A pitch to buy Compass stock goes horribly wrong

A pitch to buy Compass stock goes horribly wrong

Trending

Understanding Compass’ cash position

The firm has $431 million in the kitty. Will that be enough to brave the down market?

Compass, which has burned through nearly $800 million over the last 18 months, should have enough cash to last the brokerage at least another year, industry observers predict. But that runway could shrink if the residential market slump continues.

After a dismal second quarter in which Compass lost $101 million and said it was slashing its revenue projections by more than $1.5 billion, investors reacted by pushing its stock to a record low of $3.17 (as of Aug. 25), which sent its market cap down to $1.4 billion.

“Here’s the problem. The market has slowed significantly,” said Steve Murray, co-founder of Real Trends and a residential brokerage analyst. “We’re looking at a market that across the board is down between 6 to 8 percent in volume, down 15 percent in unit sales. Price appreciation is slowing down.”

Read more

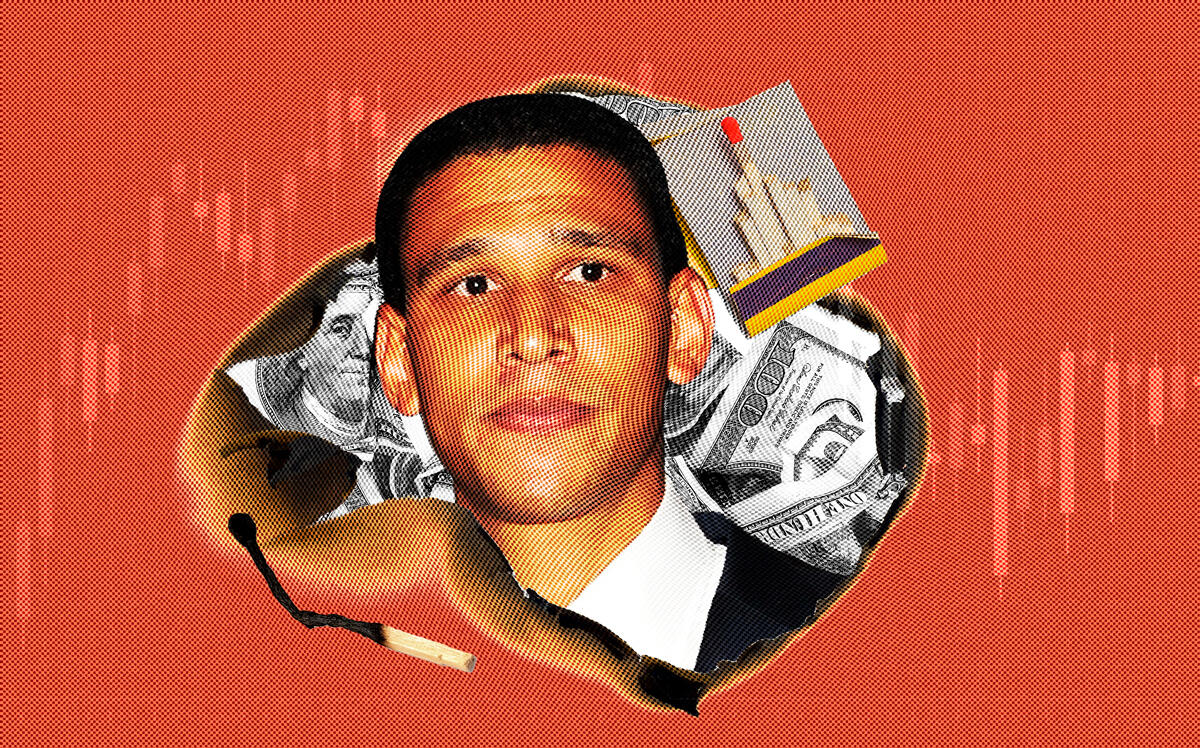

A pitch to buy Compass stock goes horribly wrong

A pitch to buy Compass stock goes horribly wrong

Compass agents defend company against taunts of “financial negligence”

Compass agents defend company against taunts of “financial negligence”

Compass revises market share after NAR changes its math

Compass revises market share after NAR changes its math

Compass ended last year with nearly $620 million in cash and cash equivalents. Its cash reserves fell by $187 million, or about 30 percent, since the start of the year. Its commissions payable was $95 million at the end of the second quarter, up slightly from $92 million in the second quarter of 2021.

To understand how much time Compass’ cash buys it, you might try dividing the brokerage’s losses by its cash on hand. But that wouldn’t account for the fact that over half of its losses stem from stock awards. At the end of the second quarter, Compass reported a $101 million loss, and $59 million (or about 60 percent) of that was stock-based compensation.

Analysts have noted that Compass’ cash reserves fell by $45 million in the second quarter, which is typically the most profitable quarter for brokerages. And in 2021, a record-breaking year for residential real estate,Compass only reported a profit in the second quarter.

Partly due to rapidly rising mortgage rates, U.S. home sales fell for the sixth consecutive month in July, the longest period of consecutive drops in eight years, according to the National Association of Realtors, which tracks sales recorded on the Multiple Listing Service.

“Compass was created in an ascending market,” a rival brokerage owner said. “How bloody is it going to get?”

Compass has adjusted its projected revenues for the rest of this year and next. Its rosiest projection for the year is that revenues could hit $6.5 billion, down from its earlier projected high of $8 billion.

“Cash burn was higher in Q1 than last year, and higher in Q2 than last year; in a rapidly cooling market, the pressure is on for the rest of the year,” Mike DelPrete, a residential industry analyst and an investor in the brokerage rival Side, wrote in an August blog post.

But Compass is stressing that it’s taking the necessary steps to survive the market slump and get a grip on losses.

The company no longer offers equity or cash incentives to new agents. And Reffkin emphasized in a company-wide email that the firm is and will continue to be in a “strong financial position… even if the market continues to show slower unit sales. Anyone suggesting the contrary is wrong.”

The brokerage, which also has about $318 million in untapped credit from Barclays, does have more cash (totaling $430.5 million at the end of the second quarter) than its competitors – Elliman ended the second quarter with about $202 million in cash, for example, while Anywhere Real Estate (formerly Realogy) had $251 million in cash. But no other firm has burned through this much money so fast.

Compass has said that it has invested a total of $900 million in its technology platform, which it believes gives it a significant moat against its rivals and serves as a powerful recruiting tool. Its rivals have continually challenged both that number and that narrative.

The plan to cut costs while continuing to recruit in a down market will be challenging. On top of eliminating incentives, the brokerage will carry out a second round of layoffs, and will likely close offices. It also plans to scale back on its technology investment; last week, The Real Deal reported that it had let go of its CTO, Joseph Sirosh, and made a round of layoffs in his department.

Jason Helfstein, an analyst at Oppenheimer & Co. who covers Compass, estimates that with the firm’s $320 million cost reduction program, it could end the year with about $300 million in the bank. By next year, Compass could generate about $15 million in free cash flow, if the market “rebounds,” Helfstein said.

Still, “we have their revenue down 3 percent next year to be conservative,” Helfstein said. “With no revenue growth and the cost reduction plan, they can break even and be slightly cash [positive]. They need to show they can generate cash flow.”

Murray, of Real Trends, said that even though the company is “in a tough spot, there is a way out for them.”

“It’s not easy what they’ve got to do,” Murray said. “The key question becomes if we [cut costs], how do we do that in such a way that we don’t impact the relationships with our agents? That’s not easy.”