Trending

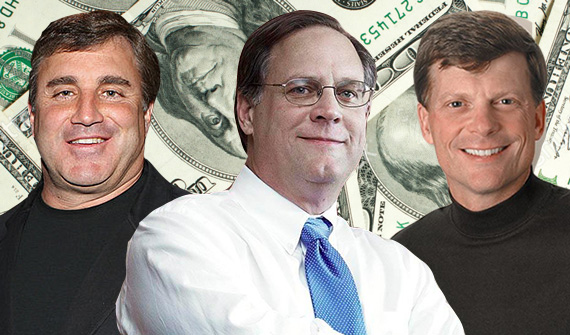

Payday! Here’s what some of LA’s top real estate players are making

From the April issue: The Los Angeles real estate market has been on a roll in recent months, posting record prices in both the residential and commercial sectors.

So who’s taking home all those handsome profits?

The Real Deal took a look at SEC disclosures to find out how much bosses at some of the most influential public companies involved in the L.A. market are personally benefiting from the boom.

Read on for a closer look at who’s making how much and why.

799.2 million

799.2 million

Stephen Schwarzman, Blackstone

Billionaire Blackstone boss Stephen Schwarzman took home a whopping $799.2 million in total compensation in 2015, the most recent year for which his salary was publicly available.

The private equity guru’s pay packet mainly comprised dividends from his ownership stake in the company, which is around 20 percent. His base salary has been just $350,000 since the company went public in 2007.

Schwarzman may have more reason to celebrate soon. His company is in contract to sell the 205,000-square-foot Wilshire Palisades building at 1299 Ocean Avenue in Santa Monica for about $287 million, or $1,400 per square foot, a record price for the area.

Schwarzman is also the head of President Donald Trump’s economic advisory council.

12.7 million

David Neithercut, Equity Residential

Equity Residential CEO David Neithercut, top consigliere to the company’s founder, Sam Zell, posted a $12.7 million pay packet in 2015 — $11.8 million was tied to his performance over the next three years at the company, according to SEC filings. Neither cut will see that cash only if he meets certain targets, the filings show.

“The compensation committee believes that as the responsibilities of our executives increase, the proportion of their total compensation that is ‘at risk’ and dependent on the company’s performance should also increase,” the company said in the filings.

The Chicago-based real estate investment trust has been on an L.A. spending spree in recent months. The company recently acquired a 298-unit apartment complex at 1710 North Fuller Avenue in Hollywood for $98 million, or $328,859 per unit. It also has plans to build a 33-story tower called the Beacon at the corner of Fourth and Hill streets Downtown.

11.56 million

11.56 million

John Kilroy Jr., Kilroy Realty

John Kilroy Jr., the president and CEO of Kilroy Realty, got a $11.56 million package from the firm in 2015, up from $10.94 million the year prior, according to the most recent SEC filings.

That packet comprised a $1.23 million base salary plus $6.2 million in stock awards and $3.8 million in non-equity incentive-based compensation.

Kilroy’s employment contract, which is slated to expire next year, also provides for a company car.

The real estate mogul is likely to get another cash infusion soon, from the sale of his house. He put his Malibu estate on the market in March for $10.8 million, or $1,535 a square foot.

In 1981, Kilroy Jr. took over the company from his father, who was a famed yachtsman. Kilroy Sr. died in October 2016 at age 94.

Kilroy Realty recently acquired the former headquarters of Playboy Entertainment on Sunset Boulevard for $210 million, or $1,179 per square foot, one of most expensive deals ever recorded in West Hollywood.

11.06 million

Howard Lorber, Douglas Elliman

Douglas Elliman CEO Howard Lorber took home $11.06 million in total compensation in the 2016 calendar year, including a $3.13 million base salary, according to SEC filings. That’s a dramatic drop from the $42.5 million he took home in 2015, though he previously told TRD that year’s number was inflated by a couple of major stock awards.

As part of his employment agreement, Lorber is entitled to various benefits, including a company car and driver, a $7,500-per-month allowance for lodging and related business expenses, two club memberships and use of the corporate aircraft.

The brokerage exec is no stranger to the high life. Last year, he shelled out $15 million for a half-floor spread at 432 Park Avenue in New York, a luxury mega-tower that’s attracted a host of international billionaires. He’s also said he plans to nab a condo unit at the Edition Hotel in West Hollywood, which he is developing in partnership with the Witkoff Group.

