Rexford takes a flyer on Inglewood industrial

Rexford takes a flyer on Inglewood industrial

Trending

An industrial “David” in a field of Goliaths

Based in Israel and NJ, Faropoint has amassed a formidable last-mile portfolio

If you can’t be bigger than your competition, be smarter and quicker.

That could be the mission statement of Faropoint, a New Jersey- and Israel-based firm that in just a few quarters has quietly amassed a formidable array of last-mile warehouses — possibly the hottest segment of the market today.

In 2021 alone, the firm bought 144 warehouses in roughly 80 deals valued collectively at around $750 million, more than tripling its 2020 spending, Adir Levitas, Faropoint’s founder and CEO, told The Real Deal.

This year it expects to double 2021’s total. That would be a feat for a relatively small firm battling the likes of Blackstone and KKR for properties in a tight, increasingly expensive market.

Industrial real estate vacancy remains at historic lows in the U.S., even with developers pouring hundreds of millions of square feet onto the market. Warehouse landlords and tenants nationwide are scrambling to accommodate a rapidly expanding e-commerce marketplace seeking faster and faster delivery times. Supply chain disruption has forced tenants to store more inventory, generating still more demand.

“People simply cannot get the space that they need,” Prologis chairman and CEO Hamid Moghadam said on an earnings call this month.

Faropoint, which Levitas started in 2012, calls itself a “data-driven real estate asset manager.” The company uses big data in a “structured” search process it says is rare if not unique in the field. It has also established itself as a buyer of means and a quick closer in the niche market of smaller, infill warehouses.

The company’s East Coast-heavy footprint stretches from New York to Miami, but it has sites in the Midwest and Texas, too.

Read more

Rexford takes a flyer on Inglewood industrial

Rexford takes a flyer on Inglewood industrial

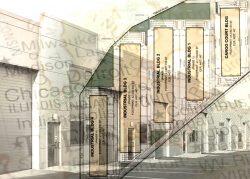

Soaring industrial demand turns Minooka into a development hotspot

Soaring industrial demand turns Minooka into a development hotspot

A year ago Faropoint set up a 10-person, in-house R&D department, consisting of data scientists and engineers who Levitas said focus exclusively “on how real estate should be done in the modern era.”

Real estate has for decades been based on handshakes and assumptions, he said. “How much is each little difference in a property worth? What is the weight of that difference in a tenant’s decision-making? That’s the kind of info we’re after.”

Faropoint supplements national data with local information gathered through “deep market relationships” with local brokers, and files away information other firms might toss — for example, data on deals it lost, Levitas said. In this way it has been able to source properties that are often overlooked.

Faropoint hasn’t had much competition in recent deals; 90 percent have been off-market purchases with no rival offer, brokered by local firms with which it has relationships, Levitas said. The company has seven satellite offices to maintain those connections.

Large institutions will typically bypass the modest, infill properties that are Faropoint’s “bread and butter” because their costs of pursuing a deal preclude purchases of only a few million dollars, Levitas said. Yet the rent growth potential of these locations, because of their proximity to cities, can be better than that of larger regional distribution centers in more remote areas.

Faropoint has exploited this market inefficiency by focusing exclusively on that cohort. And by pursuing mostly one-off transactions, Faropoint has been able to fine-tune its portfolio’s location and return profile, and thereby better manage risk.

“When we finish the composition, we will have a portfolio that is poised to be interesting to the largest pool of buyers out there,” he said.

Faropoint defines last-mile industrial as properties of 20,000 to 200,000 square feet and within a 20-minute drive of 500,000 or more people. The company also factors in other variables to determine a property’s “last-mile-ness,” including population density at various distances, the proportion of Amazon Prime members in a given area, household median income and “all kinds of things that our data science team has found to have an impact on rent growth,” Levitas said.

Faropoint has collectively raised about $700 million of equity capital in two funds over the last three years. It aims to raise a third fund with $750 million in the coming months, Levitas said. Faropoint’s investors are mostly Israeli institutions, family offices and high net-worth individuals. For its third fund it will target global institutions.

The firm plans to expand to Boston, Charlotte, Austin, Minneapolis and Los Angeles and grow its headcount this year to 120 from today’s 70, with its R&D comprising 25 percent of the total.