Trending

City planners pitch 168-acre TIF district to fund infrastructure around Lincoln Yards

The city estimates the special taxing district would rake in $800M over its 23-year lifespan

City leaders Wednesday walked hundreds of skeptical neighbors through their plan to create a tax increment financing district in a 168-acre zone surrounding the planned site of Sterling Bay’s Lincoln Yards development, saying the controversial financing tool would help fund public infrastructure projects in the area for decades to come.

Dozens of attendees at Wednesday’s meeting wore stickers saying “No Park No Deal,” calling for a 24-acre park to be included in any development plan

The proposed Cortland/Chicago River TIF district would straddle the north branch of the Chicago River between North and Webster avenues, reaching Clybourn Avenue to the east and Elston Avenue to the west. Under the plan, the city would divert revenue generated by property tax growth inside the zone into a special fund for public infrastructure projects.

Officials from the city’s Department of Planning and Development estimated the district would raise up to $800 million during its 23-year life cycle, helping pay for some $700 million in streetscape and public transportation upgrades. Some of the projects, like a pair of new bridges over the river and a “transitway” connecting Downtown with Lincoln Yards, were explicitly proposed by Sterling Bay when it unveiled its plan for the site earlier this year.

The city would also dip into the district fund to build an eastern extension of the 606 Trail, and to rebuild the decaying Clybourn Metra station.

City planner Tim Jeffries said the neighborhood would have to “adopt a different set of infrastructure standards” to transform the industrial tract into a hub of homes and offices, following a long-term strategy kicked off by last year’s sweeping North Branch Framework Plan to rezone of the area around the river.

“This shift will create a waterfall of benefits that trickle down through the rest of the city,” Jeffries said.

But the presenters withstood withering criticism from dozens of attendees at the meeting who said the plan would mean using their own tax dollars to bankroll Sterling Bay’s ambitions. Scores of neighbors wore green stickers saying “No Park No Deal,” urging city leaders to build a 24-acre public park along the east bank of the river before any new development is approved.

Officials intend to introduce their plan for the new TIF district at next month’s meeting of the city’s Community Development Commission, all leading up to final passage through the City Council in April. But Alderman Brian Hopkins (2nd), who would have to approve the use of any TIF funds inside the district, said at the end of the meeting that he was “open to considering other options” to slow down the process.

“This is the first time as alderman I’ve had to deal with the TIF issue, so this is actually new to me,” Hopkins told the crowd.

In July, Hopkins slowed the approval process for Lincoln Yards to a crawl by blocking its discussion in the City Council, saying the proposal hadn’t been sufficiently vetted by neighbors.

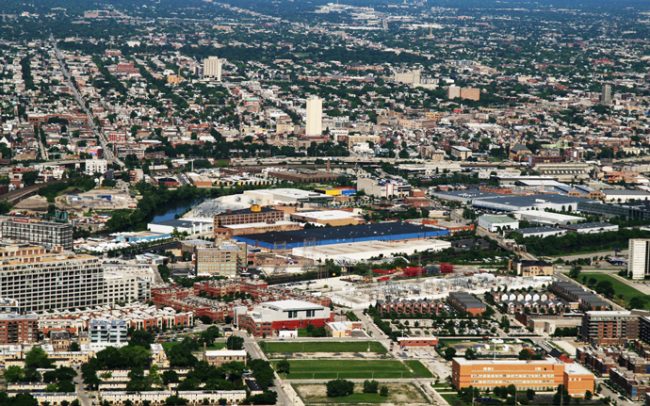

Chicago’s North Branch industrial corridor (Credit: Bernt Rostad via Flickr)

The city established its first TIF district in 1984, in an attempt to attract developers to the snakebitten Block 37 property in the Loop. Today, 144 such districts are active across the city, some spanning entire neighborhoods. The city created its most recent new TIF district earlier this year in the Northwest Side neighborhood of Mayfair, where Jaffe companies is getting $13 million in taxpayer benefits to help finance its Edens Collection retail center.

Most of the proposed Cortland/Chicago River TIF district would be carved out of an existing TIF district, called the North Branch/South TIF, which the city established in 1998. That district, which hugs the west bank of the river between Cortland and Chicago avenues, raised almost $11 million last year, according to Cook County Clerk David Orr’s TIF Viewer.

Sterling Bay bought the 22-acre site of A. Finkl Steel & Sons on the east bank of the river in late 2016, and months later paid the city $105 million for the 13-acre former home of its fleet and facilities management department on the west bank. Earlier this year, General Iron Industries announced it would sell its 21.5-acre property to the south and east of the Lincoln Yards area.

Sterling Bay has scheduled a meeting later this month to reveal new details of its Lincoln Yards plan.