Mortgage rates surge, capping fastest rise since 1994

Mortgage rates surge, capping fastest rise since 1994

Trending

More mortgage lenders lay off staff as rates rise, applications slow

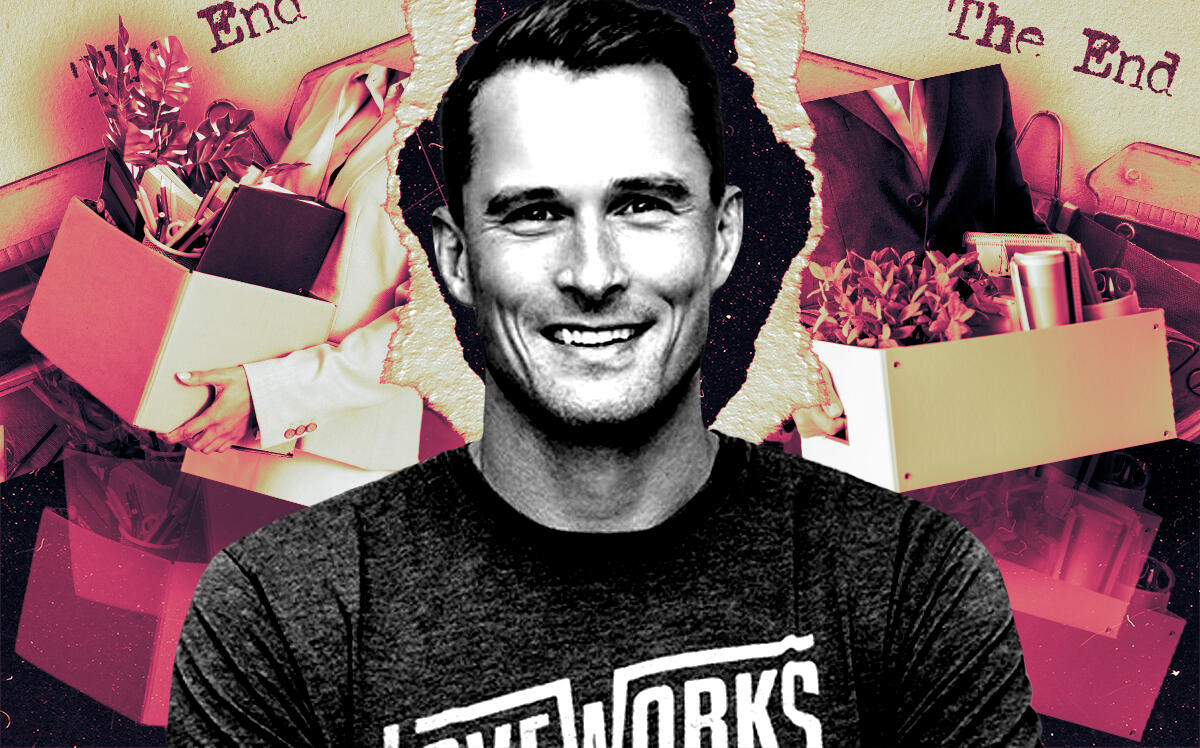

Movement Mortgage let go 170 staffers last month, following mass layoffs at competitor Better.com

Rising mortgage rates are putting pressure on lenders as applications decline.

Movement Mortgage is the latest to face struggles, laying off around 170 employees, HousingWire reported this week. Employees in the processing, underwriting and closing departments were most affected by the cuts, according to the report.

Co-founded in 2008 by former NFL player Casey Crawford, the company’s CEO, Movement Mortgage has more than 775 locations across the U.S. and employs upwards of 4,500 people, according to HousingWire. It has not commented on the layoff report.

The South Carolina-based firm is far from the only mortgage lender making cuts as mortgage rates climb to their highest level since the start of the pandemic. Interactive Mortgage and Freedom Mortgage also recently reduced staff, according to HousingWire.

Better.com, which laid off thousands of employees last month, has resorted to floating voluntary separation plans, to workers starting this week. Employees who accept could be entitled to as much as 60 days of severance and health insurance.

The cooling mortgage market is the likely culprit. Mortgage rates are surging, approaching levels not seen in years. Last week, the 30-year fixed mortgage rate increased for the fourth consecutive week, hitting 4.90 percent, according to the Mortgage Bankers Association.

As a result, demand for mortgage originations is declining. Applications last week dropped 6.3 percent from the previous week, reaching its lowest volume since the spring of 2019.

Movement Mortgage originated $33.1 billion in 2021, a jump of 10.7 percent over 2020, but activity appeared to plateau towards the end of the year, with originations falling 0.7 percent from the third quarter to the fourth quarter.

Read more

Mortgage rates surge, capping fastest rise since 1994

Mortgage rates surge, capping fastest rise since 1994

Better.com floats voluntary resignations after mass layoffs

Better.com floats voluntary resignations after mass layoffs

What brokers are seeing as mortgage rates climb

What brokers are seeing as mortgage rates climb

[HousingWire] — Holden Walter-Warner