Douglas Elliman’s top brokers Oren and Tal Alexander leave to launch Official with Side

Douglas Elliman’s top brokers Oren and Tal Alexander leave to launch Official with Side

Trending

Official business: Side lures the A-team, questions the establishment

Rainmakers for Douglas Elliman, Tal and Oren Alexander moved to a startup that prides itself on staying in the background

Some brokers need a firm behind them. Others might just need a vendor.

A number of fascinating approaches are emerging in high-end residential brokerage, a business whose demise is predicted every time there’s a market slowdown, an oligarch crackdown or a rush of venture capital that promises transformation.

Brokerages haven’t gone anywhere yet — in fact, 2021 was a banner year for most of New York’s leading firms — but their strategies for catering to talent have begun to sharply diverge. I’m going to butcher a few sports metaphors in here, so forgive me in advance.

Let’s call the first approach “no player is bigger than the club,” popularized by Manchester United’s legendary coach, Sir Alex Ferguson. This treats the brokerage like a traditional company — you almost forget that agents are independent contractors — with the corporate brand superseding that of any individual rainmaker.

In this approach, exemplified by Douglas Elliman, Brown Harris Stevens or even relative newcomer Compass, the company’s expertise, training and network are highlighted. Executives give pep talks, speak on panels, pen op-eds, do TV hits and emphasize that it’s the firm that makes the magic happen.

The second approach — let’s call it the “cult of personality on social media steroids” — was pioneered in New York by Ryan Serhant, who left Nest Seekers to strike out on his own in late 2020, recognizing that his reality TV fame and Ken Doll looks were great tools for building a new-age, social-first firm.

Serhant’s star power, extreme hustle and willingness to rip apart the buttoned-up image of a luxury real estate broker make him a target for the old guard — he took heat from BHS CEO Bess Freedman on a recent panel I hosted — but he’s clearly finding success in building a firm in his own image.

The Serhant model is the least replicable, because few brokers have that kind of reach (Elliman’s Fredrik Eklund or Josh Altman are the only others who come to mind). But there’s a third approach coming into focus, one that seeks out stars but not to outshine them.

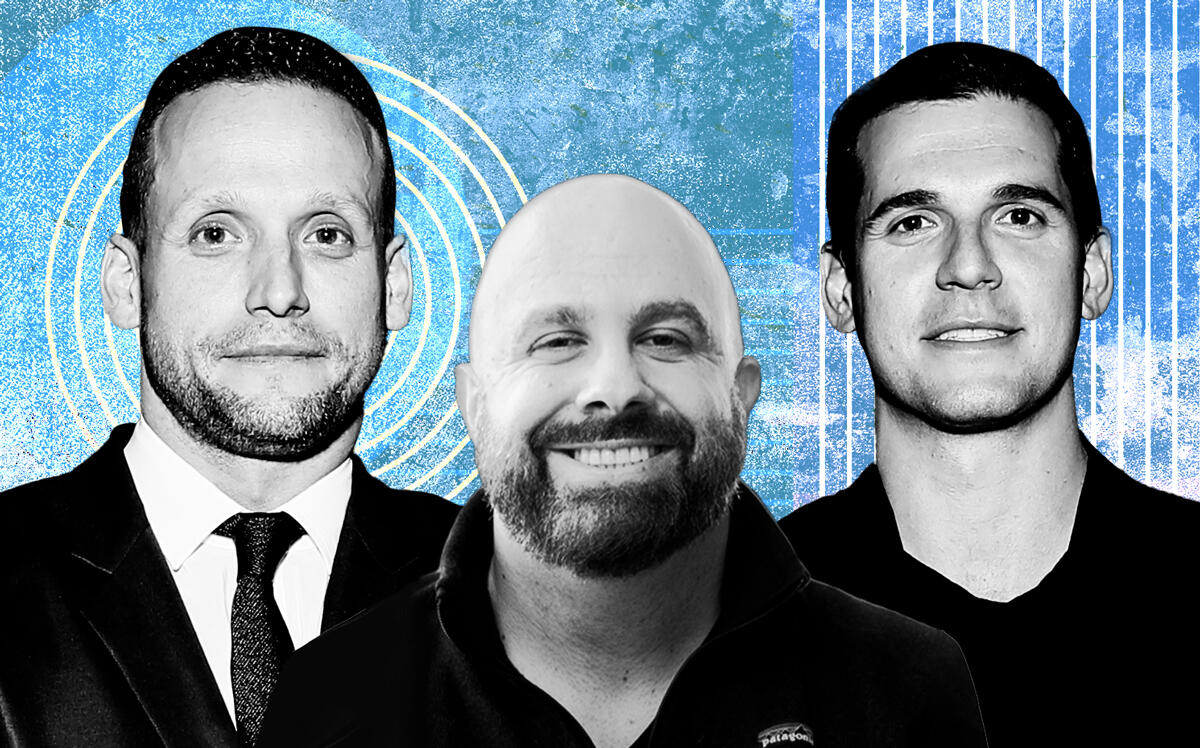

It’s epitomized by Side, a venture-backed startup that bills itself as a “back office for top brokers,” and as my colleague Katherine Kallergis reported yesterday, just landed two of the country’s most high-profile dealmakers, Tal and Oren Alexander.

Call them what you like — attention-obsessed, controversial, bro-y — the Alexanders are clearly top performers. The Alexander team at Elliman said they brokered $1.8 billion in sales last year across New York, South Florida, the Hamptons and Aspen, and rode the wave when South Florida’s high-end market went bananas during the pandemic, breaking records and putting even Manhattan prices to shame.

Side’s gain is a big loss for Elliman — the team represented a sizable 3.5 percent of the firm’s $51 billion book of business last year — and a direct challenge to New York’s establishment firms, whose other rainmakers might now question whether they still need a traditional brokerage.

Side founder Guy Gal seems to be channeling former Chicago Bulls head coach Doug Collins with his “Get the ball to Michael and everybody get the fuck out of the way” philosophy. His company, he’ll tell you, is a service provider to elite agents — nothing more.

“They can fire us whenever they feel like it,” he said of the Alexanders Tuesday. “We are a vendor to them.”

Read more

Douglas Elliman’s top brokers Oren and Tal Alexander leave to launch Official with Side

Douglas Elliman’s top brokers Oren and Tal Alexander leave to launch Official with Side

You can’t sit with us: How Side’s elite-agent model could upend the resi brokerage game

You can’t sit with us: How Side’s elite-agent model could upend the resi brokerage game

Side has ridden that approach to a $2.5 billion valuation and built a roster of star brokers in Los Angeles, San Francisco and Miami — all of whom manage their own brands and pocket 90 percent of the spoils. Side’s 10 percent cut is far smaller than what traditional firms would typically take in New York.

The startup has had its own challenges to deal with; last week, Inman reported that it had laid off a tenth of its staff. But landing the Alexanders gave Gal another opportunity to question why New York’s rainmakers would give up so much of their commissions for hand-holding they don’t need. He called standard commission rates — traditionally, top New York firms keep 25 percent to 50 percent of the agent’s commissions, depending on seniority, sales volume and other factors — “outrageous and exploitative.”

“How are agents supposed to invest in their growth and service when they carry all the cost and risk, do all the work, and still give a quarter of their income to a company in exchange for a logo?” he told me on Twitter. “Wild.”

Write to Hiten Samtani at hs@therealdeal.com or @hitsamty on Twitter.