Trending

Lawmakers reach sweeping housing deal with “good cause eviction,” new 421a

Lawmakers reach sweeping housing deal with “good cause eviction,” new 421a “Investing before the ‘all clear’ sign”: Jon Gray on Blackstone’s $10B apartment deal

“Investing before the ‘all clear’ sign”: Jon Gray on Blackstone’s $10B apartment deal Tony Park and Elad Dror take a gamble on Koreatown office-to-resi conversion

Tony Park and Elad Dror take a gamble on Koreatown office-to-resi conversion Victor Sigoura picks up site of failed West Chelsea condo for $87M

Victor Sigoura picks up site of failed West Chelsea condo for $87MZell’s Equity Residential drops revenue forecast for second time in 2016

Firm cites “continued weakness in its New York portfolio”

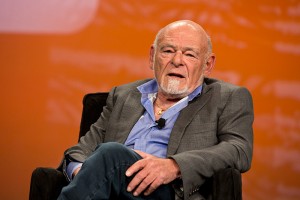

A few days after he expressed deep pessimism about property markets nationwide, Sam Zell’s Equity Residential is again lowering its 2016 revenue forecast.

The Chicago-based landlord, which as of late January owned about 85,000 apartments nationwide, said revenue growth on its properties this year will likely be no higher than 4.5 percent, specifically citing the company’s assets in New York.

The reduction is Equity’s second this year. It dropped its forecast to 5 percent from 5.25 percent in April, Bloomberg reported.

“The revision is being driven by continued weakness in its New York portfolio and recent under performance in the company’s San Francisco portfolio,” the company said in a statement, according to Bloomberg. “New lease rates are not meeting original projections due to new rental apartment supply.”

The company’s share price fell about 3.2 percent on the news, to $67.01.

The Manhattan rental market has appeared increasingly precarious to many over the past few months. Landlords offered incentives on 13 percent of new leases in April, up 2.7 from April of last year, and dropped original asking rents by about 2.9 percent on average, according to a report by appraisal firm Miller Samuel for Douglas Elliman.

Rental inventory spiked that month as well, according to the report, with a total of 6,718 listings on the market, an increase of 23 percent year over year.

“No one ever accused me of not being a realist,” Zell told CNBC this week.

Still, Manhattan’s median rent was up after having fallen in March for the first time in two years. The rate rose 1.4 percent over last year in April, to $3,415, according to the report. [Bloomberg] – Ariel Stulberg