Here’s how much money the GM Building makes

Here’s how much money the GM Building makes

Trending

Firm ditches Park Ave for entire floor of GM Building

Eldridge takes 75% more space at Boston Properties’ tower

As many firms downsize but upgrade their office space to account for hybrid work, one Midtown tenant is expanding — leaving Park Avenue for larger digs on Fifth.

Eldridge is moving its city offices to the entire 17th floor of 767 Fifth Avenue, a 50-story office tower owned primarily by Boston Properties and better known as the General Motors Building.

It signed a nearly 11-year lease for 37,150 square feet, roughly 75 percent more than it will leave at Vornado Realty Trust’s 350 Park Avenue, where the landlord is only granting short-term renewals in expectation of constructing a tower to open in 2027. Eldridge, based in Greenwich, Connecticut, expects to move in the first quarter of 2023 after the space is completely rebuilt.

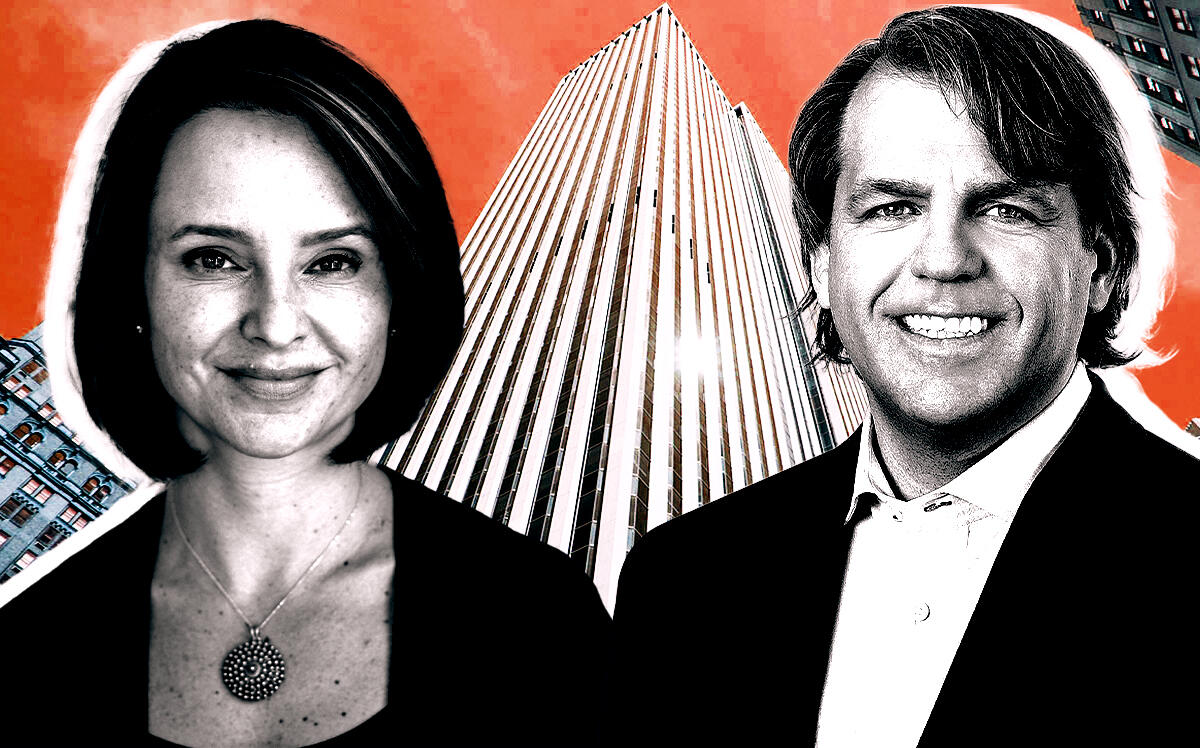

From left: CBRE’s Caroline Merck, Boston Properties’ Sophie Smolen, and Newmark’s E.N. Cutler (Newmark, CBRE, LinkedIn/Sophie Smolen)

E.N. Cutler and Noel Flagg of Newmark represented Eldridge while 767 Fifth Avenue, owned by a group led by Boston Properties, was represented in-house by Andrew Levin and Sophie Smolen along with the CBRE team of Christie Harle and Caroline Merck.

Read more

Here’s how much money the GM Building makes

Here’s how much money the GM Building makes

Under Armour to sublease planned Fifth Avenue flagship

Under Armour to sublease planned Fifth Avenue flagship

Vornado, Rudin mull 1,450-foot tower in Midtown East

Vornado, Rudin mull 1,450-foot tower in Midtown East

The 2 million-square-foot, full-block building overlooks Central Park and is bounded by Fifth and Madison avenues and East 58th and East 59th streets. The Apple Cube sits on its plaza and luxury retailers have other spaces.

The companies declined to reveal asking rents or other terms but the address is known for prices in the triple digits per square foot. Another real estate source confided that the asking rent on the floor Eldridge leased was $119 — and $180 on the top floors.

Considered one of the city’s “country club” buildings for its luxury and amenities, 767 Fifth features such tenants as Estee Lauder, Weil Gotshal Manges, Perella Weinberg and Baron Capital.

Eldridge invests in other companies by providing debt and equity capital. On its website, CEO Todd Boehly says in a video, “Our approach is very simple: we invest in what people need and what people want.” Apparently, it believes its employees need and want a lot more than a desk and a water cooler.

Conventional wisdom says offices must be nicer than ever to lure work-from-homers back to their cubicles. At 767 Fifth, Boston Properties is constructing a new 35,000 square-foot amenity center that will have a café, fitness, wellness, conferencing, a lounge, and locker rooms.

Others in the industry suspect certain office upgrades will prove to be overkill. “In four years, all of us owners and advisers are going to laugh at each other at how much money we spent on amenities that no one uses,” Chris Shlank, founder and managing partner of Savanna Fund, said at The Real Deal’s Showcase event last week.

The space that Eldridge is taking was previously occupied by York Capital, which wound down its non-European hedge fund investments in November 2020.

Kathryn Brenzel contributed reporting.