City Council bill would force hotels to pay severance to laid-off workers

City Council bill would force hotels to pay severance to laid-off workers

Trending

Hotels launch ad campaign after omicron sinks occupancy

Attacked by virus and city government, owners renew call for help

How do you sell relief?

With occupancy back down to 42.5 percent, the city’s hotel owners launched a web and TV campaign Monday to tug at the hearts and minds of elected officials.

Specifically, they want financial aid and a break on late tax payments.

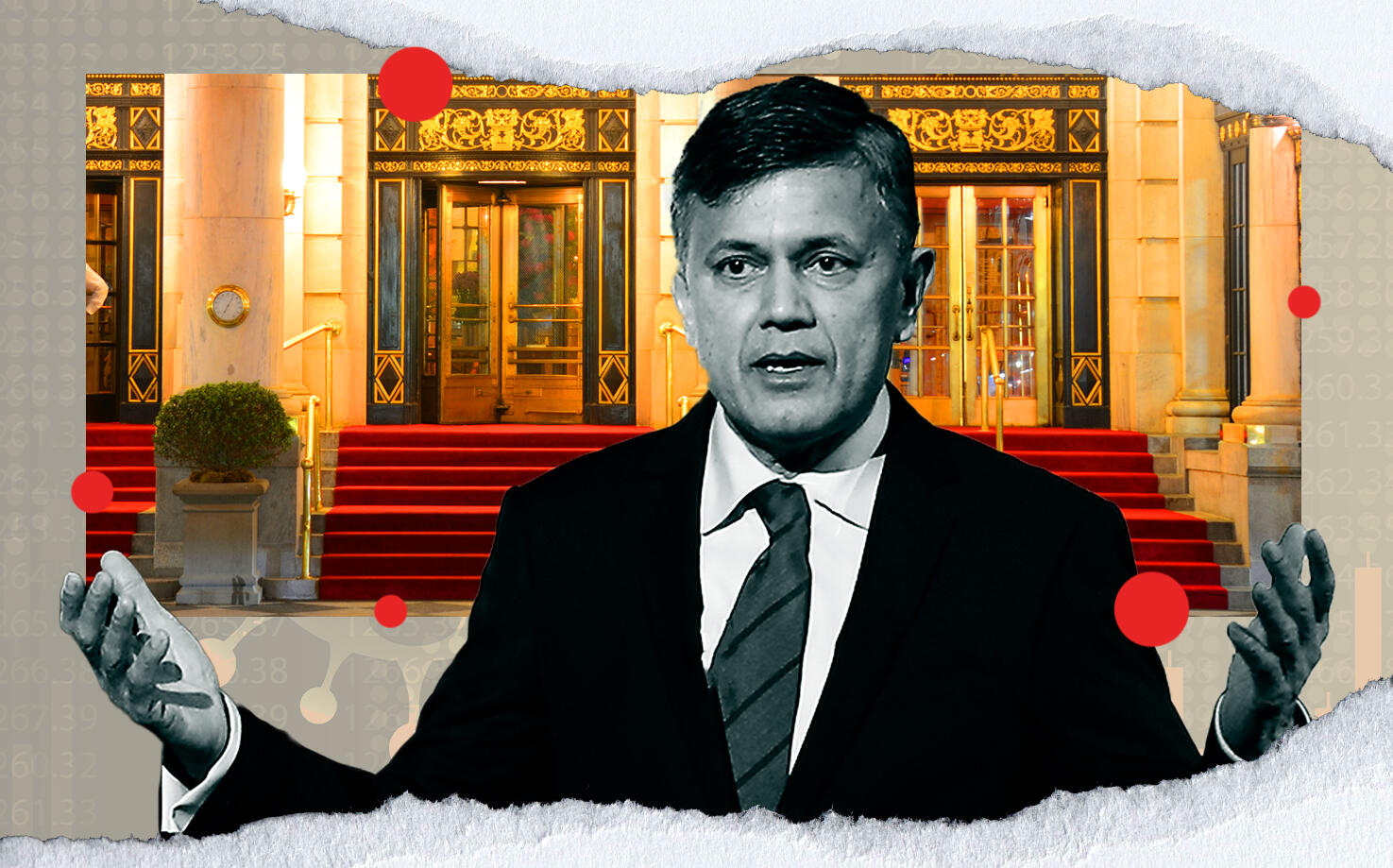

“We need real property tax relief. We had a liquidity crisis and now have a solvency crisis,” said Vijay Dandapani, president and CEO of the Hotel Association of New York City, told The Real Deal.

The group did not say how much it is spending on the effort.

The trade group’s new campaign website, StayNYC.com, says, “Saving hotels would be a downpayment on our recovery.” It adds, “Common sense measures like property tax debt relief and assessments that more fairly represent the current value of hotels will keep hotels open and workers employed.”

By debt relief, the hotel owners mean a lower interest rate than 13 percent — they would prefer zero — on overdue property taxes. They made a similar call one year ago, and in December released a report showing their taxes as a percentage of revenue had tripled in 2020, to 30 percent.

Read more

City Council bill would force hotels to pay severance to laid-off workers

City Council bill would force hotels to pay severance to laid-off workers

NYC City Council passes bill forcing hotels to dish out severance pay

NYC City Council passes bill forcing hotels to dish out severance pay

The new website says that prior to the pandemic, city hotels employed 50,000 people — largely “immigrants and people of color” — accounted for $3.2 billion in revenue and supported $22 billion in spending from global tourism.

“The future for hotels is even less certain,” said Dandapani, who is hopeful that new Mayor Eric Adams and the overhauled City Council will craft targeted measures that drop assessments, reduce the penalty for unpaid taxes and help hotels stay open.

The association is already suing the city in federal court to strike down a law mandating severance pay of $500 per employee for 36 weeks for hotels that did not re-open by November.

“It’s money that the hotels simply don’t have,” wrote David Paz, president of Omnia Group, which owns the Sister City hotel, in a Jan. 27 Crain’s op-ed.

A few hotels did open, perhaps to avoid the penalty, but Dandapani said 145 have closed since the pandemic began.

The city delivered a blow to hotel developers as well by requiring a special permit to build hotels, a law that is expected to stifle nonunion hotel projects. The measure was passed as a favor to the hotel workers union, although in a few years it could help existing hotels by limiting competition. A pipeline of supply that pre-dated the law includes a Ritz-Carlton opening in May, a Virgin Hotel opening this summer and the Fifth Avenue Hotel opening this fall, all in Nomad.

Before Adams was sworn in, Dandapani told him the industry was looking for “safety and cleanliness.” But the ad campaign is more about money. The city’s hotel property taxes are the highest in the country and “inequitable, unfair and unsustainable,” the trade group leader said.

Of the city’s new proposed tax assessments, he said, “It doesn’t reflect the fact that in the first year of the pandemic, revenues were down nearly 65 percent from 2019 and down 44 percent in 2021,” he explained. “We need short-term real property tax relief.”

The new assessments, released Jan. 18, will affect taxes beginning in July. But these were calculated by the city’s Finance Department when hotels were rebounding. Their occupancy rate was 82 percent in December — the highest in two years — but plunged to 43 percent last week. “Omicron took the wind out of our sales,” Dandapani punned.

The assessments push hotels’ average billable values up by 5.9 percent citywide. Many owners figure to challenge their assessments by the March 1 deadline.

“You have to be in a cave in Afghanistan not to file,” Dandapani said.