Landlord fears his mother gifted him $50M tax liability

Landlord fears his mother gifted him $50M tax liability

Trending

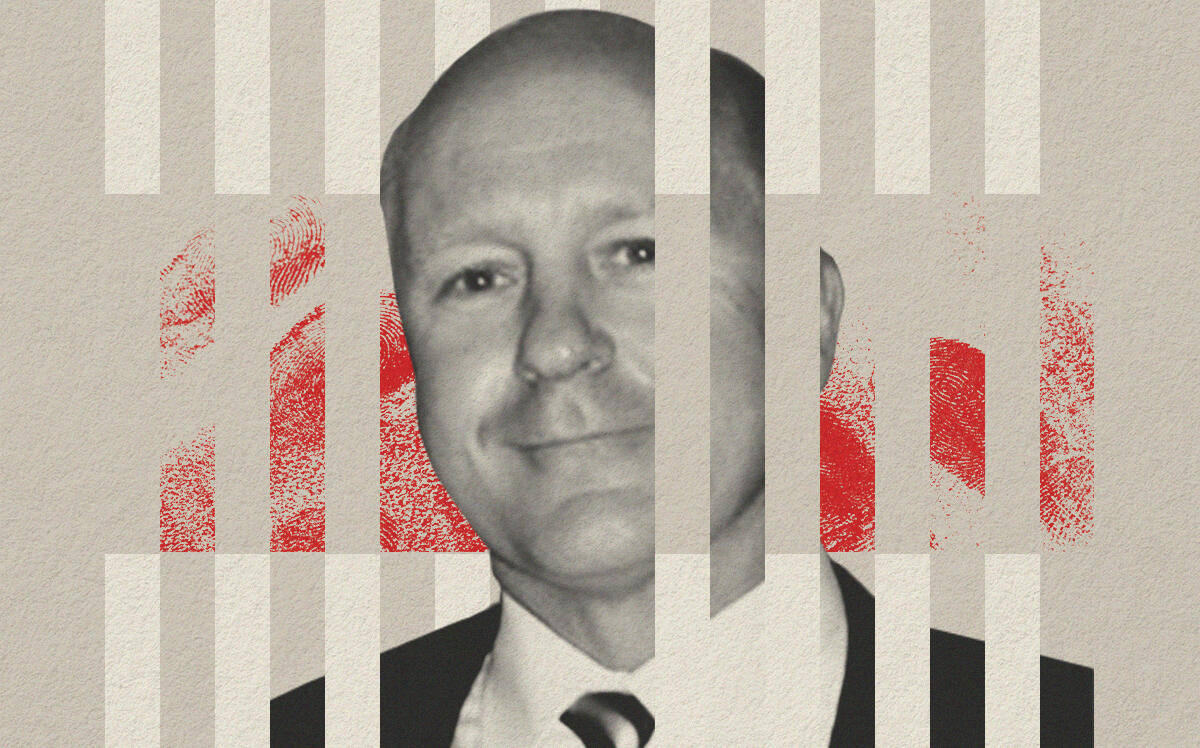

Michigan developer sentenced to prison for tax evasion

Claimed hardship while spending on yachts, vacation homes, cosmetic surgery

Plastic surgery, a house on the lake, an assortment of cars, a 62-foot McKinna Express yacht –– these were among the things Scott Chappelle spent money on while telling the IRS he was broke.

Michigan-based real estate developer Scott Chappelle, an attorney and former certified public accountant, was handed a 38-month prison sentence for tax evasion, the Lansing State Journal reported this week.

According to a press release from the Department of Justice, Chapelle spent the better part of a decade evading taxes owed and feigning financial hardship.

Federal prosecutors told the outlet that the developer’s crimes were “multifaceted, sophisticated, and extremely serious.”

One of the crimes wasn’t so sophisticated, though: Rather than pass on taxes withheld from his employees’ paychecks, Chapelle kept them.

In addition to delivering the prison sentence, U.S. District Judge Jane Beckering ordered Chappelle to pay $1.2 million in restitution and serve three years of supervised release. He was also fined $150,000, according to the outlet.

Read more

Landlord fears his mother gifted him $50M tax liability

Landlord fears his mother gifted him $50M tax liability

Real estate broker Michael Flavin sentenced in fraud scheme

Real estate broker Michael Flavin sentenced in fraud scheme

Brooklyn developer vanished with $4M in buyer deposits: lawsuit

Brooklyn developer vanished with $4M in buyer deposits: lawsuit

Chappelle’s attorney declined a request from the outlet for comment.

Chappelle headed Strathmore Development Company Michigan LLC, Terra Holdings LLC, and Terra Management companies, entities whose investments spanned commercial and residential real estate in Michigan and other states, according to the publication.

According to the Department of Justice, Chappelle admitted to not paying $1.6 million in taxes withheld from his employees’ paychecks. Once IRS agents contacted Chappelle to collect, the developer made false statements about his assets and income.

The Department of Justice said Chappelle hid his Lake Michigan vacation house from the agency, did not tell criminal investigators about property he purchased, and submitted falsified bank statements on a loan application.

In one instance documented by investigators, Chappelle filed an employment tax return for Terra Holdings LLC claiming the company had no employees and paid no wages. He did so despite approving documented payroll submissions.

— Kate Hinsche