Simon Development, BPG marketing $425M Queens tower

Simon Development, BPG marketing $425M Queens tower

Trending

Investors in huge LIC project buy out Durst for $97M

Group including Bruce Teitelbaum, MAG nabs financing for “Lake Vernon” development

The Durst Organization is out of a planned 112 million square-foot development along the Long Island City waterfront, clearing the way for the huge project to move ahead.

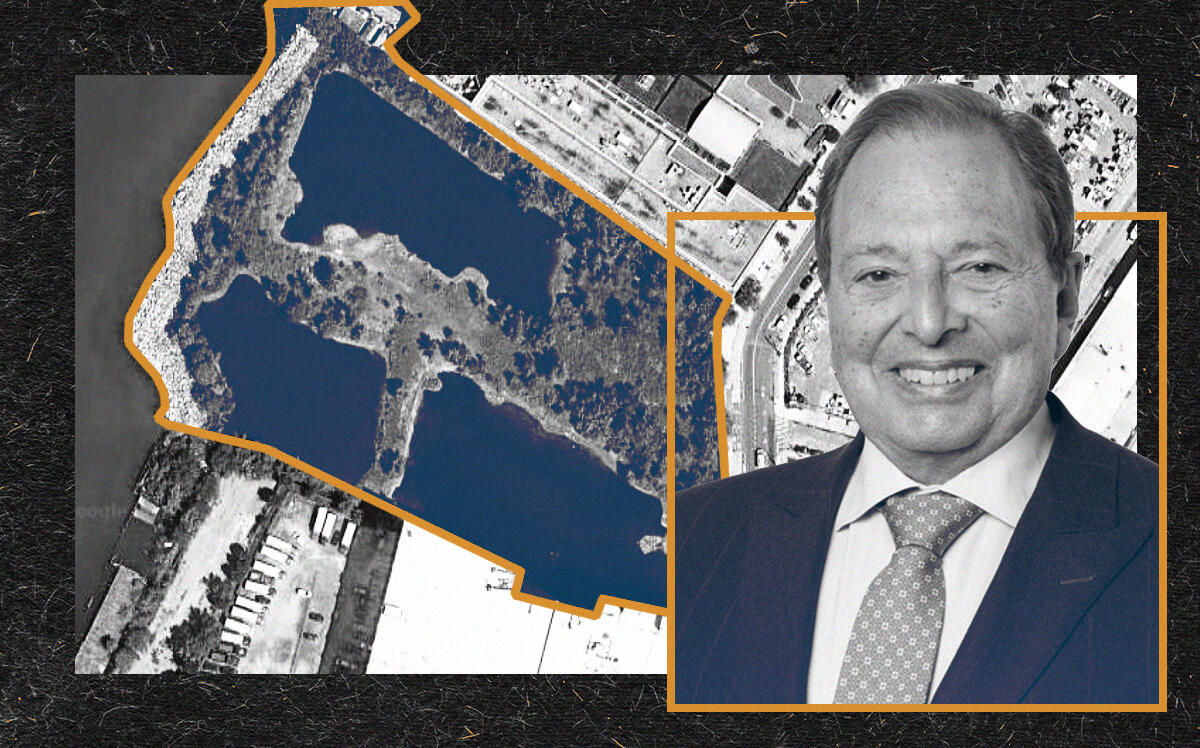

A group of investors including Mayor Rudy Guiliani’s former confidante Bruce Teitelbaum and MaryAnne Gilmartin’s MAG Partners bought out Douglas Durst from the “Lake Vernon” site near the Anable Basin in Queens, The Real Deal has learned.

Durst Organization spokesperson Jordan Barowitz confirmed the transaction, saying the group bought out Durst’s position for approximately $96.9 million.

”We wish them well,” Barowitz said.

Teitelbaum and his partners closed on financing Tuesday, allowing them to end a long dispute with Durst over 44-02 Vernon Boulevard.

Read more

Simon Development, BPG marketing $425M Queens tower

Simon Development, BPG marketing $425M Queens tower

Carmel Partners buys one of Queens’ most expensive development sites

Carmel Partners buys one of Queens’ most expensive development sites

A spokesperson for Teitelbaum did not immediately respond to a request for comment.

Durst’s exit removes one hurdle for the redevelopment project, but others remain. Plans call for a mixed-use development on a 28-acre site that includes other properties owned by TF Cornerstone, Plaxall and Simon Baron Development.

The developers could build a 1.2 million-square-foot residential building with a small commercial space as-of-right, but plan to seek a rezoning to construct something larger. In that scenario, the residential portion would be required to include affordable housing under the city’s Mandatory Inclusionary Housing law.

Any rezoning would almost certainly need the approval of City Council member Julie Won, a Democrat who represents the area.

The property is worth at least $200 million, but the project’s cost remains unknown. Details of the financing could not be determined.

The “Lake Vernon” site, which earned its moniker for its large puddles, has been at the center of a decade-long court battle between Durst and the property’s owners.

Durst held the mortgage on the site and filed to foreclose in 2009 after acquiring the non-performing debt. The company spent millions of dollars on property taxes and fines over the years to keep the city from seizing the neglected land.

Teitelbaum’s group said it had been trying to pay back the loan for years, but the two sides disagreed on how much money was owed and how much interest should be charged while the loan was in default.

An attorney representing Teitelbaum’s group had said that under the state’s equity of redemption right, Durst couldn’t take control of the site as long as the owners paid the money owed.

A referee in the foreclosure proceedings put the amount owed at $69.3 million in 2019. Durst, however, deemed that too low and filed an objection. In May 2020, a state Supreme Court judge agreed with the amount set by the court-appointed referee the year before.

After Amazon abandoned an effort in February 2019 to build a portion of its second headquarters on the Anable Basin development site, the owners made plans to develop as many as 15 buildings there.

The builders’ task force presented a plan to the local community board in May 2020 that broadly outlined 10 million to 12 million square feet of development over the next 10 to 15 years. Half of that total is expected to be commercial, with the other 50 percent split between residential and nonresidential uses.