Lorber also sits on the board of Nathan’s Famous, the hot dog company, and is a director of the Morgans Hotel Group.

8.65 million

8.65 million

Richard Smith, Realogy

Realogy CEO Richard Smith, whose company oversees residential real estate firms such as the Corcoran Group, Citi Habitats, Sotheby’s International Realty, Century 21, ERA and Coldwell Banker, took home $8.65 million last year, down from $9.1 million the year prior. His compensation included a $1 million base salary, $4.95 million in stocks as well as other incentive-based compensation.

The dip is at least partially due to missed performance targets. In an SEC filing, Realogy noted that it set robust annual bonus performance goals for 2016 and paid executives at approximately 70 percent of those targets, “principally due to the market share losses at [subsidiary] NRT and the lack of improvement in the company’s operating leverage.”

Smith does get other perks, though. He’s the only executive permitted to fly at will in a jet co-owned by the company, though he has to pay for it when using it for personal travel.

7.54 million

Jordan Kaplan, Douglas Emmett

Douglas Emmett may be shelling out top dollar for properties all over L.A., but when it comes to executive compensation, the company’s a bit more conservative.

The company’s president and CEO, Jordan Kaplan, made $7.54 million in 2015, including a base salary of $1 million and $6.5 million in additional incentive-based compensation, public filings show.

That’s up from $6.4 million the previous calendar year.

In SEC filings, Douglas Emmett said it purposefully limits perks for its executive officers, who don’t get pension benefits beyond regular participation in the company’s 401(k) plan. They do get a company car and are entitled to use their secretaries for personal matters in order to “increase efficiency.”

Still, Kaplan isn’t exactly short on spare cash.

He bought his Pacific Palisades home, formerly owned by Paramount Chairman and CEO Brad Grey, for $21.5 million in 2010, records show.

Douglas Emmett has been on a spending spree in recent months, outbidding its competitors for trophy properties, oftentimes in partnership with the Qatari Investment Authority. Last year, the duo bought a four-building Westwood office portfolio from Blackstone for $1.3 billion.

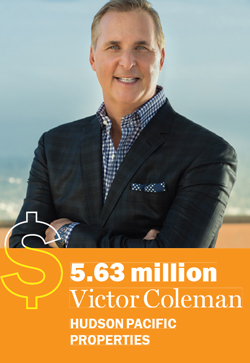

5.63 million

5.63 million

Victor Coleman, Hudson Pacific Properties

Victor Coleman, who heads Hudson Pacific Properties, pocketed $5.63 million in 2016, down from $8.86 million the year prior. That included a base salary of $725,000, $3.43 million in stock awards as well as other incentive-based compensation.

Coleman declined to comment, but sources said his compensation for 2015 was abnormally high because of a one-time stock award connected to the completion of HPP’s $3.5 billion acquisition of an 8.2-million-square-foot Northern California office portfolio from Blackstone, which effectively doubled the size of the company. HPP’s total market cap grew from $2.8 billion to $6.4 billion because of the acquisition.

While Coleman, a Canada native who lives in Pacific Palisades, doesn’t appear to be much of a big spender, he did once attempt to bring a National Hockey League franchise to Seattle.

4.96 million

Robert Sulentic, CBRE

Global CBRE chief Robert Sulentic took home $4.96 million last year, a drop from the $7.7 million he pocketed in 2015, SEC records show.

That included a base salary of $990,000, a $500,000 bonus and $2.06 million in stock.

Executives at the brokerage saw their salaries drop after the firm narrowly missed internal growth targets, primarily due to generally softer marketwide property sales volumes and tepid global economic growth, according to public filings.

Still, the firm didn’t do poorly overall.

CBRE reported net income of $778.5 million in 2016, up 16 percent from the prior year.

4.03 million

Michael Schall, Essex Property Trust

For his role as CEO of Essex Property Trust, Michael Schall made $4.03 million during fiscal year 2016, according to SEC filings. That includes a base salary of $650,000, stock awards of $1.14 million and more than $1 million in non-equity incentive-based compensation.

That’s up from just $3.52 million in 2015, records show.

Schall’s 2016 bonus was tied to certain objectives, including ranking in the top quartile of multifamily REITs and executing succession planning.

Equity’s recent L.A. deals include the sale of the Jefferson at Hollywood apartment complex to a joint venture between Redwood Urban and Beverly Pacific for $132.5 million, or $490,740 a unit.