Soloviev bets long-dormant Midtown East site in casino sweepstakes

Soloviev bets long-dormant Midtown East site in casino sweepstakes

Trending

Going for the jackpot: A look at the high rollers competing to build NYC casinos

Related, SL Green, Thor and other developers put cards on table

Developers, place your bets.

Next month, state officials will start accepting proposals for new casinos in and around New York City. Six bigwigs have already unveiled visions for casinos in the five boroughs, pledging to parlay their winnings into the city’s economic recovery.

Firms proposing venues in Times Square and Hudson Yards — tourist attractions near transit hubs — have an edge, though opposition from local elected officials could cost them what is sure to be a lucrative pot. Other bidders are hoping to create entertainment ecosystems in Queens and Brooklyn.

Technically, three licenses are up for grabs, but only one is likely truly in play. Regulators may favor two sites that already have gambling — Aqueduct Racetrack and Yonkers Raceway — because the application provides a “speed to market” bonus, said James Featherstonhaugh of Saratoga Casino Holdings, which is working with Joe Sitt's Thor Equities on a Coney Island bid.

The remaining license does not have to go to the city, just downstate. Manhattan is where the most money is, but has historically been a hard sell because few Manhattanites want a casino.

Approvals hinge on local support. If the City Council member is not on board initially, a proposal may face trouble later on, given that it would likely need to go through the city’s land use review process.

Details on individual proposals are incomplete, given that the state has not yet released a request for applications. Some developers have put some cards on the table, while others have yet to show their hands. The Real Deal took a look at the players going all-in.

SL Green and Caesars, Times Square

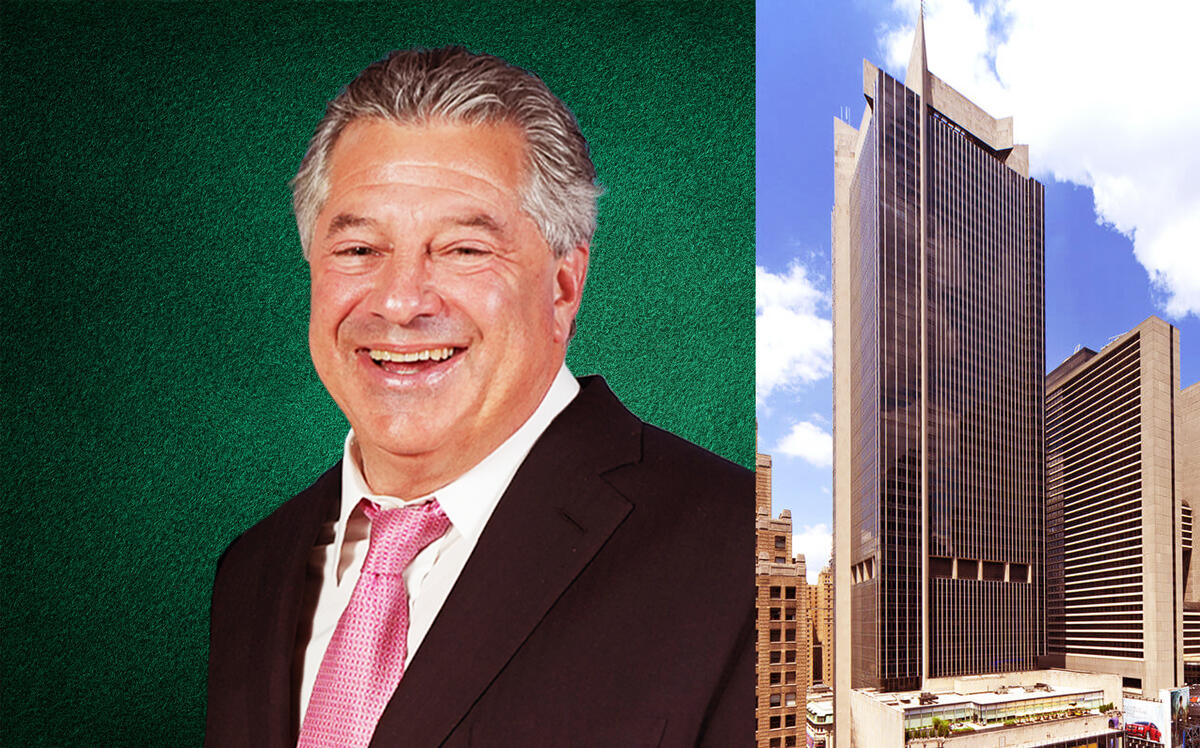

SL Green's Marc Holliday and 1515 Broadway (Getty, SL Green)

Times Square seems an obvious location for a casino. The average number of daily visitors reached 305,886 in October, up 35 percent from the same time last year, though still 17 percent below pre-pandemic levels, according to the Times Square Alliance.

