Chicago office buildings among most expensive outside NYC

Chicago office buildings among most expensive outside NYC

Trending

Loop office building owners face borrower woes

Jackson Boulevard and LaSalle Street buildings continue to struggle from the pandemic

Two Loop landlords are on the brink of default.

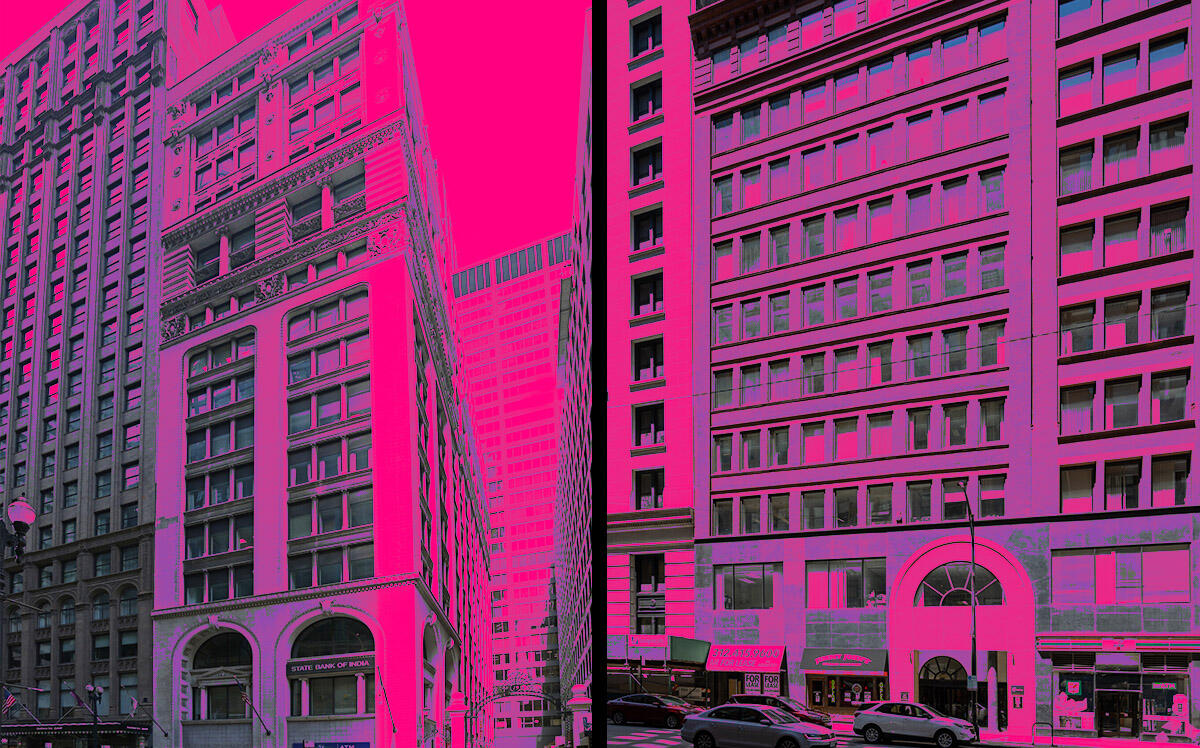

A $16.5 million loan on the 10-story building at 216 West Jackson Boulevard was transferred to a special servicer this month and a separate $19 million loan on the 16-story office property at 19 South LaSalle Street has matured after being transferred to a special servicer months ago, Crain’s reported. Both loans were sold off to commercial mortgage-backed securities investors.

Many Loop landlords were hit hard by the pandemic as remote work resulted in empty office space. Older buildings face additional headwinds due to their dated appeal and a lack of flexibility to accommodate modern professional needs.

Owners of the Jackson and LaSalle buildings are still current on their loans, according to Bloomberg. However, right now neither are generating enough revenue properties to offset their annual debts.

Marc Realty paid $2.3 million for the 198,000-square-foot Jackson Boulevard building in 2013. When the building was purchased it was nearly fully occupied. The company listed the building in February 2020, expecting to fetch bids nearing $27 million. But its viability was stymied by the pandemic in months that followed and its occupancy fell to 62 percent. Last year its net cash flow was $629,000, which was $371,000 short of its annual debt.

Marc’s loan was transferred to special servicer LNR Partners due to “imminent default due to cash flow issues,” according to Bloomberg. It’s scheduled to mature in October 2023.

The LaSalle Street building was purchased by Ruben Espinoza for $22 million in 2019. It was 61 percent leased at the time. Espinoza looked to pack the 129-year-old building with new tenants, but the pandemic squashed those plans. Last year, the 159,000-square-foot building’s occupancy dropped to 56 percent and it generated less than $147,000 in net operating income — much less than the $1.1 million debt service payment for 2021.

In May, Espinoza’s loan was transferred to special servicer KeyBank. The loan report said Espinoza was looking into potential redevelopment options ahead of the mortgage’s July 10 maturity date.

Read more

Chicago office buildings among most expensive outside NYC

Chicago office buildings among most expensive outside NYC

Leases more than doubled for 2 companies in West Loop office building

Leases more than doubled for 2 companies in West Loop office building

— Victoria Pruitt