BlackRock to pay $1.25B for lease at 50 Hudson Yards

BlackRock to pay $1.25B for lease at 50 Hudson Yards

Trending

Big tech’s struggles threaten tax breaks that propped up NYC offices

Companies that pledged job creation are now cutting back on expenses

In the heyday of ping pong and free lattes in the workplace, many of the city’s fastest-growing startups paid for their high-priced office space with help from the state in the name of economic development.

One-time unicorns like Peloton, Snap and Casper agreed in recent boom years to create hundreds of jobs in exchange for tax credits offered under the state’s lucrative but controversial Excelsior Jobs Program, which aims to keep jobs from leaving the state.

With the economy now slowing, a number of these companies have made layoffs, downsized offices or otherwise transitioned from growth mode to focus on profitability, and may struggle to deliver all the jobs they pledged.

A review of program disclosures by The Real Deal suggests many of the tax breaks are in danger.

A spokesperson for Empire State Development, which administers the program, noted the pandemic and macroeconomic factors affected many companies, particularly those in New York City.

“The 10-year term of Excelsior tax credits accommodates short-term market fluctuations,” spokesperson Kristin Devoe said by email. “Companies that fall short of job commitments in one year can still receive tax credits the following year if they deliver on their job-creation goal.”

Read more

BlackRock to pay $1.25B for lease at 50 Hudson Yards

BlackRock to pay $1.25B for lease at 50 Hudson Yards

Peloton resorts to sublease at Hudson Commons

Peloton resorts to sublease at Hudson Commons

The program, launched by former Gov. David Paterson’s administration in 2010, offers companies $2,500 to $5,000 for each job they create in the state. Officials typically offer the incentives to retain growing companies seeking more office space.

Peloton, for example, agreed to quadruple its roughly 400-person New York City workforce in 2018 when it relocated from a small office in Chelsea to a 300,000-square-foot spread at Cove Property Group and Baupost Group’s Hudson Commons office redevelopment at 441 Ninth Avenue.

The fitness company said it would add 1,263 jobs over 10 years in exchange for $20 million worth of tax credits. In 2019, its first year in the program, Peloton exceeded its goal by creating 206 jobs, earning about $265,000 in tax credits.

Peloton’s business exploded in the early months of the pandemic, when lockdowns shuttered gyms and fitness enthusiasts eagerly shelled out thousands of dollars for its stationary bikes. But the company has since run into huge problems: It replaced its CEO in February and announced plans to cut 2,800 jobs, or 20 percent of its workforce, and to stop making its own bikes and treadmills.

In June, Peloton put about a third of its Hudson Commons office space up for sublease.

A spokesperson for Peloton did not respond to a request for comment, but new CEO Barry McCarthy told employees in an August memo that while the company is cutting jobs in certain areas, “we continue to fill roles on key teams to drive the business forward.”

It’s not clear how the job cuts and hiring will affect Peloton’s job numbers in New York.

Another once-hot tech company, Snapchat parent Snap, entered the Excelsior program in 2016, pledging to create 396 new jobs in exchange for $5 million in credits.

The social media company had just expanded its office at Columbia Property Trust’s 229 West 43rd Street in Times Square, and its last disclosure shows that it fell just six jobs short of its 2018 goal to create 211 jobs. Companies can receive a proportional share of their credits if they reach at least 75 percent of their goal in a year.

In an August SEC filing, Snap disclosed that it plans to cut 20 percent of its more than 6,400-person global workforce to stem its losses.

In 2015, the direct-to-consumer mattress company Casper Sleep had just 12 employees in the city. It said it would create 307 jobs in exchange for $3.1 million in tax credits.

The company had just signed a lease for 31,000 square feet at TF Cornerstone’s 320 Park Avenue, and by 2019 it had relocated to 70,000 square feet at Silverstein Properties’ 3 World Trade Center.

But Capser struggled to meet its goals, falling short in three of its first four years in the program. Last year, it reportedly cut dozens of jobs and laid off three members of its C-suite. In November, it sublet 43,000 square feet at 3 World Trade Center to the advertiser marketplace Index Exchange.

Office math

The tax breaks can be lucrative for companies that meet the benchmarks.

BlackRock, which is taking about 1 million square feet at Related Companies’ 55 Hudson Yards, is eligible to claim $25 million in credits, or 20 percent of the $1.25 billion cost of its lease. The asset manager will need to create 700 jobs to receive the credits, but it won’t have to start reporting its progress until next year.

The Excelsior program is designed to lure or retain companies that might otherwise hire elsewhere, but it’s been criticized as a giveaway to firms that likely would have expanded in the state anyway.

