Apartment landlord Waterton jumps into single-family rentals with $500M JV

Apartment landlord Waterton jumps into single-family rentals with $500M JV

Trending

New York firm buys 20% stake in Chicago landlord Waterton

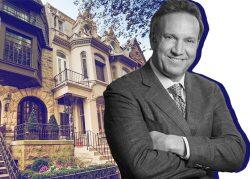

David Schwartz’s Chicago-based company is investing $500M in single-family rentals and targeting assets across the residential spectrum

New York-based Almanac Realty Investors bought a 20 percent stake in Chicago-based Waterton, a residential landlord with more than 6,000 apartments in and near the city and assets across the nation.

Waterton CEO David Schwartz’s move to sell a substantial portion of the business, which includes 26,000 apartments nationwide, adds fuel for the streak of acquisitions across the residential sector the company is plotting.

The company this year jumped into the fast-growing single-family rental market with a $500 million joint venture with Florida-based Second Avenue to buy and build rental homes in the Sun Belt. With the new infusion of cash from Almanac, an affiliate of New York’s Neuberger Berman, Waterton will raise its investments in senior housing and hospitality, as well as its traditional multifamily approach and new single-family rental business.

Earlier this year, Waterton pledged to spend $150 million on multifamily development in Chicago and across the nation. Its Chicago holdings include Presidential Towers, a West Loop complex of four 49-story towers totaling more than 2,300 units that it bought in 2007 from the Pritzker family of Hyatt fortune for about $470 million.

The investment by Almanac is an “exciting development,” Schwartz said in a statement.

The dollar value of Almanac’s stake wasn’t disclosed. The size of Almanac’s stake was first reported by PERE. It is a passive stake, meaning it won’t have a controlling interest.

Waterton was touted as a “best-in-class” real estate investor, particularly for its multifamily prowess, in a statement by Almanac’s Andrew Silberstein. “We are proud to be partnering with this impressive team on this next phase of their growth,” Silberstein said.

Waterton was founded in 1995 and its portfolio included more than $9 billion in real estate assets as of the end of 2021, its website said. Almanac has invested almost $7 billion in 50 real estate companies, and its affiliated companies control $36.5 billion of assets, according to the company.

Read more

Apartment landlord Waterton jumps into single-family rentals with $500M JV

Apartment landlord Waterton jumps into single-family rentals with $500M JV