SL Green Realty in October announced plans to turn its office building at 1515 Broadway into a casino operated by Caesars Entertainment. SL Green’s Brett Herschenfeld told The Real Deal that unlike other proposals, the real estate investment trust’s plan does not aim to keep visitors solely on the premises.

The casino, hotel and restaurants in the building would be able to accommodate several thousand customers, but many will need to venture out to Times Square and other parts of Manhattan. The idea, he said, is that numerous city businesses would benefit.

“Everybody else is doing a Vegas project,” he said. “We’re doing a New York project.”

A common criticism from casino opponents is that gambling venues don’t generate consumer spending but merely siphon it from other establishments. Some local groups have spoken against bringing one to Times Square.

SL Green bills Times Square as ideal, in part because it is an established entertainment district, rather than a residential area where a casino could prove disruptive. Herschenfeld also noted that a casino on its site would not deprive the city of potential apartments, whereas officials may view housing as a better use for sites in residential neighborhoods.

It was not immediately clear how a casino would affect long-term tenants at the Times Square tower, including anchor tenant Viacom, which has a lease through 2031. Herschenfeld indicated that the lease term would not affect the casino’s timeline.

SL Green could have faced fierce competition nearby. It was reported that L&L Holding Company was considering a casino for 1568 Broadway, but it appears the company won’t ante up. A spokesperson for the firm said L&L is “not pursuing or considering a casino license.”

Read more

Soloviev bets long-dormant Midtown East site in casino sweepstakes

Soloviev bets long-dormant Midtown East site in casino sweepstakes

Developers all-in on Manhattan casino push

Developers all-in on Manhattan casino push

Mets owner pursuing NYC pols for Citi Field casino

Mets owner pursuing NYC pols for Citi Field casino

Related and Wynn Resorts, Hudson Yards

Different visions for the Western Yards have come and gone. The city once sought to build an Olympic stadium over the 10-plus acres of tracks. In September, the Related Companies announced that it hopes to include a casino in the second phase of its megadevelopment.

At the time, Related CEO Jeff Blau called the Western Yards an “ideal site for a resort that will reinvigorate our tourism economy and provide billions in tax revenues for the city and state.” A selling point for city and state officials may be its potential to draw events to — and visitors from — the nearby Javits Center, which just underwent a $1.5 billion expansion.

Related also touted the site’s proximity to Penn Station, the 7 train, Moynihan Train Hall and the West 39th Street ferry stop. It said its proposal would kickstart development of the western yards, which would have a mix of office and residential, a school and outdoor public space.

An earlier plan called for 2 million square feet of office and 4 million square feet of housing, though this would likely change if the developer built a casino and hotel. The company has said that would not affect the number of affordable housing units planned for the Western Yards.