When BuzzFeed struck an agreement for $4 million in credits in 2015, it cited the “excessive” cost of renting New York City office space and building out a video studio as reasons it had considered relocating those jobs to New Jersey or Los Angeles.

Critics argued the company never really intended to leave the news and media capital of the world. Buzzfeed had been making progress toward its goal of 475 jobs, but has gone through a series of restructurings and cut hundreds of employees since 2019. In August, it consolidated its office space in the city to 110,000 square feet in Times Square.

A 2016 audit of the Excelsior program by state Comptroller Thomas DiNapoli found that Empire State Development could not verify that companies actually created the jobs they said they would, and that the agency lowered job-creation goals after companies didn’t meet them.

The program came under particular scrutiny in 2018, when the Cuomo administration offered $1.2 billion worth of credits to lure Amazon to Long Island City. Public pushback eventually led Amazon to scrap its plans for Queens. But the tech company is still the largest applicant in Excelsior.

It’s eligible for up to $43 million in credits, for which it says it will create 4,750 jobs across a corporate headquarters and two fulfillment centers in the five boroughs.

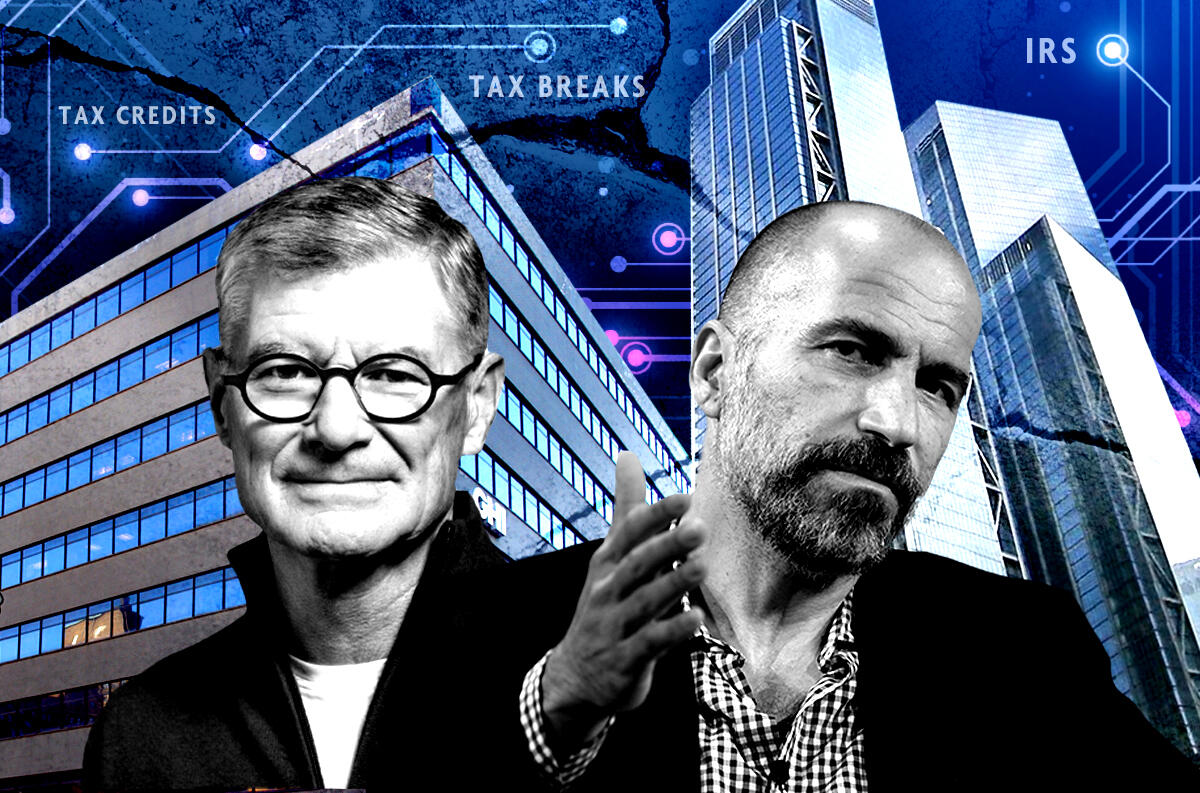

Behind Amazon, Uber is the second-largest applicant. The company, which signed a lease for more than 300,000 square feet at 3 World Trade Center in 2019, is eligible for up to $29 million in credits. The next spring it announced plans to lay off about a quarter of its workforce.

Uber CEO Dara Khosrowshahi said in May that the company was focusing on cutting costs, adding cryptically that it would “treat hiring as a privilege.”

Company spokesperson Josh Gold said during the pandemic that Uber applied for an extension under the program and will begin reporting its job growth next year.

“We are well on our way to hitting our 2023 target,” he said.