Trending

LA retail market took a dip in Q4: report

Los Angeles retail tenants actively shopped for space in the first three quarters of 2015 — until they dropped in the fourth quarter.

Demand for retail properties in the Los Angeles basin dipped in Q4, despite a strong performance earlier in the year, according to a new report by Colliers International.

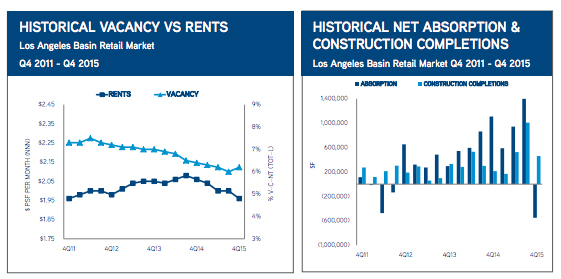

Indeed, the regional market, which includes Orange County and Inland Empire, actually recorded negative absorption of more than 550,000 square feet in the fourth quarter — the first time negative absorption has been recorded since the third quarter of 2012, the report shows.

The Los Angeles Country retail market accounted for the greatest decline in absorption, at 517,500 square feet, causing its vacancy rate to rise by 20 basis points to 5 percent. But rents still remained high — averaging $2.23 a foot for a triple net lease — thanks to a spate of new retail developments with high price tags.

There is approximately 827,600 square feet of new retail space under construction across the county, according to Colliers.

The largest property currently under construction in the area is a 470,000-square-foot IKEA facility in Burbank.The dip comes on the heels of what was a strong first three quarters of the year for retail. L.A. County had recorded position absorption of 870,700 in the third quarter and vacancy had dropped 10 basis points to 4.8 percent.