EverWest pays $66M for NJ industrial portfolio

EverWest pays $66M for NJ industrial portfolio

Trending

Tri-state deal roundup: Multifamily, industrial still hot

Recent sales in Elizabeth, Newark, Hudson Valley

In a world of rising apartment and warehouse rents, it is not hard to find investors for multifamily and industrial assets in the tri-state area.

A number of recent sales in New Jersey and the lower Hudson Valley, along with a development in Newark, reflect that interest.

In North Brunswick, the Northwood Estates Apartments, a 253-unit garden-style community at 500 Adams Lane, sold in an off-market deal between undisclosed parties for $63.5 million. The sale was the first part of a 1031 exchange, which allows investors to defer capital gains taxes on the sale of a property if the proceeds are quickly used to make a similar real estate purchase.

David Jarvis (Gebroe-Hammer Associates)

The 21-building complex was built in 1974 and consists entirely of two-bedroom, two-bathroom units from 1,086 to 1,199 square feet. The deal was arranged by David Jarvis of Gebroe-Hammer Associates.

In Newark, Jarvis also arranged a multifamily portfolio sale totaling 484 units for more than $80 million. The buyer of the Skylark-North Newark Portfolio was a long-time private investment client, while the seller was a private investment group.

In Elizabeth, Joni Sweetwood of Kislak Realty arranged the $50 million sale of a 10-building, 324-unit portfolio between undisclosed parties. The deal also included two cell towers and represented the highest-priced multifamily sale in the city’s history, according to CoStar.

On the industrial side, EverWest Real Estate Investors acquired a 215,000-square-foot warehouse at 329 New Brunswick Avenue in Rahway, New Jersey, for $62 million, the Commercial Observer reported. The seller was an entity called 329 New Brunswick Avenue Owners LLC.

Denver-based EverWest has been making moves in the New Jersey industrial market, one of the country’s most robust because of its proximity to 20 million consumers and nearly as many highways (sorry, Garden State). Last year, EverWest paid $65.9 million for a three-building portfolio in Moonachie.

Read more

EverWest pays $66M for NJ industrial portfolio

EverWest pays $66M for NJ industrial portfolio

Shorewood plans 227K-sq ft mixed-use project in Jackson Heights

Shorewood plans 227K-sq ft mixed-use project in Jackson Heights

Bergen County apartments trade for $22M in 1031 exchange

Bergen County apartments trade for $22M in 1031 exchange

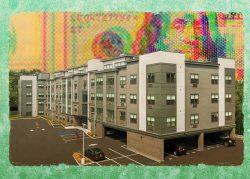

On the development front, Shorewood Real Estate Group started construction of a six-story, mixed-use building at the site of the former Ballantine Brewery in Newark. The $88 million project at 80 Freeman Street will deliver 280 units, including affordable housing, and 2,600 square feet of retail.

The project, done in partnership with Bridge Investment Group, is expected to be completed in the first quarter of 2025.

Shorewood is also working on a mixed-use development in Queens, at the site of a Food Bazaar in Jackson Heights. Filed plans call for a six-story, 227,000-square-foot development at 34-20 Junction Boulevard with 125 apartments.

Matt Weilheimer (Kislak Realty)

In New York’s Hudson Valley, the Tudor Gardens Apartments in Port Jervis was sold for $14.3 million. The 140-unit complex at 29 Culvert Street and 103 Ryan Street is fully occupied. Kislak’s Matt Weilheimer brokered the deal, but the firm did not reveal the buyer or seller.