Trending

NYC real estate titan Harry Macklowe makes his first move on Miami with $32M deal

More and more of the Big Apple’s real estate elite have been turning to the Magic City

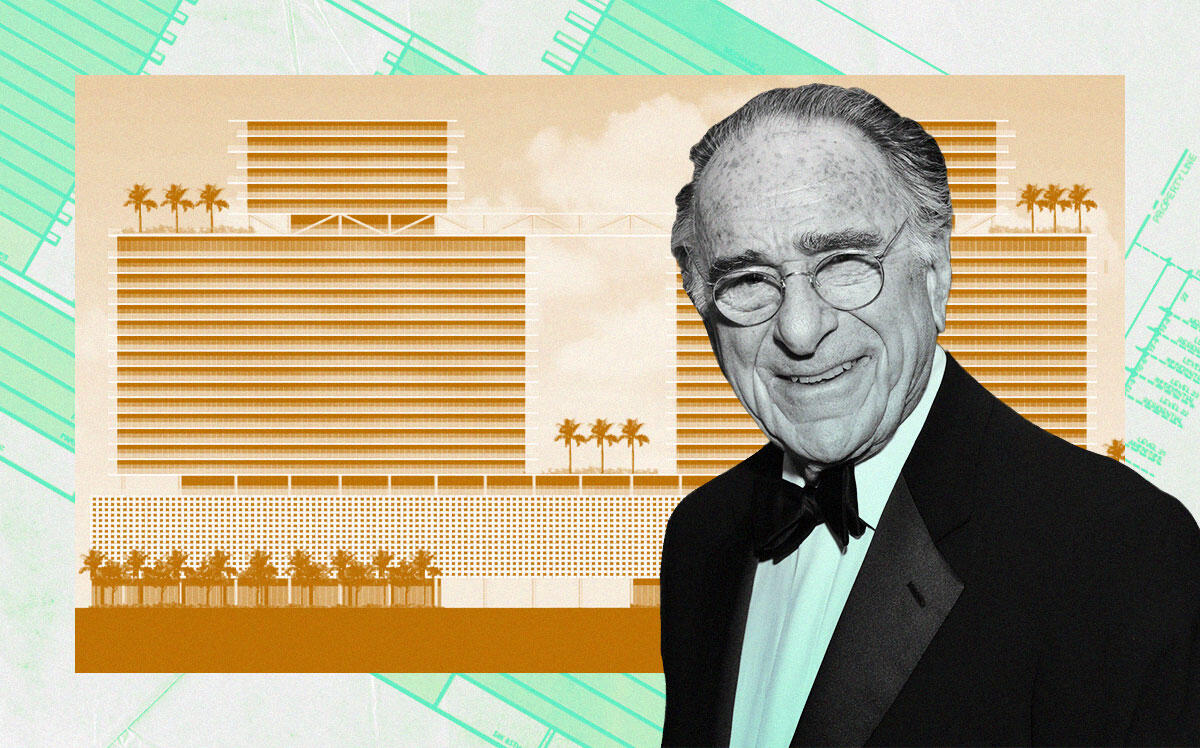

Harry Macklowe is joining the ranks of New York City’s real estate elite with a colorful past who are now turning to Miami, The Real Deal has learned.

Macklowe Properties purchased 1.7 acres of land between Dadeland Mall and the Metrorail tracks with plans to build a pair of apartment towers with several hundred units, marking its first South Florida project.

Rilea Group and Euroamerican Group, through an affiliate, sold the property for $31.9 million, according to Charles Penan of Aztec Group, who represented the sellers.

Penan declined to disclose the buyer. But Macklowe Properties in February had filed a project application with Miami-Dade County, saying it has the property under contract.

The plan is for up to 25-story buildings with a combined 650 units, as well as 11,455 square feet of retail; 27,725 square feet of amenities; and 614 parking spaces, according to Macklowe Properties’ submittal to the county seeking a modification of a previously approved site plan that allows for 448 units.

Rilea bought the land in 2015 from an affiliate of Florida East Coast Industries for $13 million, property records show. In 2016, Rilea received approval for the smaller project. The property is south of the Snapper Creek Canal, west of the Metrorail tracks, and steps from the Dadeland North station, allowing for a transit-oriented development giving renters easy access to the Metrorail.

Macklowe founded his namesake company in New York City in the mid-1960s, and built projects such as the 432 Park Avenue residential skyscraper, developed with CIM Group; and the 510 Madison office tower.

Yet, during the credit crunch of the Great Recession, Macklowe lost control of seven Manhattan buildings after he was unable to refinance them. Among the properties were the GM Building and the Crédit Lyonnais Building.

And more recently, the 85-year-old had a highly public, acrimonious divorce from his ex, Linda Macklowe. The art collection they shared was auctioned off in November, reaping $676.1 million.

Other members of New York’s real estate royalty with a storied past who are honing in on South Florida include Jeshayahu “Shaya” Boymelgreen, who was banned from offering or selling securities, including condos, following a settlement with the New York attorney general in 2016. Before that, in the early 2000s, Boymelgreen partnered with diamond billionaire Lev Leviev on projects but the partnership was later dissolved.

Boymelgreen scored a $30 million construction loan for a 200-key hotel at 9300 Collins Avenue in Surfside in March. Previously, an entity controlled by his wife, Sarah, and others had planned to build a residential project along Miami Beach’s Pine Tree Drive, but sold the site for $31 million in 2017.