Compass, Redfin cut hundreds of employees amid cooling market

Compass, Redfin cut hundreds of employees amid cooling market

Trending

@properties, Berkshire brace for cooling market

Chicago brokerages say they’re ready to rein in costs

As home sales slow and Compass and Redfin announce layoffs, Chicago’s @properties and Berkshire Hathaway’s local brokerage say they’re girding for the long haul.

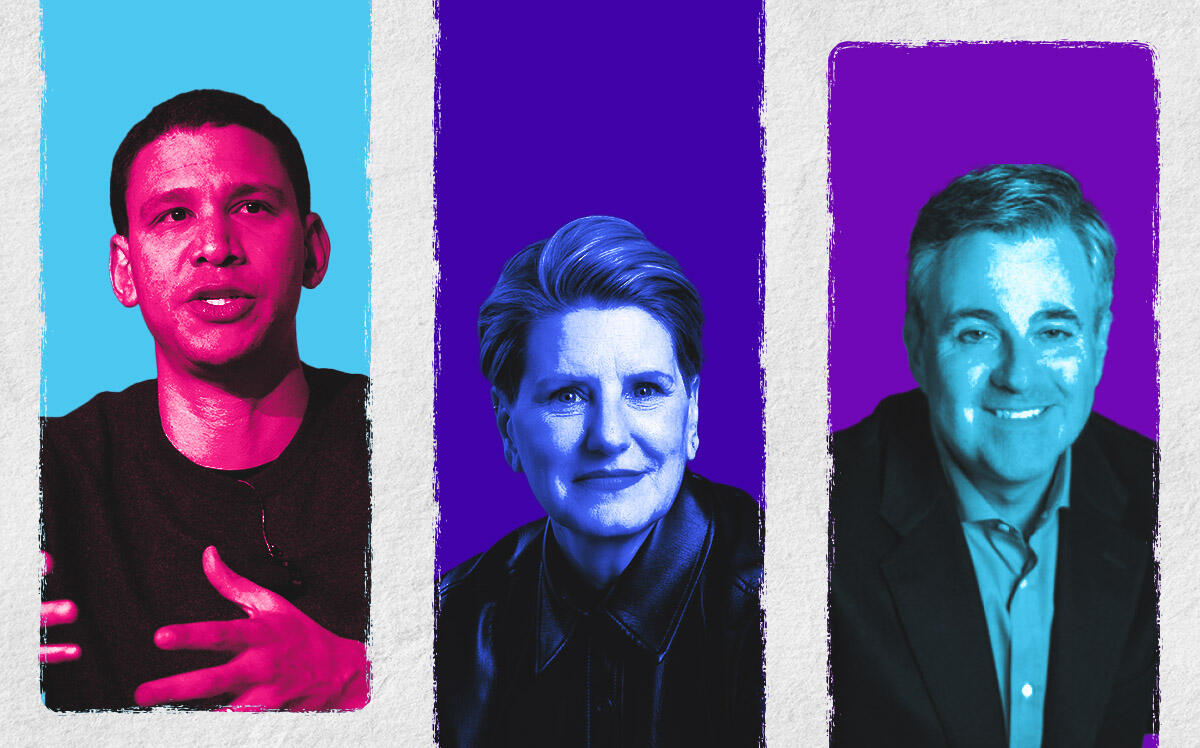

@properties aims to replicate its performance after the 2008 recession, when the brokerage came back larger and with a profit, co-founder and CEO Mike Golden said in an interview. He does anticipate challenges after every major Chicago brokerage posted record years during the pandemic.

“It doesn’t mean it’s going to be fun or easy, but we definitely see opportunity,” he said.

Berkshire Hathaway, meanwhile, is asking top brokers to give presentations to newer agents about building and maintaining a business during a slower market, Diane Glass, the CEO of Berkshire Hathaway Home Services Chicago, said in an interview.

She doesn’t expect a recession to be deep, saying, “When you are coming off of the two best years in real estate, it’s hard to keep perspective.”

Brokers across the nation are taking stock as the seller’s market comes back to earth.

While the S&P CoreLogic Case-Shiller home price index pushed higher in April, it was a modest gain that stemmed less from high demand than from low inventory — a bane of brokerages.

The data underscore concern that rising rates will crimp demand as housing affordability remains stubbornly stuck at a 15-year low. In Chicago, home sales dropped 11 percent in May from a year earlier as prices rose 5.5 percent to $327,000.

Redfin cut about 8 percent of its workforce, or 470 employees, the same day as the Compass cuts. The company cited falling home sales and “a historic jump in interest rates.”

Compass, which started an aggressive Chicago expansion in 2017, five years after its founding, and ranks among the area’s biggest brokerages, said this month it would cut 10 percent of its staff, or about 450 employees, halt moves into new markets and close the title and escrow arm it acquired in 2020.

The New York firm declined to comment about how the layoffs would affect its business in Chicago. CEO Robert Reffkin said on June 14 that the cuts were largely “on teams that do not directly support agents.”

Compass added 398 principal agents in the first quarter, bringing its total to 12,574, and reported a loss in those three months of $188 million on $1.4 billion of revenue and $1.6 billion of expenses. As a public company, it must report earnings on a granular basis, unlike privately held rivals.

After going public in April 2021 at a valuation of $8.2 billion, Compass shares have tanked, leaving it valued at $1.8 billion — less than the $2 billion it raised from investors.

Your blockquote here…

“We’re a cyclical business, you’re going to have up years and down years,” said @properties’ Golden. “The fact that Compass couldn’t make money in one of the most profitable years speaks to the fact that I don’t think they fundamentally understand the business.”

Read more

Compass, Redfin cut hundreds of employees amid cooling market

Compass, Redfin cut hundreds of employees amid cooling market

Compass reports $188M first-quarter loss, CFO’s resignation

Compass reports $188M first-quarter loss, CFO’s resignation

Times ahead will be tough for brokerages that don’t control their expenses, Glass noted. “Not all real estate companies are equal,” she said.

Chicago has about 17,500 brokers, up from 16,000 at the end of 2020, according to the Chicago Association of Realtors. The increase was less than in other markets, reflecting relatively subdued price increases. The area is normalizing after a spurt of breakneck growth, said Maria Dickman of the Chicago Association of Realtors.

A slower market is coming and with it, a likely departure of agents, something that’s hard to track given their status as independent contractors. Golden said it’s not necessarily a concern if agents who joined the profession during the peak of the market depart as the pace of buying and selling slows.

“What happens is the better brokers survive,” he said.

CORRECTION, 7/1/2022, 10:45am: This story has been corrected to show that Compass is among the area’s biggest brokerages.