Trending

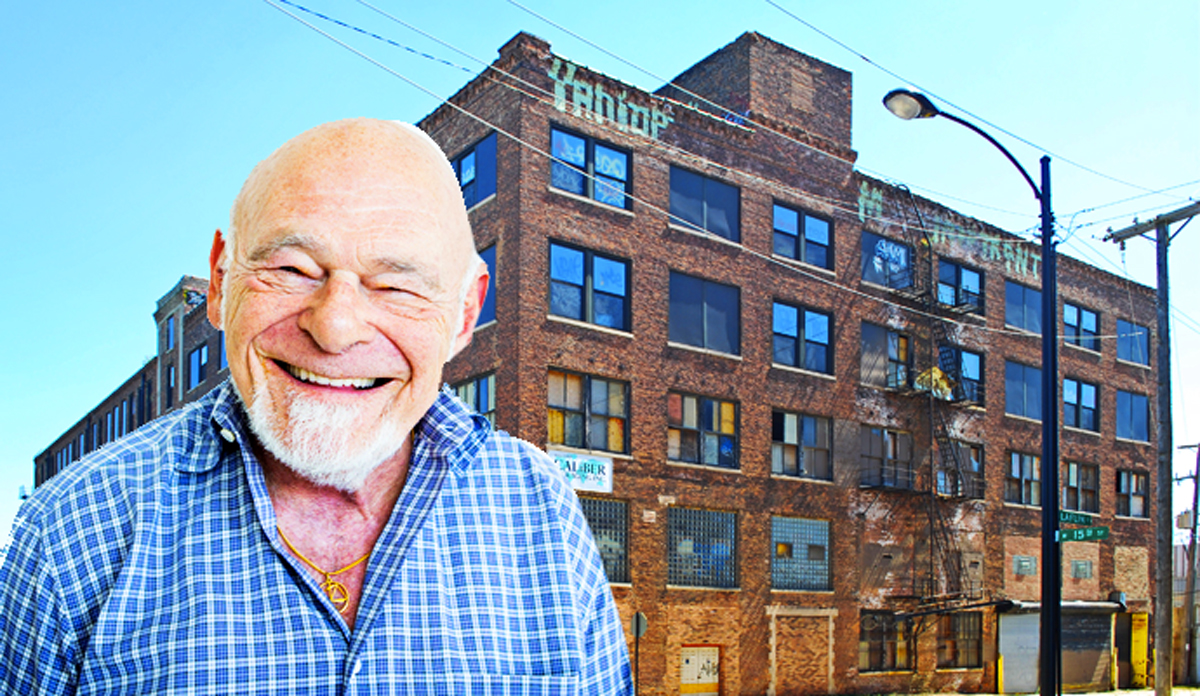

Sam Zell isn’t hot on industrial real estate

The king of distressed real estate said he doesn't see demand for all the industrial space being built across the country

It seems everyone is bullish on industrial real estate except for at least one well-known billionaire who has made a fortune investing in distressed real estate.

Equity International founder and chairman Sam Zell told Bloomberg he was more than skeptical about demand for the large amount of industrial space coming online nationwide. As e-commerce continues gain ground on brick and mortar retail stores, investors are betting big on industrial and warehouse space, which will supply the likes of Amazon. The market is soaring, but Zell is worried the market is… overzealous.

“My guess is that it’s getting too exciting and we’re building too much industrial space,” Zell said told Bloomberg on Monday. “I think we got a lot of people owning industrial space today and I’m not sure there are enough tenants.”

Zell’s comments came on the same day as real estate investment trust Prologis announced its $8.4 billion acquisition of rival DCT Industrial Trust. The deal would give Prologis an additional 71 million square feet of warehouse space in the U.S.

Industrial isn’t the only sector Zell is skeptical about. The other: office. The billionaire who gave himself the nickname the “Grave Dancer” for scooping up distressed real estate, said he doesn’t see demand for the “enormous office space” developers are adding around the country either.

“We need to have somewhat of a market clearing,” he said. “We’re a long way from that but when it starts, it’ll likely happen relatively quickly… there’s lot of stuff under construction and when that finishes, that’s like draining the swamp. You’ll find out who’s got tenants and who doesn’t.”

It’s safe to say Zell won’t be making any big investments through Equity any time soon. He said he doesn’t see the value out there as a buyer.

“I’m a little bit like that old Wendy’s commercial — ‘Where’s the beef?’” he said, later adding that “it is very hard to sit there and not pull the trigger, but it’s the guys who don’t pull the trigger who are around to pull it when it works.”

Instead, he’s selling to build up capital to deploy when the market takes a turn south, and mentioned Equity Commonwealth, the Chicago-based office REIT he acquired in 2014. The REIT has “done nothing but sell,” and built up $3.2 billion in cash to spend.

“And we’re just sitting there, waiting for the world to come to us,” he said.