Trending

Developers, rejoice: Carried-interest loophole is saved again

Promotes are taxed as capital gains, making issue critical to industry

Closing the carried-interest loophole is a game of Whac-a-Mole the Democrats just can’t seem to win. And real estate players won’t shed any tears about that.

Carried-interest income is what private-equity and hedge-fund players make when their investments are sold at a profit. This income is taxed as a long-term capital gain, at a lower rate than ordinary income. Crucially for real estate, “promotes,” the share of profits that developers and fund managers get from a project, are treated as carried interest.

A spending bill passed by the Senate Sunday originally included a provision that required fund managers to hold on to investments for five years rather than the current three in order to garner that tax advantage. Though real estate industry experts didn’t see the proposal as the “final nail” in the coffin, they did predict it could lead to complications in fundraising for developers and affect how they’d think about selling assets.

(Related: Real estate scores loophole to save loophole)

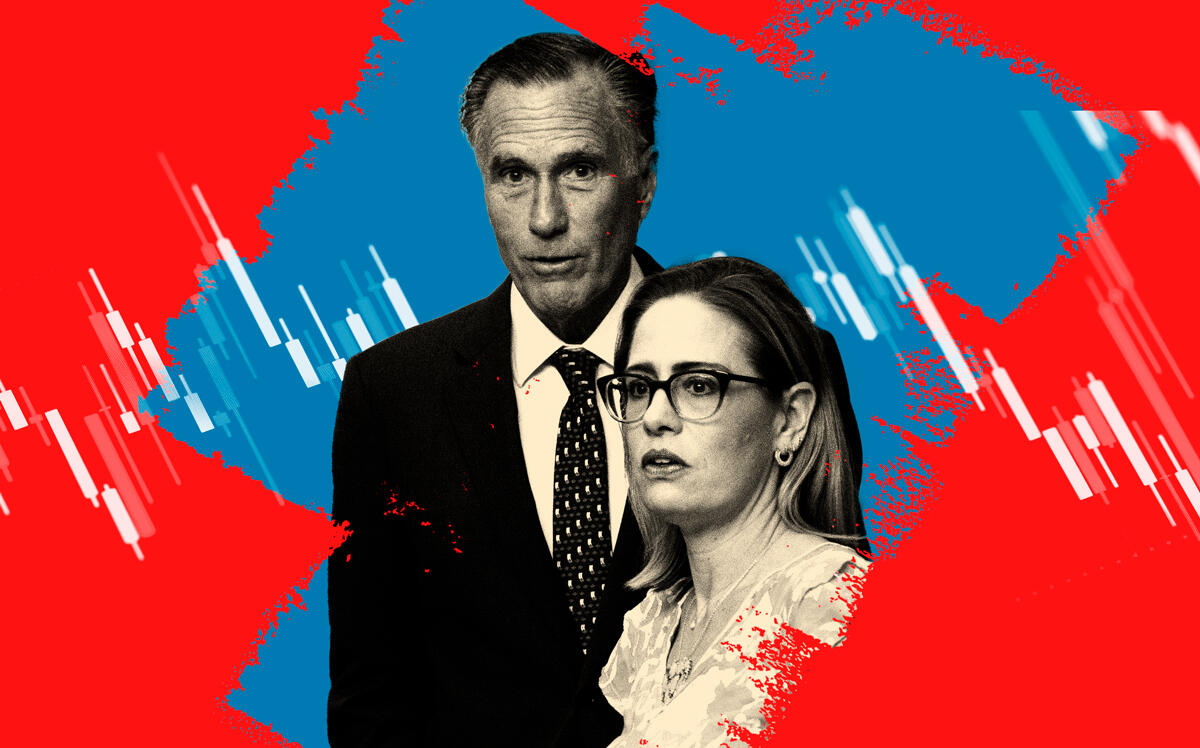

Late Thursday, however, after an intervention by centrist Sen. Kyrsten Sinema (D., Ariz.), Democrats agreed to take carried interest off the table. Instead, they will add a 1 percent tax on stock buybacks to the legislation, in a bid to cut the federal deficit by $300 billion, according to the Wall Street Journal.

The revision to the bill came after intense lobbying by the private equity industry, which is the biggest beneficiary of the carried-interest loophole. The Journal reported on how its lobbying efforts, through the soberly named American Investment Council, have successfully kept the loophole from being eliminated.

Sinema has taken $2.3 million in campaign contributions from private-equity interests since 2017, according to data from the Center for Responsive Politics cited by the publication.

As far as real estate is concerned: More power to them.