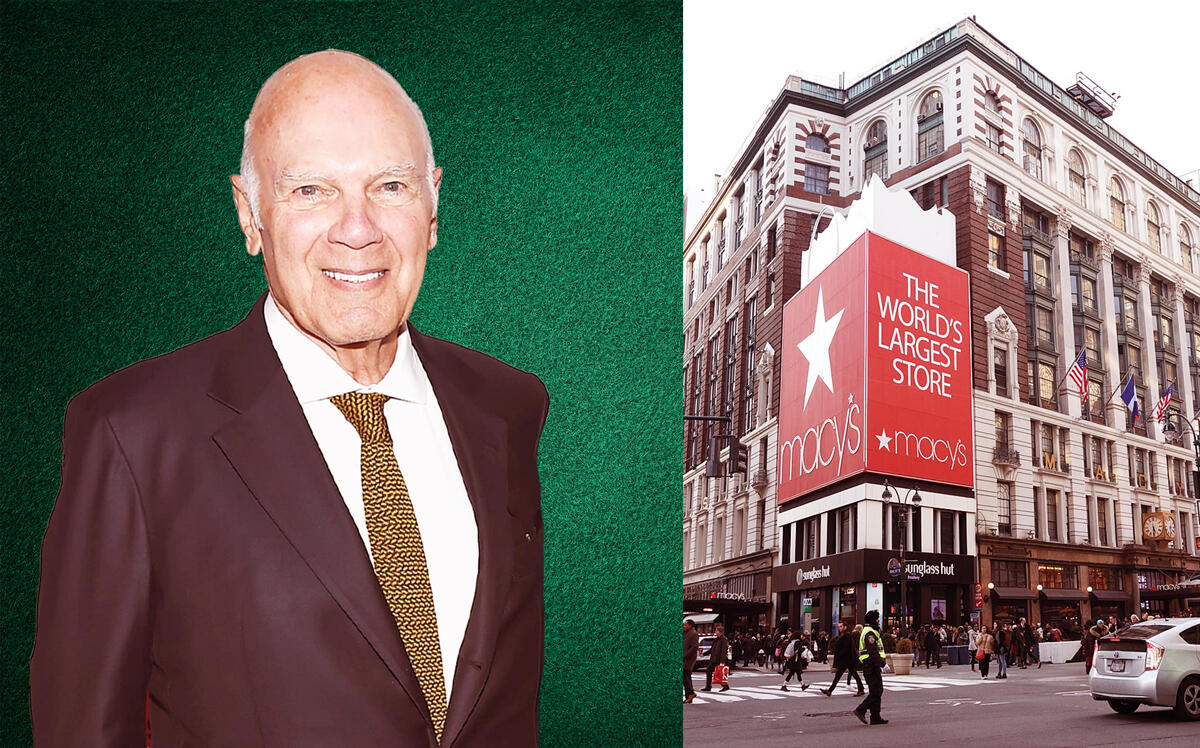

Vornado Realty Trust, Herald Square

If only Steve Roth had a tell. The Vornado CEO has kept his company’s casino ambitions close to the vest. In an April 2021 letter to shareholders, he indicated that Vornado had been “approached” about pursuing a casino in Manhattan.

“It makes perfect sense for the third and final license to go to Manhattan,” Roth wrote. “Being the center of everything, Manhattan will generate by far the highest revenue for our education system; after all, aren’t we in it to maximize the tax revenue?”

Vornado is considering pitching one of its properties in Herald Square, the New York Times reported. The REIT declined to comment further.

Roth has noted the tough economic conditions for ground-up development, but Vornado might consider a casino as helping to diversify its Penn District development plans, which have a heavy office component. During an earnings call in November, Roth said the company continues to be “very interested” in bidding for the license.

Steve Cohen and Hard Rock, Flushing

Were the Mets owner and hedge fund billionaire’s family office to build a casino near the team’s stadium in Willets Point, Queens, gambling would become real-life neighbors with professional sports. The casino would be a stone’s throw from the U.S. Open tennis stadium, and a future soccer venue, too.

“Our goal is to create connectivity between the community, the ballpark and the surrounding park and waterfront,” said a representative for Cohen. However, casino license competitor Related has claims on land east of the ballpark, where affordable housing and a soccer stadium for New York City FC are slated to replace a junkyard and some car repair shops.

Cohen’s potential casino partner Hard Rock has an Atlantic City gambling and hotel operation. But finding a casino site in Willets Point may be tricky, as even the Citi Field parking lot is tied up in leasing and bond agreements, The City reported.

Soloviev Group, Midtown East

Stefan Soloviev, who took over his late father Sheldon Solow’s empire last year, told Bloomberg that he is in talks with various Las Vegas-based companies about doing a casino project in Midtown East.

That is not exactly a tourist hotspot. The city rezoned the neighborhood to modernize its office district and is contemplating allowing older offices to be converted into residential space.

But Soloviev is pairing his proposal with other attractions. His plan centers on a six-acre site primarily between East 38th and East 41st streets east of First Avenue, and would include a 1,000-room hotel, a Ferris wheel and a “democracy museum.” The site, formerly home to a Con Edison plant, is a 10-minute walk from Grand Central Terminal, which is probably farther than state officials would like. There is a ferry stop on East 34th Street.

Solow Building Company did not respond to a request for comment on the proposal.

Thor and Saratoga Casino Holdings, Coney Island

A Coney Island casino may be a passion project for Thor Equities CEO Joe Sitt, a Brooklyn native and Gravesend resident, but he will need more than enthusiasm to cash in his proposal.

To boost his bid, the developer would pair a casino and hotel with a roller coaster and indoor water park on a 5-acre stretch of beachfront, between the Maimonides Park baseball stadium and Luna Park (from Stillwell Avenue to West 12th Street).

Thor’s Melissa Gliatta said that a casino would deliver year-round jobs and help build careers for local workers who don’t benefit enough from Coney Island’s seasonal economy, which she said never fully recovered from Superstorm Sandy 10 years ago. A representative of Global Gamings Solutions, a subsidiary of the Chickasaw Nation and Thor’s partner in the bid, said the seaside landscape would inform the project’s design, and referred to the low-rise Shiloh Resort and Casino in Sonoma County, California, as an example of its work.

Ari Kagan, who represents Coney Island in the City Council, has taken a hard line against the project. He claims the casino will attract social vices, including prostitution and crime. But Brooklyn Borough President Antonio Reynoso has said the project deserves a hard look.

“Coney Island has one of the highest unemployment rates in Brooklyn,” Reynoso said, adding that “5 million visitors, 10 million visitors per summer — it’s just not happening anymore.”