Trending

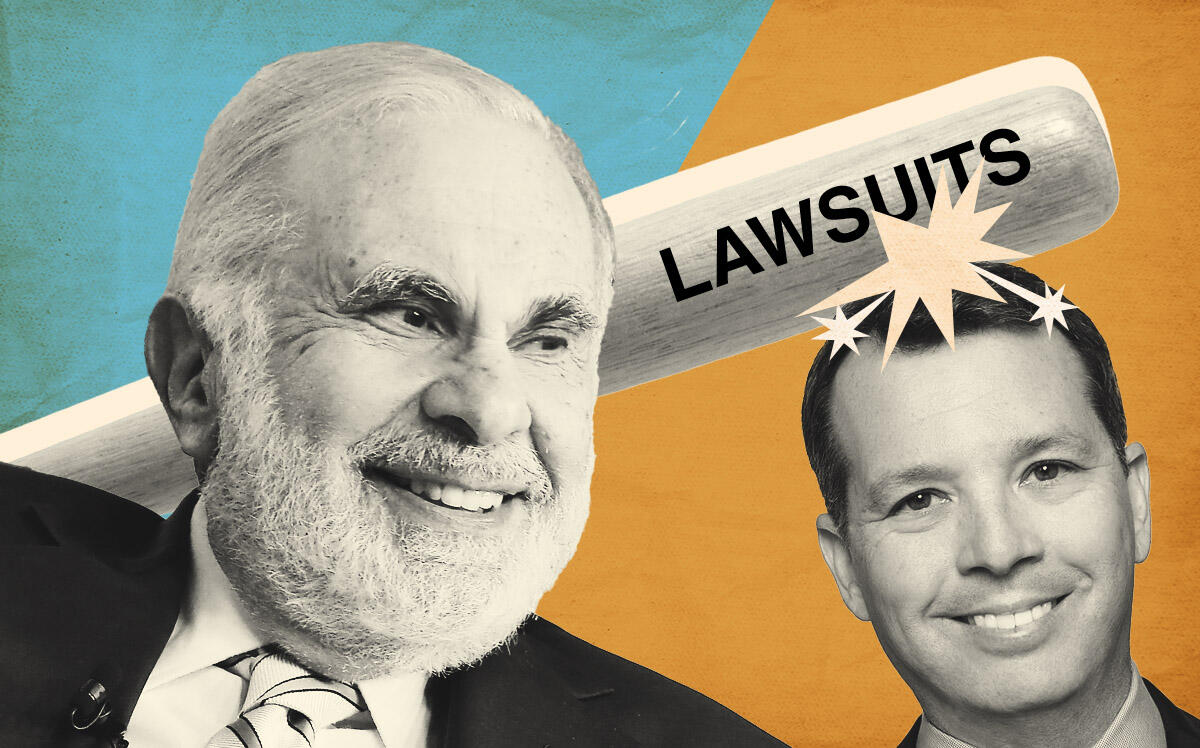

Carl Icahn goes to war against Rialto, CMBS servicers

Bombshell lawsuit: Dying mall was propped up to generate millions in fees

Activist investor Carl Icahn has a new target — one that has long pestered short sellers and property owners: servicers of commercial mortgage-backed securities debt.

Icahn’s funds are suing Rialto Capital Advisors, a prominent special servicer, for delaying the sale of a Nevada shopping center and allegedly siphoning millions of dollars from investors, according to a complaint.

Icahn also alleges that Rialto manipulated appraisals to steer servicing decisions away from certain bondholders.

The suit echoes real estate investors’ long-standing gripes over CMBS’s special servicers.

When a CMBS loan runs into trouble, a third party is supposed to service the debt, but there are inherent conflicts. Servicers earn fees as long as a loan is in special servicing, leading critics to suspect some intentionally prolong that status.

The deep-pocketed Icahn seeks a systemic change, but he has his own motive: He is shorting CMBS mall debt through an index known as CMBX.6, which has reaped him huge profits in the past (others mistimed their trades). A change in the way appraisals are calculated could allow Icahn to cash in again on retail woes.

In this case, Icahn’s grievances stem from a faltering retail center in Primm, Nevada, near the border of California. Five years after the property borrowed money in 2012, it was half vacant and the loan’s unpaid principal was about $67 million. Rialto, as the servicer of the loan, appointed a receiver to oversee the property.

That’s when things went south, according to the complaint.

The property, Prizm Outlets, was reappraised in April 2018 for $25.5 million— some $50 million less than the loan balance. According to the complaint, the appraisal should have wiped out the most junior bondholders and most of the second-most-junior bonds. Holders of the Class E bonds, including Icahn, were supposed to become the controlling class of the trust.

“Instead, because it was not in Rialto’s interest — or the interest of other influential market participants — to appropriately recognize losses … Rialto schemed to deny control to the Class E Certificates while running Prizm Outlets into the proverbial ground,” the complaint said.

Icahn alleges Rialto used inflated appraisals to deny control of the retail complex to the Class E bondholders, who would have demanded an immediate sale of the property or replaced Rialto as the special servicer.

An April 2019 appraisal of $28.8 million assumed the center was nearly 100 percent occupied when it was half vacant, according to the complaint.

In October 2019, the servicer ordered another appraisal, this one inflated by a 10-year lease with HeadzUp, an experiential entertainment facility, the lawsuit alleges. It claims that Rialto penned the lease to create an illusion of improving conditions at Prizm Outlets.

In reality, Rialto had to induce HeadzUp with a $650,000 upfront payment and the tenant never paid rent, which the complaint alleges Rialto concealed.

Then came the pandemic. By March 2020, the Class E bondholders were in charge. But by then, Prizm Outlets’ value had fallen by millions more and fees totaling millions of dollars had been paid.

A year later, Prizm Outlets was sold to Kohan Retail Investment Group, a noted buyer of distressed malls, for about $400,000. Rialto had incurred about $12.85 million in fees, advances, and expenses at the property, meaning investors lost $12.4 million.

The sale led bondholders to recognize a loss of $62.2 million, the full principal outstanding of the loan. According to one Bank of America analyst, it was the largest loss, both in terms of dollar amount and in percentage terms, for a CMBS conduit loan since the 2008 financial crisis.

The Icahn funds claim that other players are influencing the CMBS market. It points a finger at mutual fund Putnam and other funds that sold billions of dollars of protection to the CMBX.6 index. It claims that sellers of CMBX.6 protection were the primary beneficiaries of Rialto’s actions on Prizm Outlets.

The complaint does not provide a smoking gun showing Putnam influenced the servicer at the Nevada mall. Still, it alleges such behavior is common in the CMBS world.

“The free and fair operation of the CMBS market is routinely eroded when servicers artificially avoid recognizing manifest losses in the short-term and, in doing so, exacerbate losses to CMBS investors in the long-term,” Icahn’s attorneys at Kasowitz Benson Torres argued.

One outside observer, Shlomo Chopp, an adviser on distressed commercial real estate deals, said the lawsuit could have large implications for CMBS borrowers, not just investors.

“Borrowers should thank Icahn, as this case will be quoted in many foreclosure cases and may even bring change to the industry,” said Chopp. “It brings to light issues that judges have dismissed for the past 10-plus years.”

Chopp explained that when a delinquent borrower alleges servicers of their loans are playing games to rack up fees, judges dismiss it, reasoning “you owe the money, so who cares — pay up.”

“At the same time, default interest and fees are piling up, so most borrowers either walk away or settle because the downside is too great,” he said.

Rialto did not return a request for comment.