Ivanhoe Cambridge lands $360M Natixis loan for 85 Broad buy

Ivanhoe Cambridge lands $360M Natixis loan for 85 Broad buy

Trending

Evictions surge at Hialeah’s luxury apartment projects Shoma Village, Pura Vida and Manor

Evictions surge at Hialeah’s luxury apartment projects Shoma Village, Pura Vida and Manor Lawmakers reach sweeping housing deal with “good cause eviction,” new 421a

Lawmakers reach sweeping housing deal with “good cause eviction,” new 421a Charles Schwab slashing Chicago office space with big subleases

Charles Schwab slashing Chicago office space with big subleases Tony Park and Elad Dror take a gamble on Koreatown office-to-resi conversion

Tony Park and Elad Dror take a gamble on Koreatown office-to-resi conversionMetro Loft, Fortress seek resi conversion for 85 Broad

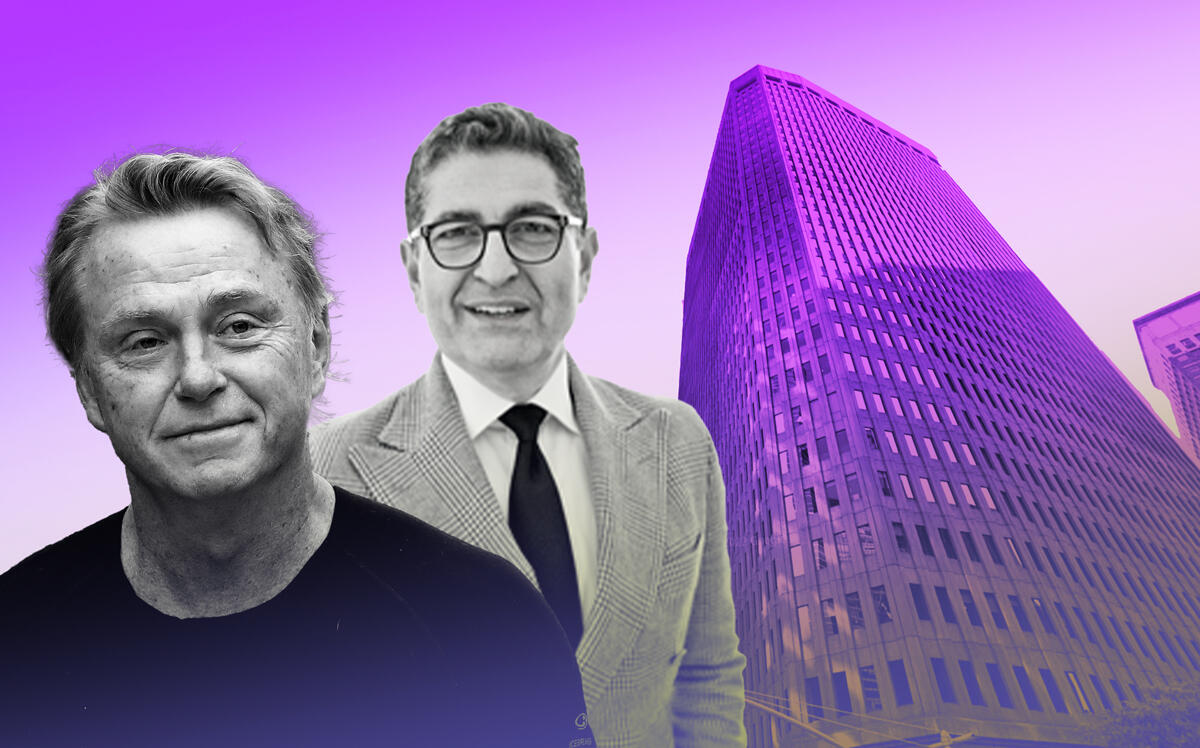

Companies nearing deal to buy stake from Ivanhoe Cambridge

Metro Loft Management is seeking to end the year by doing what it does best: redeveloping another office property for residential use.

Metro Loft and Fortress Investment Group are nearing a deal to buy a stake of 85 Broad Street in the Financial District from Ivanhoe Cambridge, Bloomberg reported. People familiar with the matter told the outlet talks are ongoing and no deal has been reached for the stake yet; financial terms of the potential stake sale were not disclosed.

Ivanhoe, a subsidiary of Quebec’s public pension fund manager, agreed to buy the 30-story property in 2017 for $658 million. Natixis provided a $360 million CMBS loan to fund the acquisition.

The office building was built in the 1980s to house the headquarters of Goldman Sachs. The bank moved out in 2009 and vacancies have since persisted at the 1.1 million-square-foot building. The property was 20 percent vacant earlier this year.

Nathan Berman’s Metro Loft is one of the leaders in office-to-resi conversion, a practice the firm has dabbled in for decades.

Read more

Ivanhoe Cambridge lands $360M Natixis loan for 85 Broad buy

Ivanhoe Cambridge lands $360M Natixis loan for 85 Broad buy

TRD Tips: Metro Loft’s Nathan Berman on office-to-resi conversions

TRD Tips: Metro Loft’s Nathan Berman on office-to-resi conversions

GFP, MetroLoft seek to convert 25 Water Street to 1,200 rentals

GFP, MetroLoft seek to convert 25 Water Street to 1,200 rentals

The firm, along with Jeff Gural’s GFP Real Estate and Rockwood Capital, was in October reportedly closing in on a $500 million construction loan from Michael Dell’s MSD Partners. The loan would go towards a planned conversion of 25 Water Street into 1,200 rental apartments, which would make it one of the largest office-to-resi conversions by unit count in New York City.

Metro Loft is also involved in a potential conversion of 55 Broad Street in the Financial District. Silverstein Properties, which is raising $1.5 billion for office conversions, is a partner in that project.

The award for largest office-to-resi conversion belongs to Harry Macklowe’s 1.2-million-square-foot One Wall Street, which debuted this year with 566 condos. The stars may be aligning for more conversions, however, as office distress, housing demand and government action could create more opportunity in the sector.

“If you know what you’re doing, prices are low enough to undertake conversions,” Berman previously told The Real Deal.

— Holden Walter-Warner