Trending

Evictions surge at Hialeah’s luxury apartment projects Shoma Village, Pura Vida and Manor

Evictions surge at Hialeah’s luxury apartment projects Shoma Village, Pura Vida and Manor Lawmakers reach sweeping housing deal with “good cause eviction,” new 421a

Lawmakers reach sweeping housing deal with “good cause eviction,” new 421a Charles Schwab slashing Chicago office space with big subleases

Charles Schwab slashing Chicago office space with big subleases Tony Park and Elad Dror take a gamble on Koreatown office-to-resi conversion

Tony Park and Elad Dror take a gamble on Koreatown office-to-resi conversionFifth Avenue office asks $400M

Beacon Capital and MetLife put 500K sf condo unit on market

An office property in the heart of Midtown hit the market aiming for a sale price north of $400 million.

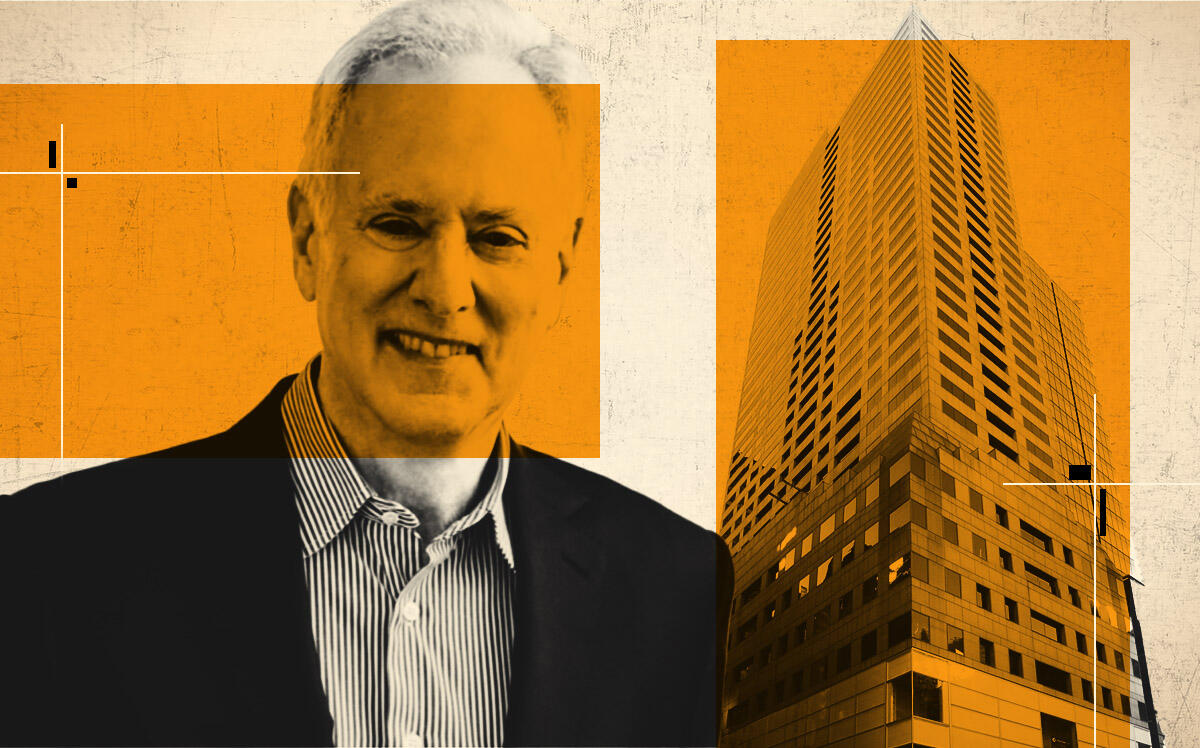

Beacon Capital Partners and MetLife are seeking a buyer for their space at 575 Fifth Avenue. The roughly 500,000-square-foot office condominium at the corner of West 47th Street is 80 percent leased, according to marketing materials from Cushman & Wakefield, where a team led by Adam Spies and Doug Harmon is handling the process.

Representatives for Beacon did not immediately respond to a request for comment. A spokesperson for MetLife declined to comment.

Boston-based Beacon Capital Partners, founded by company CEO Alan Leventhal, acquired a 50 percent stake in the office condo from MetLife in 2015. MetLife also owns the ground-floor retail condo, which is not part of the offering.

Read more

The owners recently pumped about $30 million into renovations of the building and over the past six months have signed leases for 130,000 square feet, according to the marketing teaser. The sales pitch describes the property as one of the “flight-to-quality” buildings that’s performing well in the tenant-friendly office leasing market.

Tenants at the property include Axpo, Charlesbank and Russell Investments. Earlier this year the property manager FirstService Residential leased about 48,000 square feet at the building, which is across Fifth Avenue from the Diamond District.

Beacon’s Leventhal is a major donor to the Democratic Party. In January, President Joe Biden named him the U.S. ambassador to Denmark.