Spike in investment sales pushes Colliers’ quarterly revenue above $1B

Spike in investment sales pushes Colliers’ quarterly revenue above $1B

Trending

Colliers acquiring majority stake in Rockwood

Brokerage to expand real estate credit business

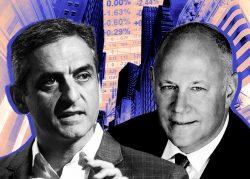

Colliers International is poised to expand its in-house offerings after picking up a majority stake in a major real estate investment firm.

The brokerage announced this week it is acquiring a 65 percent stake in Rockwood Capital. The financial terms of the investment were not disclosed.

Rockwood’s leadership will retain the other 35 percent of the company in the deal Colliers called a “perpetual partnership.” The firm projects it will draw annual management fee revenue between $70 million and $75 million from the acquisition, which is expected to close in the third quarter.

Colliers CEO Jay Hennick said the acquisition was part of the company’s “growth strategy to build a world-class investment management platform.”

Rockwood, which is headquartered in New York, makes equity and credit investments in multifamily, office, mixed use, life science, hospitality, and retail sectors. The firm has more than $12 billion assets under management.

Read more

Spike in investment sales pushes Colliers’ quarterly revenue above $1B

Spike in investment sales pushes Colliers’ quarterly revenue above $1B

Intercontinental Exchange expands mortgage play with $13B Black Knight buy

Intercontinental Exchange expands mortgage play with $13B Black Knight buy

Colliers is one of the biggest commercial real estate brokerages in the country. The firm has $57 billion assets under management, but that will grow by $20 billion once the company’s pending transactions close.

In January, Colliers purchased British-based infrastructure investment management firm Basalt Infrastructure Partners, according to Bisnow. The brokerage also recently raised its revenue forecast for the year.

Colliers finalized a deal last fall to acquire Bergmann, a national architecture, engineering and planning firm, for an undisclosed sum. In 2020, the company acquired Dougherty, whose subsidiaries provide loan servicing and mortgage lending, and Maser Consulting, an engineering and design consulting firm.