Trending

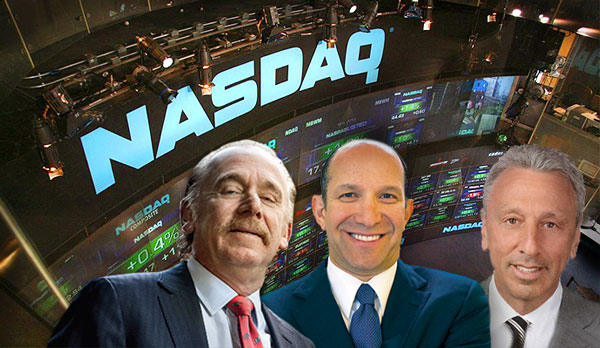

Newmark files for $100M IPO

Commercial brokerage NKF is being spun off from its parent BGC Partners

From TRD LA: Newmark Group filed for a $100 million initial public offering with the U.S. Securities and Exchange Commission on Monday.

The entity, which is being spun off from its parent company, Howard Lutnick’s BGC Partners, will include the commercial brokerage Newmark Knight Frank and the mortgage firm Berkeley Point.

Newmark plans to list on the Nasdaq under the symbol NMRK. Goldman Sachs, Bank of America Merrill Lynch, Citibank and Cantor Fitzgerald are affiliates on the deal.

The New York-based Newmark Group generated revenues of $1.5 billion for the 12-month period ended June 30, 2017, according to its registration statement.

BGC acquired Berkeley Point in July for $875 million to increase the scale of Newmark as the IPO neared. When it acquired the brokerage, then known as Newmark Grubb Knight Frank, in 2011, Lutnick described the move as a “dramatic new footprint in commercial real estate by BGC.”

Last year, NKF’s president Jimmy Kuhn said the brokerage quadrupled its revenue since it was acquired by BGC, and talked up brand-name poaches such as Kevin Shannon, a CBRE alum who is one of the top investment sales brokers on the West Coast, and Robert Griffin, who enjoys a similar reputation in New England.

Earlier this month, Jeff Gural stepped down as the chairman of NKF as part of a larger effort to differentiate the Gural family’s business from the brokerage prior to the IPO.