Crashing the party: New SPAC rules could slash proptech deals

Crashing the party: New SPAC rules could slash proptech deals

Trending

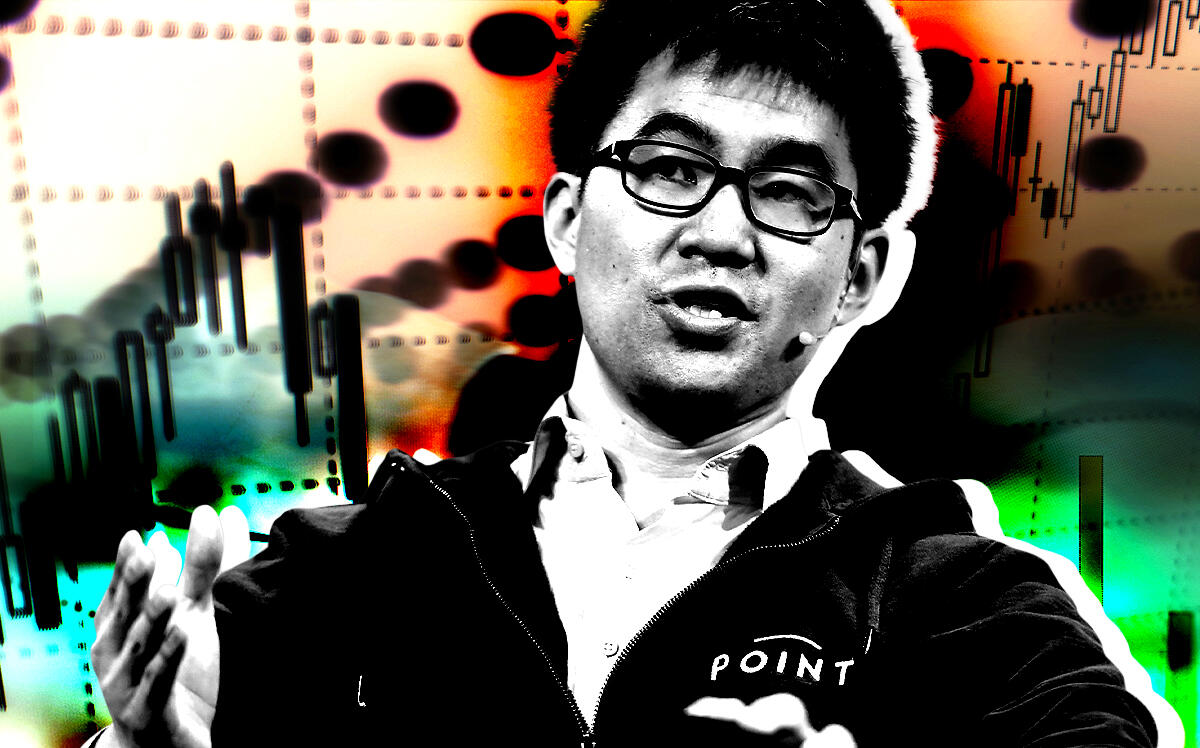

Home equity financing startup Point raises $115M Series C

Company, which says it grew its home equity investments five-fold in Q1, did not disclose its valuation

Point, a fintech startup that pays homeowners cash in exchange for a share of the equity in their homes, raised $115 million in Series C funding, it said Tuesday.

The Palo Alto-based company did not disclose a valuation figure with the funding round, which was led by WestCap and follows a $22 million Series B in 2019. With the new raise, the startup’s total equity funding comes to about $145 million, according to Crunchbase.

The funding comes after a period of fast growth for Point, whose CEO, Eddie Lim, said its home equity investments increased five-fold in the first quarter on a year-over-year basis. Lim declined to offer actual figures or information about the startup’s profitability.

Co-founded by Lim, Eoin Matthews and Alex Rampell in 2015, the startup is not the only one to offer cash for home equity — an alternative to traditional home equity lines of credit — but it has taken a novel approach to the back end of the business.

Point is a self-described “asset-light” fintech; its operations focus on originating and servicing home equity investment agreements, or HEIs, for investors including the startup’s own backers. Once there is a critical mass of HEIs, the company — with the help of investment bankers — packages them into a new security, which it markets to real estate and mortgage-backed securities investors.

The company claims to be the first to have completed a securitization backed entirely by HEIs, in a $146 million deal last September, underwritten by Nomura.

“The securitization is the point where we went from junior varsity to varsity,” Lim said. “There’s liquidity and we can show that these are really institutional grade.”

Also participating in the Series C round were existing investors Andreessen Horowitz, Ribbit Capital, Redwood Trust, Atalaya Capital Management and DAG Ventures, which led the company’s Series B.

New investors included Deer Park Road Management, The Palisades Group and Alpaca VC.

Point’s business is fundamentally a bet on the continued rise of home prices — a risky bet as rising interest rates threaten to derail the U.S. housing market’s historic run. At the same time, rising inflation and borrowing costs have made products like Point’s more attractive for cash-strapped consumers, according to Lim.

Point, whose average investment is around $100,000 — typically 15 to 20 percent of a home’s value — charges homeowners a 3 percent transaction fee up front, but there are no monthly interest payments. Homeowners have 30 years to pay the company back.

The company also collects asset management fees from investors.

The startup’s main competition, Lim said, is consumer financial products that offer more immediate access to liquidity, such as credit cards and personal loans.

There are other startups at the intersection of fintech and proptech that similarly offer cash for home equity, including HomePace and Splitero, which both recently completed funding rounds of less than $10 million. EasyKnock, a firm that offers sale-leasebacks for homeowners — cash for the whole home, rather than just a piece of it — raised $57 million in a Series C round earlier this year at an undisclosed valuation.

Point plans to use the new funds to invest in “new products” and expand into 11 new markets including Ohio and Nevada, Lim said, declining to offer more specifics. It now operates in 16 states, including New York, California and Florida, as well as Washington, D.C.

“We have effectively unlimited supply on the capital side and unlimited demand from homeowners,” he said. “Now it’s all about hiring as quickly as possible and building out the technology platform.”

Read more

Crashing the party: New SPAC rules could slash proptech deals

Crashing the party: New SPAC rules could slash proptech deals

CoStar shares rebound on higher Q1 profits, revenue

CoStar shares rebound on higher Q1 profits, revenue

Insurtech startup TheGuarantors raises $50M

Insurtech startup TheGuarantors raises $50M