NY Public Library leases 41k sf for Midtown offices

NY Public Library leases 41k sf for Midtown offices

Trending

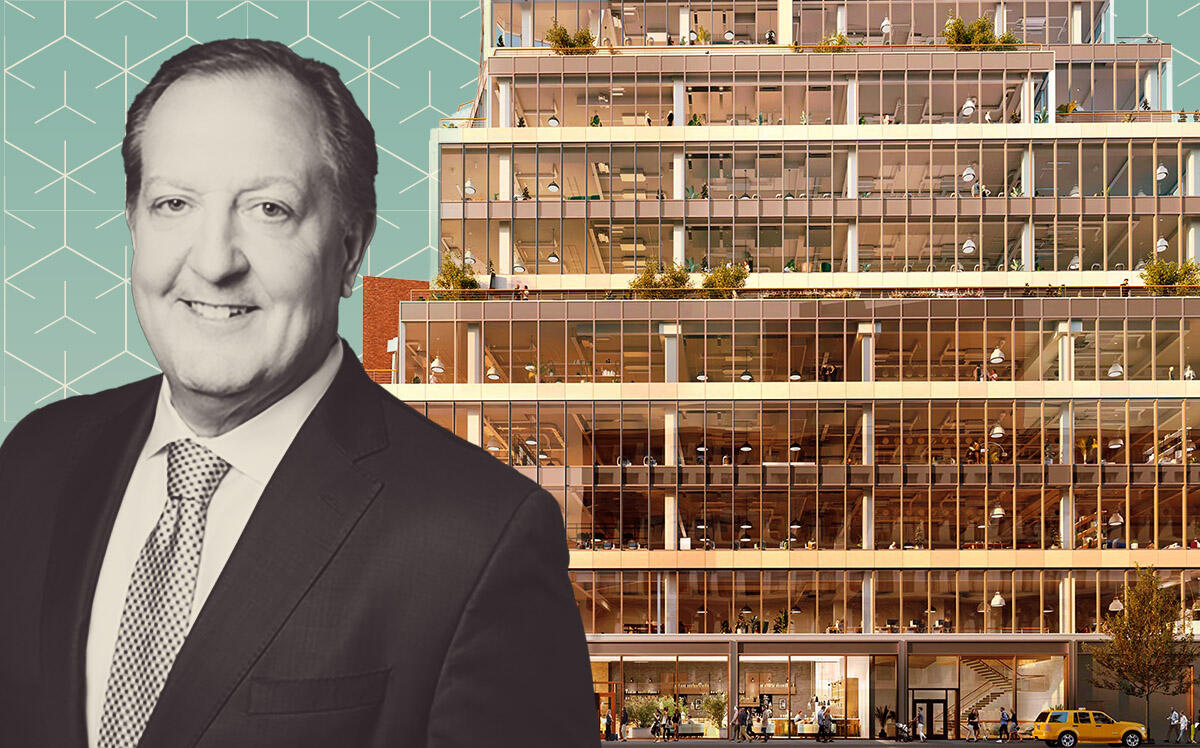

Columbia Property Trust signs investment firm to 71K sf at 799 Broadway

Boston-based Wellington Management becomes fourth tenant at boutique building

A Boston-based investment management firm has selected Columbia Property Trust’s 799 Broadway for its first New York City office.

Wellington Management beefed up its real estate footprint by leasing 71,000 square feet across four floors at Columbia Property Trust’s new boutique office building three blocks south of Union Square.

Wellington’s 16.5-year agreement makes it the largest occupant of the office complex, which sits on the corner of East 11th Street and Broadway where Union Square, Greenwich Village and the East Village converge. Wellington will occupy about 40 percent of the building’s 182,000 square feet.

The financial terms of the lease were not disclosed. JLL Capital Markets represented both parties in the negotiations.

Read more

NY Public Library leases 41k sf for Midtown offices

NY Public Library leases 41k sf for Midtown offices

Vice scraps move to Rudin’s Dock 72

Vice scraps move to Rudin’s Dock 72

Wellington is the fourth tenant to call 799 Broadway home. National mortgage lending and servicing organization New Residential Investment Corporation signed a two-floor, 25,000-square-foot lease. The agreement also included four outdoor terraces totaling 2,700 square feet.

Investment firm Bain Capital Ventures signed a full-floor, 9,000-square-foot lease for 10 years to move its offices up the street from 632 Broadway. An undisclosed tenant nabbed two floors in January.

Columbia Property Trust has found tenants for nine of the building’s 12 floors. The structure is now 70 percent leased, according to the REIT.

Annual asking rents in the building have reportedly ranged from $150 to $200 per square foot. Designed by Perkins & Will, the building has a communal garden, gym, lounge and bike room. The St. Denis Hotel previously stood at the site before the office development popped up.

Normandy Real Estate Partners and Columbia Property Trust finalized a $300 million joint venture for the building’s development in 2018, landing a $187 million construction loan from Apollo Commercial Real Estate Finance. Columbia Property Trust closed on its 50 percent stake from Ares Management at a $142.5 million valuation.