Trending

Higher property taxes narrow Chicago city deficit by more than $500M

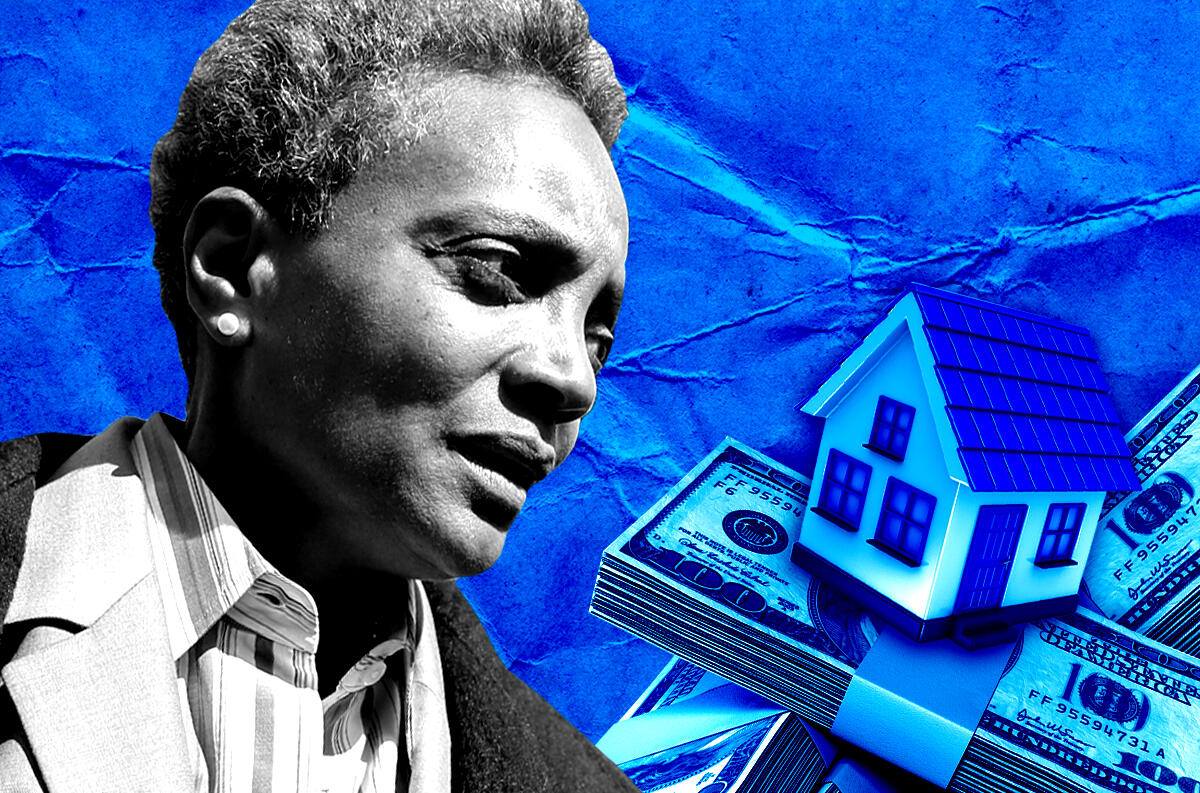

The improved outlook could help Mayor Lori Lightfoot in an election year

Chicago leaders are projecting a much smaller budget deficit in 2023 — about $500 million less.

Initial estimates put the deficit at $866 million; city finance officials are now saying that gap will only be $305.7 million. The city said the figures won’t be final until August, when budget season begins, according to Crain’s.

Much of the money will come from increased revenue from real estate taxes in 2021, which was revealed during a city hall Budget Committee hearing on Wednesday. Federal COVID funds also are contributing to the additional funds.

Should the forecast deficit reduction come to pass as predicted, it could give a big boost to Mayor Lori Lightfoot’s re-election campaign. Lightfoot’s budget will come out in the fall.

An increase in 2021 tax revenue will give the city about $250 million more than it originally expected, with about $201.3 million coming from real estate transactions, according to Crain’s.

The other portion of the money comes from $152.4 million in federal COVID-19 relief funding that the City Council set aside in August.

Earlier this year, the county assessor’s office announced plans to increase assessments on commercial property owners in Cook County. The 75 percent hike on their assessments was roughly three times the increase for homeowners.

Citywide assessments are anticipated to rise by an average of 50 percent as a result of Cook County Tax Assessor Fritz Kaegi’s first triennial reassessment, according to an analysis by property tax appeals firm O’Keefe Lyons & Hynes reported by Crain’s at the time.

“The shift from residential to commercial demonstrates the 2018 under-assessment of large commercial properties in downtown Chicago and elsewhere during the (Joe) Berrios administration,” Assessor’s Office Spokesman Scott Smith told Crain’s, citing assessments by Kaegi’s predecessor.

Kaegi has long said that commercial properties have historically been under-assessed, thereby shifting the tax burden onto homeowners. While independent analyses support that claim, the business community has pushed back against the increases, saying they can’t afford a dramatic hike during the pandemic.

[Crain’s] — Miranda Davis