Hoboken penthouse breaks record with $4.2M sale

Hoboken penthouse breaks record with $4.2M sale

Trending

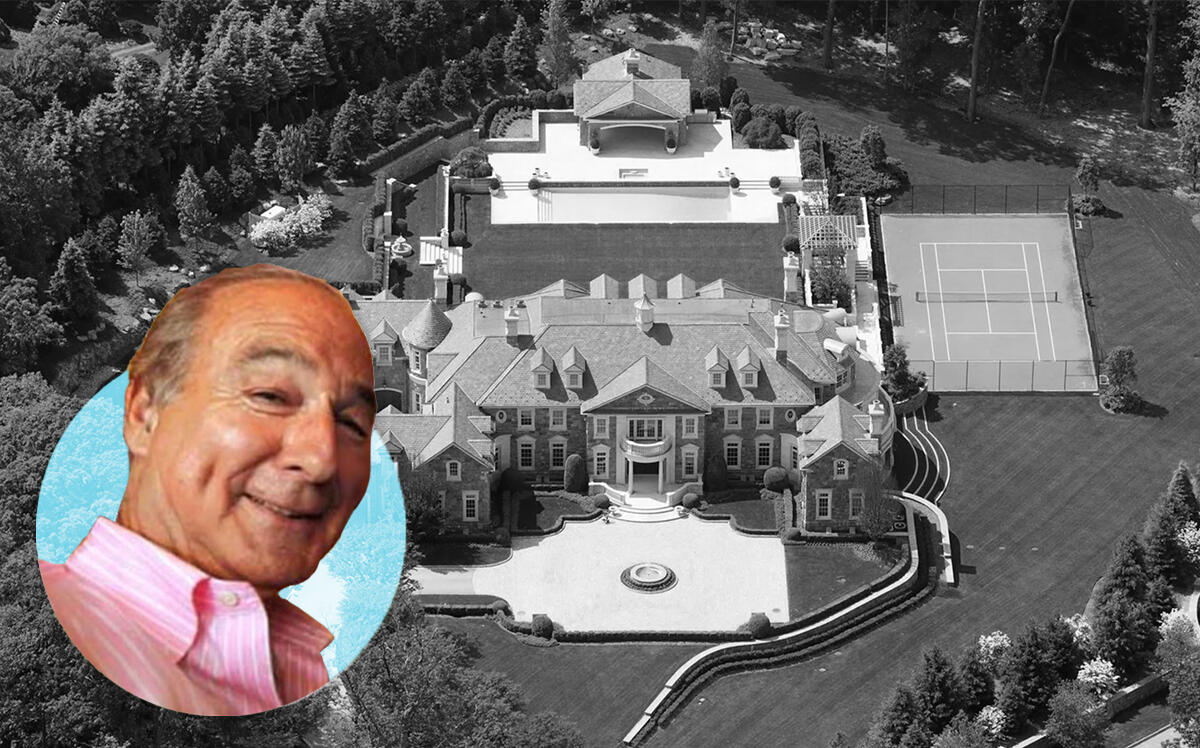

“We’re done”: Seller comes to grips with NJ mansion saga

Grandiose plan didn’t go as hoped for apartment magnate

Bigger isn’t always better, as a businessman who bought, built and abandoned a massive estate in New Jersey now admits.

The story involves a 60-acre Alpine property once owned by the family of steel magnate Henry Clay Frick, the Wall Street Journal reported.

A home on the site just sold for $27.5 million to an unknown buyer, offering a window into the saga of seller Richard Kurtz, the founder of New Jersey-based apartment owner and manager Kamson.

Kurtz purchased the entire estate in 2006 for $58 million and split the property into smaller — but not small — parcels. Kurtz and his then-wife carved out six acres and spent $27 million to construct a 30,000-square-foot mansion with a saltwater pool, tennis court and indoor basketball court.

But Kurtz spent most of his time at homes in other states and never formally moved in. After just a few years, he realized the absurdity of having a 30,000-square-foot pied-a-terre.

“It was kind of silly to have such a big home when I’m not there all the time,” Kurtz told the Journal. His primary residence was in Palm Beach, though he owns another home in Alpine.

Read more

Hoboken penthouse breaks record with $4.2M sale

Hoboken penthouse breaks record with $4.2M sale

Making money moves: Cardi B buying up real estate

Making money moves: Cardi B buying up real estate

More than a decade ago, the apartment mogul then put the Alpine palace on the market for what proved to be a ridiculous price: $68 million. “Way too much,” Kurtz admitted to reporter E.B. Solomont.

In 2013 he tried again, listing the home for $43 million and then for $49 million. Nobody bit.

Kurtz pointed to the property taxes — one year, he paid $340,000 — as the reason it didn’t sell. He appealed his assessment and won a reduction. “Even if you’re wealthy, you don’t want to overpay your taxes,” Kurtz told the paper.

Humbled, but perhaps not humbled enough, Kurtz listed it for $36 million (the highest asking price in the state) just before the pandemic. Ultimately, he accepted an offer of $27.5 million — meaning after the commission (Dennis McCormack of Prominent Properties/Sotheby’s International Realty had the listing) and other expenses, Kurtz suffered a loss.

“It was sold for somewhere in the vicinity of what we spent to build it, so we’re not that far away,” Kurtz said. “It was a journey, but we’re done.”

[WSJ] — Holden Walter-Warner