Black Spruce scored $675M for American Copper Buildings buy

Black Spruce scored $675M for American Copper Buildings buy

Trending

Carmel Partners looks to sell FiDi skyscraper for $500M+

Ron Zeff’s company completed 19 Dutch Street in 2019

Another trophy Manhattan apartment building is up for sale.

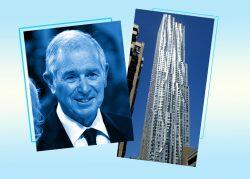

Ron Zeff’s Carmel Partners is looking to sell its nearly 500-unit rental tower at 19 Dutch Street in the Financial District for more than $500 million, The Real Deal has learned.

Carmel purchased the development site, then with an address on nearby Fulton Street, in 2014. In building the 64-story, 330,000-square-foot tower, the company decided to embrace the narrow Dutch Street.

The building includes patterns and other design elements that evoke the Dutch Golden Age, the period during the 17th Century when the Netherlands was at its height of European influence.

“We took the name, 19 Dutch, to heart and tried to create something that embodied Dutch style and elegance,” Douglas Elliman’s Jason Hill, who led marketing at the building, said in a 2018 interview.

A representative for Carmel Partners could not be immediately reached for comment.

Completed in 2019, the luxury skyscraper could be taken as an example of the Manhattan rental market’s recovery from the pandemic.

The building is 98 percent occupied and the owners haven’t given any concessions on new leases or renewals since October, according to marketing materials from Cushman & Wakefield, which is shopping the property to prospective buyers.

As the city bounced back from renters fleeing en masse and leaving behind record vacancies, investors have moved in to snap up trophy properties.

Josh Gotlib’s Black Spruce Capital closed earlier this month on its $837 million purchase of the American Copper Buildings in Murray Hill from Michael Stern’s JDS Development Group and the Baupost Group.

Read more

Black Spruce scored $675M for American Copper Buildings buy

Black Spruce scored $675M for American Copper Buildings buy

Blackstone close to $930M purchase of Lower Manhattan apartment building

Blackstone close to $930M purchase of Lower Manhattan apartment building

Blackstone Group in December struck a deal to buy the Gehry Building at 8 Spruce Street for roughly $930 million from Brookfield Asset Management and Nuveen.

Those kinds of megadeals were outliers in 2021. The investment-sales recovery in Manhattan’s multifamily market lagged the city’s outer boroughs due to a dearth of big-ticket deals normally seen on the island, according to Ariel Property Advisors.

But the momentum at the end of the year signaled that things may be changing.

San Francisco-based Carmel Partners bought the development site at 19 Dutch Street from the Lightstone Group in 2014 for $171 million. The 483-unit property has a 421-a tax abatement that expires in 2039.

Earlier this year, Carmel paid nearly $74 million to buy a 153,000-square-foot development site on the Upper East Side.