Pretium-backed venture targeted distressed suburbs to become mega-landlord

Pretium-backed venture targeted distressed suburbs to become mega-landlord

Trending

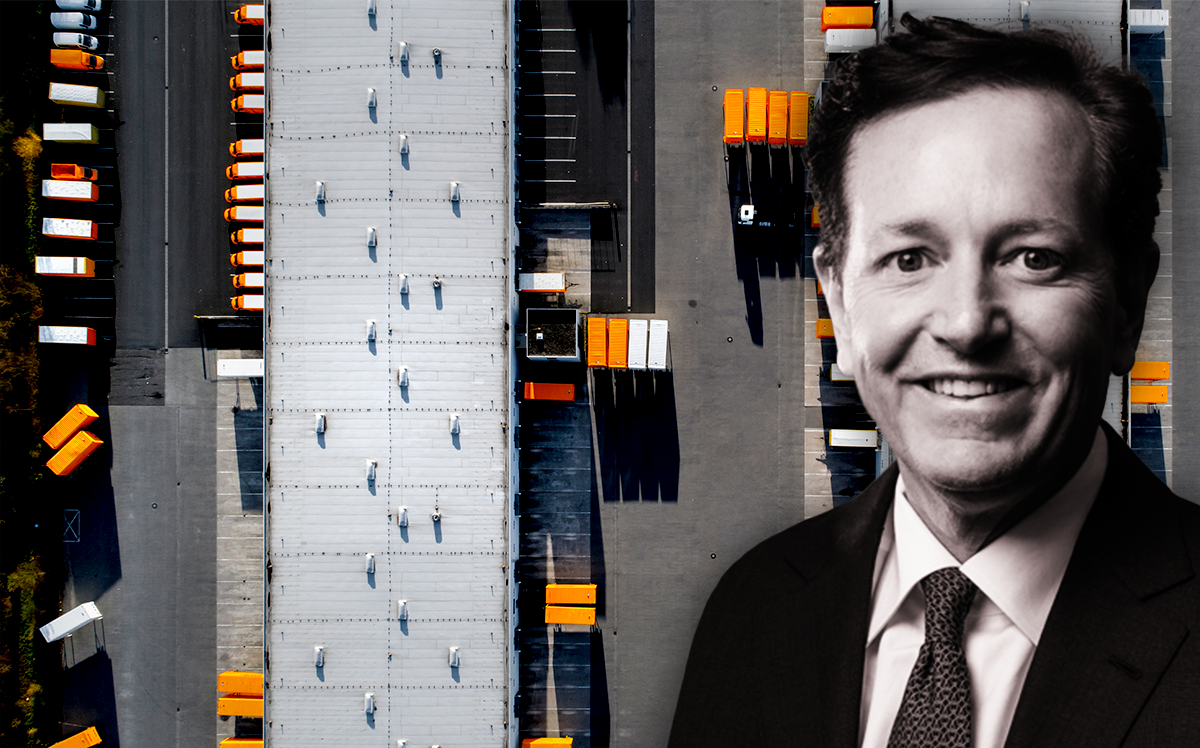

Investor duo snaps up eight-property industrial portfolio

JV involving Chicago’s Brennan Investment Group bought 1.6 million-square-foot portfolio spanning the Midwest, Southwest at undisclosed price

An investor duo including a private Chicago-based concern bought an eight-property industrial portfolio spanning six states in the Midwest and Southwest.

Chicago-based Brennan Investment Group and New York-based Arch Street Capital Advisors purchased the assets, which span some 1.6 million square feet, from an unidentified automotive parts supplier that uses them as foundries. The buildings will be leased back for 25 years.

A price was not disclosed.

Brennan Investment Group buys, develops and operates industrial facilities nationally. The firm’s portfolio spans 44 million square feet across 29 states, according to its website.

Arch Street Capital Advisors is a full-service real estate investment and advisory outfit, according to its website. The firm acted “on behalf of a capital partner” in the latest deal, according to a statement.

The deal is the ninth joint venture between the two buyers. Together they have acquired nearly 25 million square feet of industrial property over the last 10 years.

Industrial has emerged as commercial real estate’s strongest asset class over the last couple of years, due in large part to the consumers’ increased reliance on e-commerce during the pandemic. Availability nationwide is at historic lows.

Read more

Pretium-backed venture targeted distressed suburbs to become mega-landlord

Pretium-backed venture targeted distressed suburbs to become mega-landlord

John Deere plans to hire up to 300 tech workers for its new Chicago office

John Deere plans to hire up to 300 tech workers for its new Chicago office