Innovo lands $155M construction loan for LIC warehouse

Innovo lands $155M construction loan for LIC warehouse

Trending

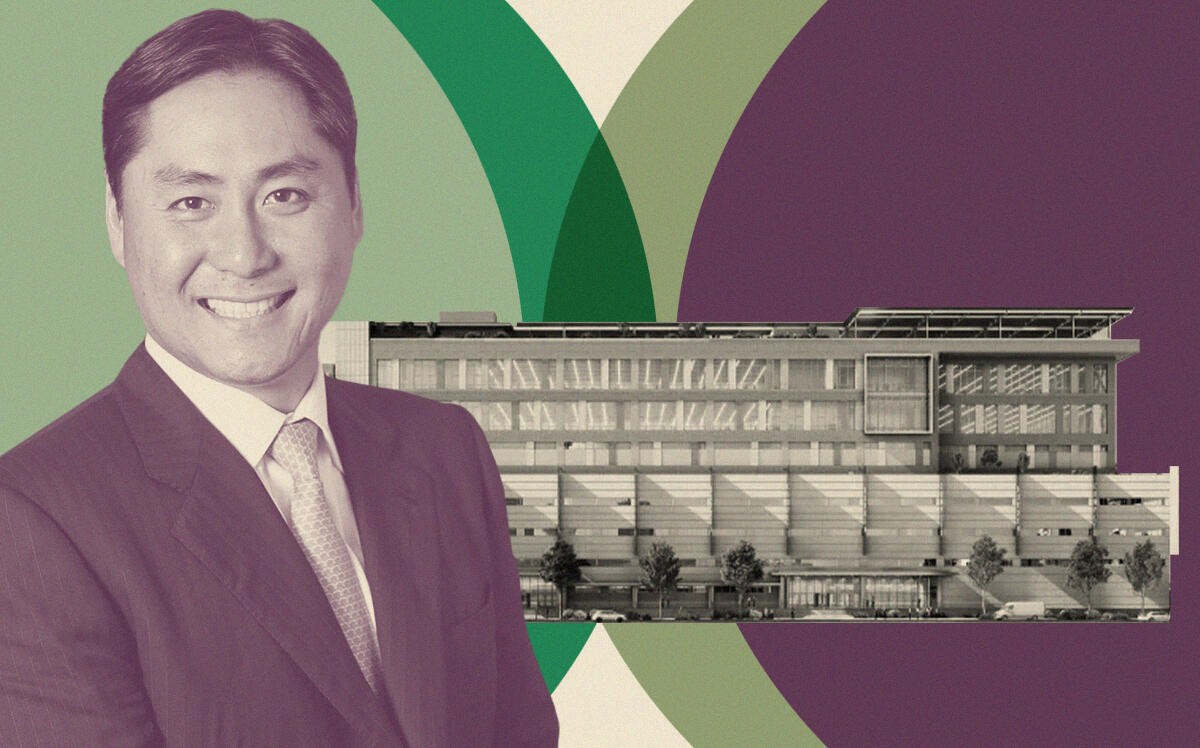

Andrew Chung lands major refi for LIC last-mile project

Multistory industrial complex in Queens gets $435M loan

After his fiasco with the HSBC tower, Andrew Chung needed some good news. And he got it.

Chung’s Innovo Property Group scored a massive $435 million refinancing of its project at 23-30 Borden Avenue in Long Island City, the Commercial Observer reported. JPMorgan Chase provided the senior loan and Starwood Property Trust, the mezzanine debt.

The refinancing comes slightly more than a year after Innovo landed a $155 million construction loan from a Starwood affiliate for a project at the site, previously home to a FreshDirect warehouse.

Read more

Innovo lands $155M construction loan for LIC warehouse

Innovo lands $155M construction loan for LIC warehouse

How the $855M deal for the HSBC tower fell apart

How the $855M deal for the HSBC tower fell apart

Innovo is developing an 842,000-square-foot, five-story industrial structure on the lot, located a short drive from Midtown. It is expected to include truck courts and a vertical parking structure. Multi-level warehouses are common in Asia but rare in the U.S., although they have become cost-effective in dense cities with expensive land, such as New York.

Innovo partnered with Atalaya Capital Management and Hong Kong-based Nan Fung Group to acquire the property in January 2019 for $75 million. The owners demolished the existing warehouse to make way for the project. Construction is expected to conclude in 2024.

During the pandemic, Chung has become the face of warehousing in New York City and an aggressive player in the booming sector. A surge in e-commerce has led many to rethink logistics real estate, particularly last-mile distribution centers like the one being planned in Long Island City.

While Chung’s bets on the sector put him ahead of the curve, one he made outside of it did not pay off.

Chung agreed in December to buy the office building at 452 Fifth Avenue in Midtown for $855 million. But he failed to come up with $200 million and an acquisition loan to close the deal. Eli Elefant’s Property & Building Corp. then refinanced the building, essentially killing the plan and costing Innovo its $30 million deposit.

— Holden Walter-Warner