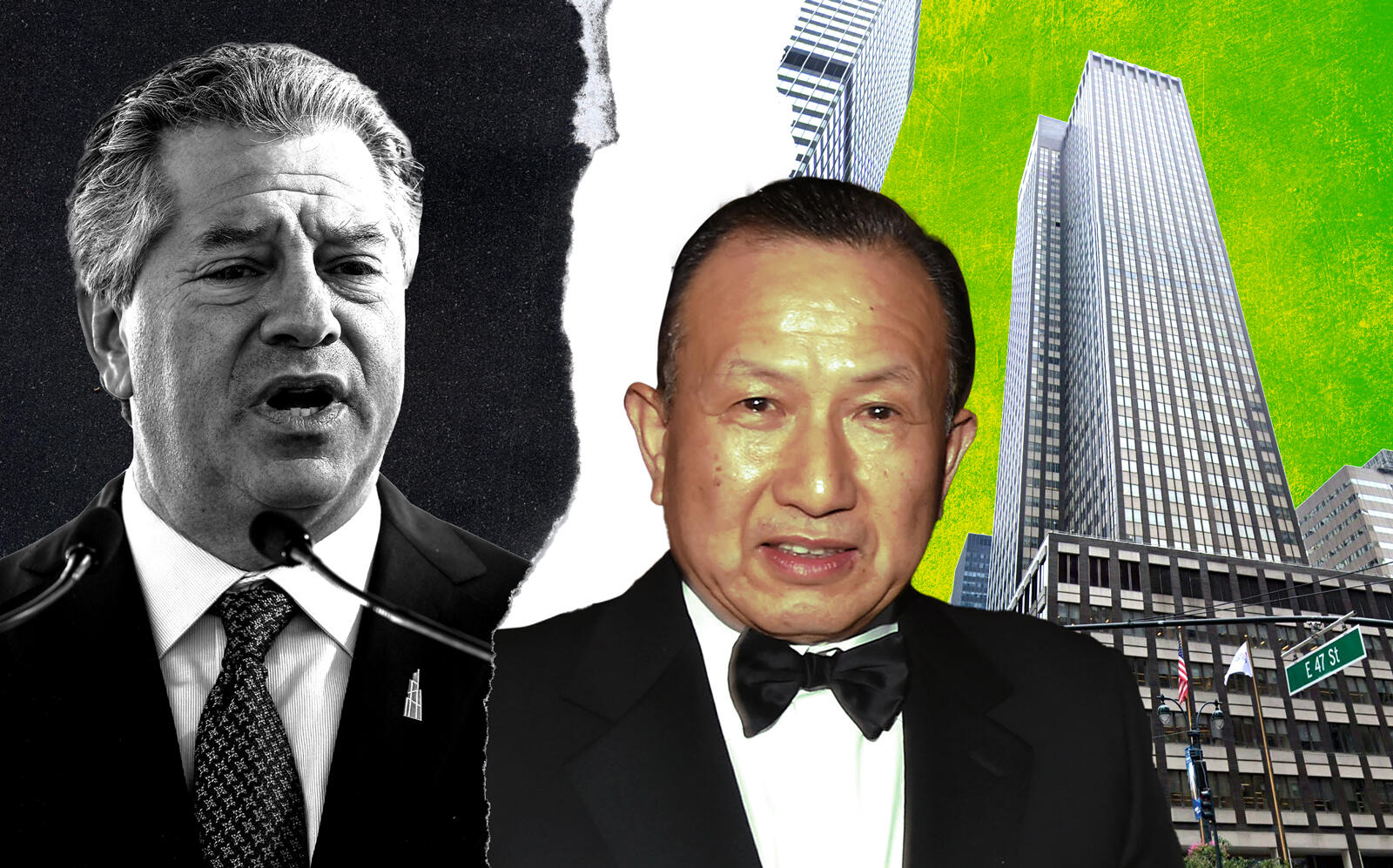

SL Green is out as manager of Park Avenue office tower

HNA cited firm in 245 Park Avenue bankruptcy filing

It’s time for SL Green to vacate 245 Park Avenue after an affiliate of HNA Group won a ruling in bankruptcy court.

A Delaware judge ruled that PWN Property Management can end SL Green’s contract as property manager of the Midtown office tower within the next week, the Commercial Observer reported.

When PWN filed for bankruptcy in October, the firm alleged SL Green failed to find a tenant to replace Major League Baseball when the company’s lease expired, leaving the building without a new tenant lease since November 2018.

The entity also alleged SL Green intentionally tried to put the building into financial duress. It claimed the office landlord benefited from not securing new leases because of its substantial equity interest in the building and ability to foreclose on the property if PWN fails to meet its payments.

SL Green has previously shifted the blame back on HNA, saying in a response to the suit the claims are a “desperate attempt by HNA to deflect from its blatant neglect of this prominent office tower.”

According to the Observer, SL Green will collect payments from PWN until the passing of five business days following the notification of the contract cancellation.

Read more

What tenants are paying at HNA’s 245 Park Avenue

What tenants are paying at HNA’s 245 Park Avenue

HNA's 245 Park Avenue is officially for sale

HNA's 245 Park Avenue is officially for sale

“While we’re disappointed that the bankruptcy has been allowed to proceed, we are incredibly proud of our stewardship of the building, which was not questioned by this ruling,” a spokesperson for SL Green told the Observer.

As of last month, the HNA-backed entity was seeking to bring MB Real Estate Services in to manage the building; the company already manages 181 Madison Avenue. According to the bankruptcy filing, revenue at 245 Park Avenue totaled about $178 million in 2020.

In 2017, HNA paid $2.2 billion to acquire 245 Park Avenue, financing the acquisition of the 44-story tower with a $1.2 billion CMBS loan provided by JPMorgan Chase Bank and others. The following year, however, HNA put the office tower and its building at 181 West Madison Street in Chicago back on the market.

In October, a Chinese judge approved a corporate restructuring allowing creditors of HNA to sell its assets, marking one of the largest corporate bankruptcy cases in China.

[CO] — Holden Walter-Warner