Trending

Father-daughter team accused of $50M EB-5 fraud scheme

FBI says 100 Chinese nationals invested in projects that never happened

Prosecutors accuse a California father-and-daughter team of running a $50 million EB-5 visa fraud scheme that helped fugitive criminals land U.S. residency.

According to an affidavit filed Wednesday, Victoria Chan, a lawyer and her father Tat Chen raised money from around 100 Chinese investors for hotel and real estate developments and applied for EB-5 visas, but never actually invested the money in any projects, according to the Wall Street Journal.

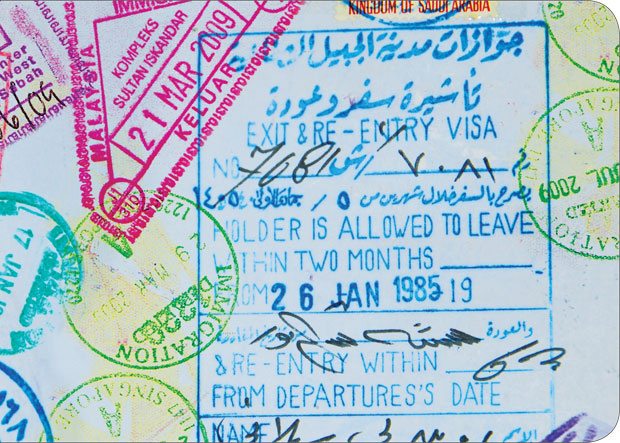

The EB-5 program grants permanent residence to foreign nationals who invest at least $500,000 in qualifying projects that produce jobs in the U.S. The program has been a popular source of funding for New York’s real estate developers, and a Bloomberg report from last month said Chinese investors are scrambling to get their applications in before the current program expires on April 28.

The latest scandal, following on earlier fraud cases in Vermont and South Dakota, comes as the U.S. Senate debates the future of the program. Critics of the program argue that it is rife with fraud and doesn’t do enough to funnel money into poor areas, as intended. “For some developers, any change to the status quo is a threat to their bottom line,” Vermont Senator Patrick Leahy said at a March hearing. “And Congressional leadership has allowed a couple of powerful developers who exploit this program’s flaws to derail critical reforms. That is unacceptable. The worst abusers of a government program should not be given veto power over its reform.”

One proposed reform would raise the minimum investment and change the criteria for qualifying projects.

According to the affidavit, some of the Chans’ investors knew their money didn’t actually go into any projects but went along because they wanted to get a green card and saw returns as less important. Some of the investors who landed green cards under the scheme were fugitive Chinese nationals accused of white-collar crimes like bribery. [WSJ] — Konrad Putzier