All Year reaches deal to sell Denizen for $500M — but there's a catch

All Year reaches deal to sell Denizen for $500M — but there's a catch

Trending

NYC’s 20 largest commercial deals of 2021

Hudson Yards and Chelsea dominate list of biggest sales

The following is a preview of one of the hundreds of data sets that will be available on TRD Pro — the one-stop real estate terminal that provides all the data and market information you need.

UPDATED, Mar. 28: The city’s biggest single-property commercial sales of last year included the priciest deal since 2019, an observation deck, and a bankrupt Brooklyn development.

Analyzing data from the city’s ARCIS database for transactions involving commercial properties, The Real Deal created a ranking of the top 20 commercial deals that closed last year.

For the purpose of this analysis, TRD excluded portfolio sales such as StorageMart’s $3 billion acquisition of Manhattan Mini Storage’s 18 locations, and Mack Real Estate’s acquisition of seven distressed hotels at auction.

Also, some partial-interest deals — such as UBS’s $421 million sale of its 49.9 percent stake in 1177 Sixth Avenue and Vornado’s $394 million buyout of 1 Park Avenue — do not appear in ACRIS records and so were disqualified from this ACRIS-based ranking.

The largest individual commercial property sale last year was CommonWealth Partners’ $1 billion purchase of Hudson Commons, a 25-story office and retail building at 441 Ninth Avenue in Hudson Yards. It was the first investment sale in the city to top $1 billion since 2019.

Next was ViacomCBS’s sale of its iconic Black Rock building at 51 West 52nd Street to Harbor Group for $760 million.

The third largest deal was the sale of the tower at 100 Pearl Street — previously known as 7 Hanover Square — by the Gural family’s GFP Real Estate and the Northwind Group to German investor Commerz Real. Originally reported as a $850 million deal, city records confirm the final price tag was $756 million.

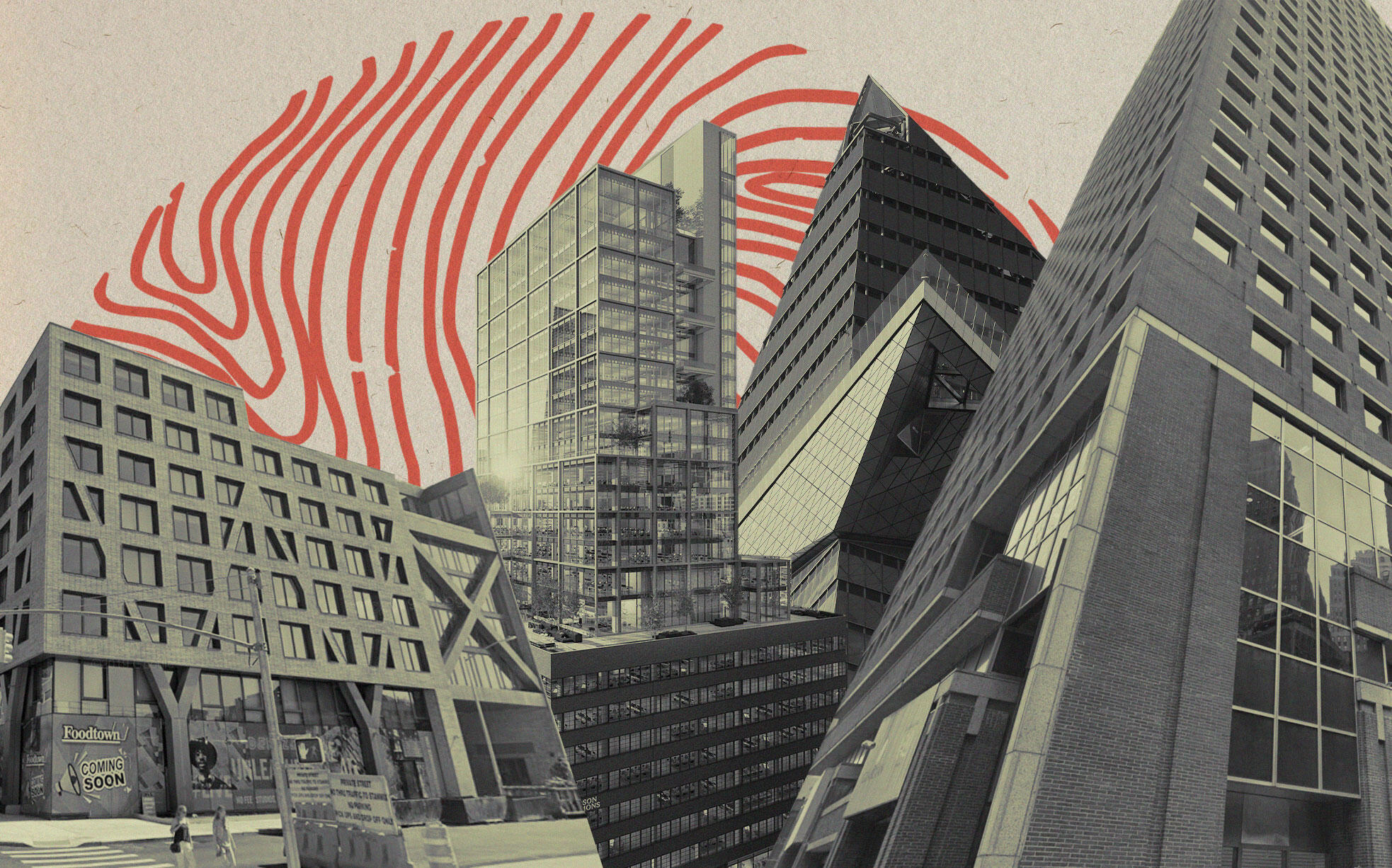

Though most of the city’s biggest sales were in Manhattan, the fourth largest was in Brooklyn: the bankruptcy sale of All Year’s Denizen Bushwick. Atlas Capital Group picked up the massive development on the site of the old Rheingold Brewery for $547 million.

KKR’s $500 million purchase of The Edge observation deck atop 30 Hudson Yards rounded out the top five.

Read more

All Year reaches deal to sell Denizen for $500M — but there's a catch

All Year reaches deal to sell Denizen for $500M — but there's a catch

ViacomCBS sells Black Rock building to Harbor Group for $760M

ViacomCBS sells Black Rock building to Harbor Group for $760M

Other notable deals included the $210 million foreclosure sale of the stalled XI condo project to Steve Witkoff and Len Blavatnik after original developer Ziel Feldman’s HFZ Capital Group lost control of it. And Andrew Farkas’ Island Capital bought the Lexington Hotel for $173 million — nearly $160 million less than seller DiamondRock Hospitality paid for it 10 years earlier.