Brookfield Properties buys two Chicago industrial buildings for $24.4M

Brookfield Properties buys two Chicago industrial buildings for $24.4M

Trending

Brookfield buys Chicago REIT Watermark for $3.8B

REIT has 25 properties in 14 states, focused on sun belt luxury hotels

Toronto-based Brookfield will acquire Chicago’s Watermark Lodging Trust for $3.8 billion in an all-cash transaction that gives it access to luxury and high-end assets in the Sun Belt.

Brookfield said in a statement that it will buy Watermark’s shares $6.768 per Class A share and $6.699 per Class T share, a premium of more than 7.5 percent above the most recent net asset value per share as of Dec. 31. Brookfield will also assume Watermark’s debt.

Watermark, founded in 2008 and based in the West Loop, has more than 8,100 rooms across 25 properties in 14 states.

“Hotels and resorts of this scale and quality are difficult to replicate,” Brookfield’s Lowell Baron, said in the statement. “This portfolio is well positioned given its concentration in high barrier to entry coastal destinations, gateway cities and the sunbelt.”

Brookfield made waves in Chicago in April, when it walked away from its ownership in Water Tower Mall, an established shopping center on the city’s most famous shopping district, the Magnificent Mile.

Brookfield relinquished the mall to its lender, MetLife Investment Management, a unit of New York insurer MetLife. Water Tower Place was the first indoor mall in Chicago when it opened in 1975 and is part of a development that included condominiums, office space and the Ritz-Carlton Chicago.

The decision underscored how challenging it’s been for landlords and retail tenants on the Chicago shopping strip to recover even as the pandemic wanes. A quarter of retail space on the Mag Mile is vacant.The mall has also lost so much equity that the firm’s investment is gone — it’s now worth less than the $300 million in debt owed on it.

[Connect CRE] — Miranda Davis

Read more

Brookfield Properties buys two Chicago industrial buildings for $24.4M

Brookfield Properties buys two Chicago industrial buildings for $24.4M

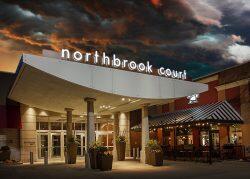

Lender eyes sale of Brookfield’s Northbrook Court mall

Lender eyes sale of Brookfield’s Northbrook Court mall