Trending

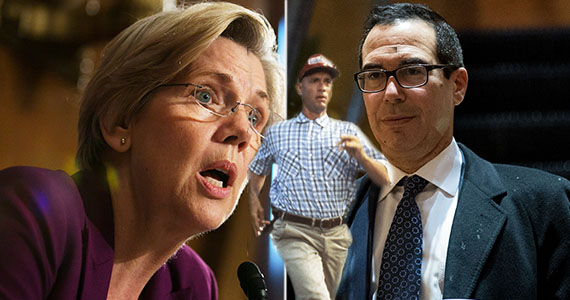

Elizabeth Warren called Trump’s Treasury pick the “Forrest Gump of the financial crisis”

Steve Mnuchin announced he’d been tapped for Treasury Secretary by President-elect Donald Trump only yesterday — but he is already a divisive figure.

Mnuchin, who had a history of problems with regulators over the foreclosure practices of his bank — OneWest, based in Pasadena — served as Finance Chairman of Trump’s campaign. One of his main priorities in the cabinet is a loosening post-crisis regulations, he said Wednesday, according to the Los Angeles Times.

“We’re really going to be focused on economic growth and creating jobs,” Mnuchin said. “The No. 1 priority will be to make sure banks lend.” He has stated that tax cuts are also on his agenda.

U.S. Senator Elizabeth Warren of Massachusetts has called Mnuchin “the Forrest Gump of the financial crisis” because he “managed to participate in all the worst practices on Wall Street” during his lengthy career.

The former Goldman Sachs partner of 17 years worked for George Soros before starting hedge fund Dune Capital Management. When he confirmed the appointment on CNBC, he appeared alongside billionaire investor Wilbur Ross, who was named Commerce secretary. The selection was cheered by some financial industry insiders, despite the fact that it ran counter to the anti-establishment rhetoric of the Trump campaign.

Tim Pawlenty, head of the Financial Services Roundtable, a Washington organization that represents the nation’s largest banking and financial services companies, praised the choice. “Steve is a seasoned and results-oriented leader who is really smart, interested in public policy and understands the urgent need to boost economic growth and opportunity,” Pawlenty told the Times.

Dennis Kelleher, chief executive of Better Markets, a nonprofit that advocates for tighter Wall Street regulation said that Mnuchin should, instead of loosening regulations, subject more financial firms to the kind of strict scrutiny now reserved for the largest banks.

“If you have a Treasury secretary who doesn’t think that type of regulation is appropriate, the country is going to end up in a disastrous situation.” Kelleher told the Times.

In 2011, dozens of activists protested the foreclosure practices of OneWest on the lawn of Mnuchin’s 22,000-square-foot Bel-Air mansion. That same year, the federal Office of Thrift Supervision hit the bank with a regulatory order saying it had failed to follow procedures when foreclosing on homeowners.

“Steve Mnuchin ran a foreclosure machine,” Paulina Gonzalez, executive director of the California Reinvestment Coalition, told the Los Angeles Times. OneWest’s reverse-mortgage business is currently being investigated by the HUD.

In defense of OneWest on Wednesday, Mnuchin said, “We saved a lot of jobs and created a lot of opportunities for corporate loans.” [LAT] — Gabrielle Paluch