Signature Bank reports record results

Signature Bank reports record results

Trending

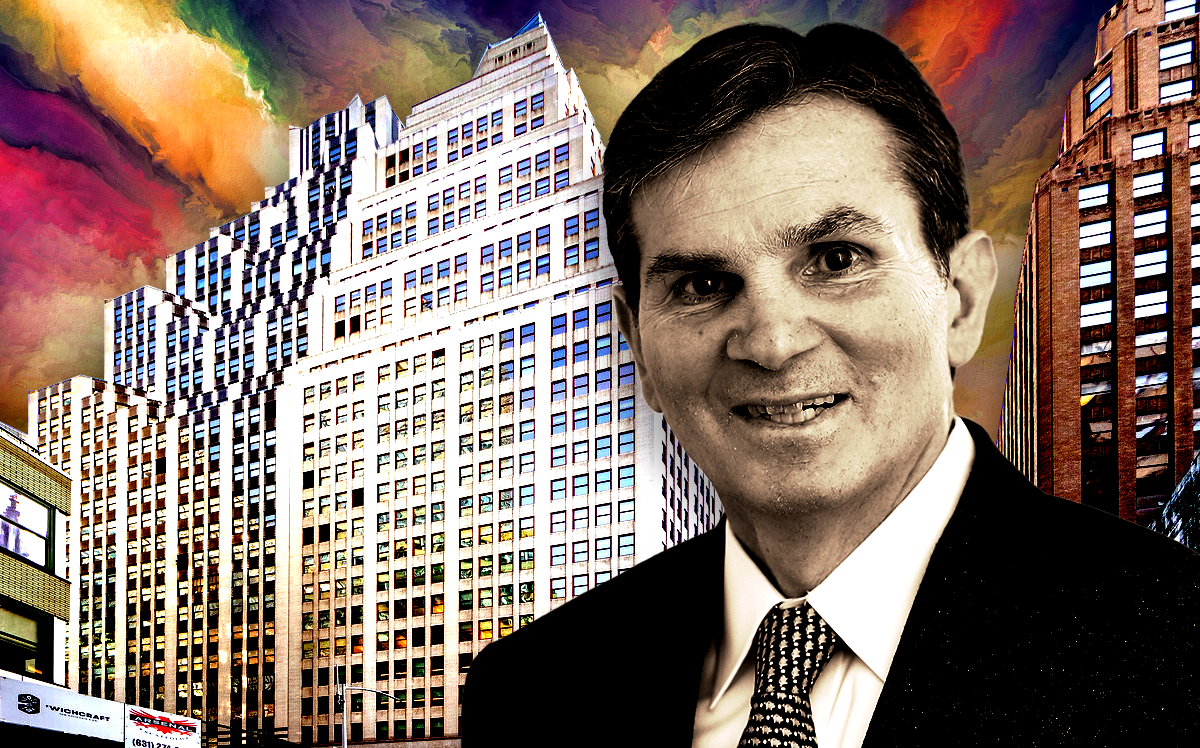

Signature Bank doubles down on ESRT’s 1400 Broadway

Company now leasing 280K sf, spanning 10 of the building’s 37 floors

Still riding high off a solid third quarter, Signature Bank’s next move is an internal one, greatly expanding its offices at Empire State Realty Trust’s 1400 Broadway.

Signature Bank is expanding by more than 168,000 square feet at the building, ESRT announced. The company already leased nearly 112,000 square feet, bringing its total to more than 280,000 square feet across 10 of the building’s 37 floors.

The asking rent was $67 per square foot and that the lease term is for 15 years, according to the Commercial Observer.

A Colliers team including Michael Cohen, Howard Kaplowitz and Andrew Roos represented Signature Bank in the deal. ESRT was represented in-house by Ryan Kass, along with a Newmark team of Erik Harris, Scott Klau and Neil Rubin.

This isn’t the first time the bank has expanded at the office tower. In November 2018, the company added approximately 21,000 square feet to its footprint. That deal came months after inking a 15-year lease for more than 91,000 square feet across three floors. Asking rents at the time were between $64 and $67 per square foot.

Read more

Signature Bank reports record results

Signature Bank reports record results

Fetner revealed as owner in ESRT’s major multifamily acquisition

Fetner revealed as owner in ESRT’s major multifamily acquisition

For ESRT, the good news at 1400 Broadway doesn’t end with Signature Bank. According to the Observer, French skincare company Clarins recently leased an entire 15,000-square-foot floor and will relocate from One Park Avenue. Scott Weiss of Savallis repped the tenant in negotiations for the 10-year lease.

Fourth quarter earnings are more than a week away, but Signature Bank may still be celebrating its third quarter. The commercial lender saw loan deferrals shrink, stocks soar and net income surge. Loan deferrals made up only 0.4 of its portfolio, a considerable jump from about 9 percent in January 2021.

The lease comes as ESRT begins its pivot to the multifamily market in a sign of the office market’s troubled times. Fetner Properties recently recapitalized two rental buildings with the REIT at a $307 million value. Fetner will retain a 10 percent stake in each of the two buildings, which span 625 units.

ESRT’s portfolio-wide vacancy rate increased to 16.5 percent during the third quarter.

[CO] — Holden Walter-Warner