Owner of NYSE, MERS to acquire property database firm

Owner of NYSE, MERS to acquire property database firm

Trending

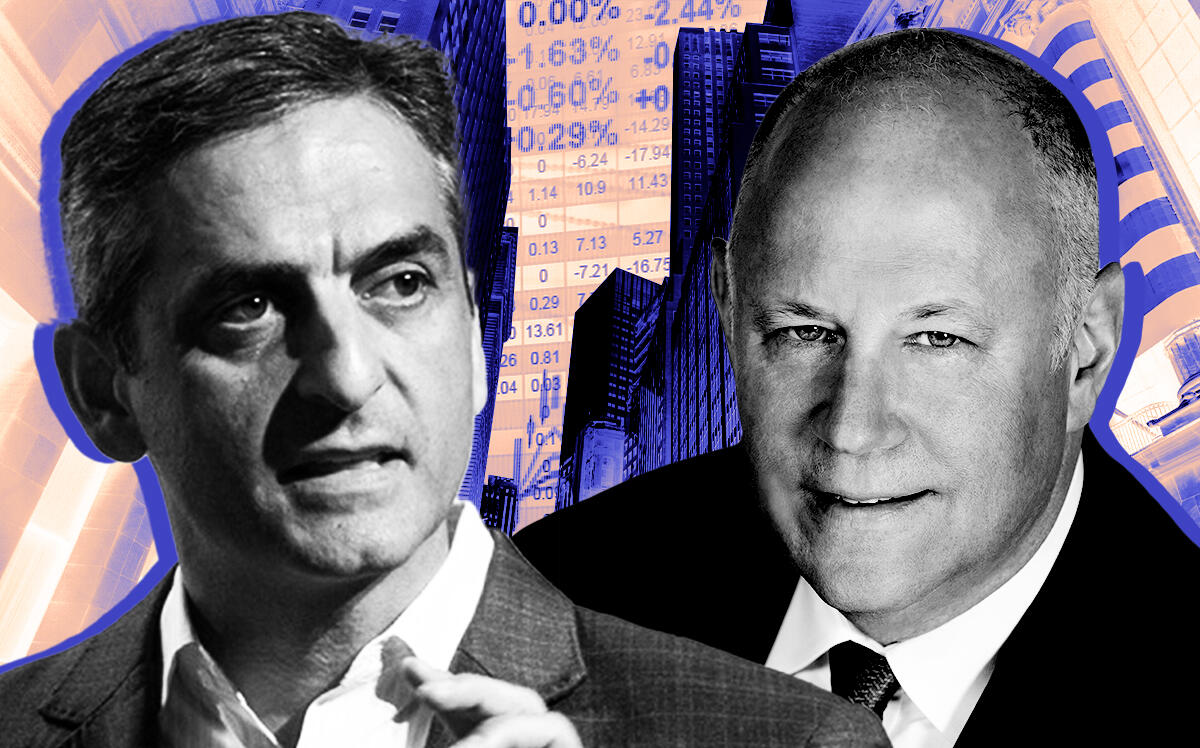

Intercontinental Exchange expands mortgage play with $13B Black Knight buy

NYSE owner to grow mortgage tech business

Intercontinental Exchange, the owner of the New York Stock Exchange, has agreed to acquire mortgage data firm Black Knight for $13.1 billion, the companies announced Wednesday. The cash and stock deal comes at $85 per Black Knight share, about a 13 percent premium to the share price as of mid-morning Thursday.

The acquisition is expected to close in the first half of next year, pending approval from Black Knight shareholders. Jacksonville-based Black Knight employs close to 6,500 people.

Black Knight provides software, data and analytics for the real estate and housing finance markets. The companies said in a release that ICE’s acquisition of the company will increase automation and efficiency to lower the cost of obtaining a mortgage, while also providing data that could help homeowners lessen monthly payments and default likelihood.

ICE CEO Jeffrey Specher said the move is aimed at producing “a true end-to-end solution” in mortgage services.

Read more

Owner of NYSE, MERS to acquire property database firm

Owner of NYSE, MERS to acquire property database firm

What brokers are seeing as mortgage rates climb

What brokers are seeing as mortgage rates climb

Former MF Global space at Park Avenue Plaza leased to Intercontinental Exchange

Former MF Global space at Park Avenue Plaza leased to Intercontinental Exchange

The deal comes as mortgage rates reached unprecedented increases, potentially spurring hesitation in the housing market as buyers weigh whether or not to deal with higher rates or drop out. Rates saw historic lows during the pandemic, but they are poised to continue rising as the Federal Reserve increases interest rates.

The NYSE is among various exchanges operated by Atlanta-based ICE. In recent years, however, the company has been angling to play a bigger role in the country’s mortgage industry.

In 2020, the company agreed to acquire mortgage software firm Ellie Mae for nearly $11 billion.

Prior to that, ICE paid $335 million to acquire Simplifile, one of the country’s largest e-recording networks and providers of property record databases for county recorder offices. The deal enabled ICE to further digitize the mortgage ecosystem.

Previously, ICE acquired mortgage database MERS.