Trending

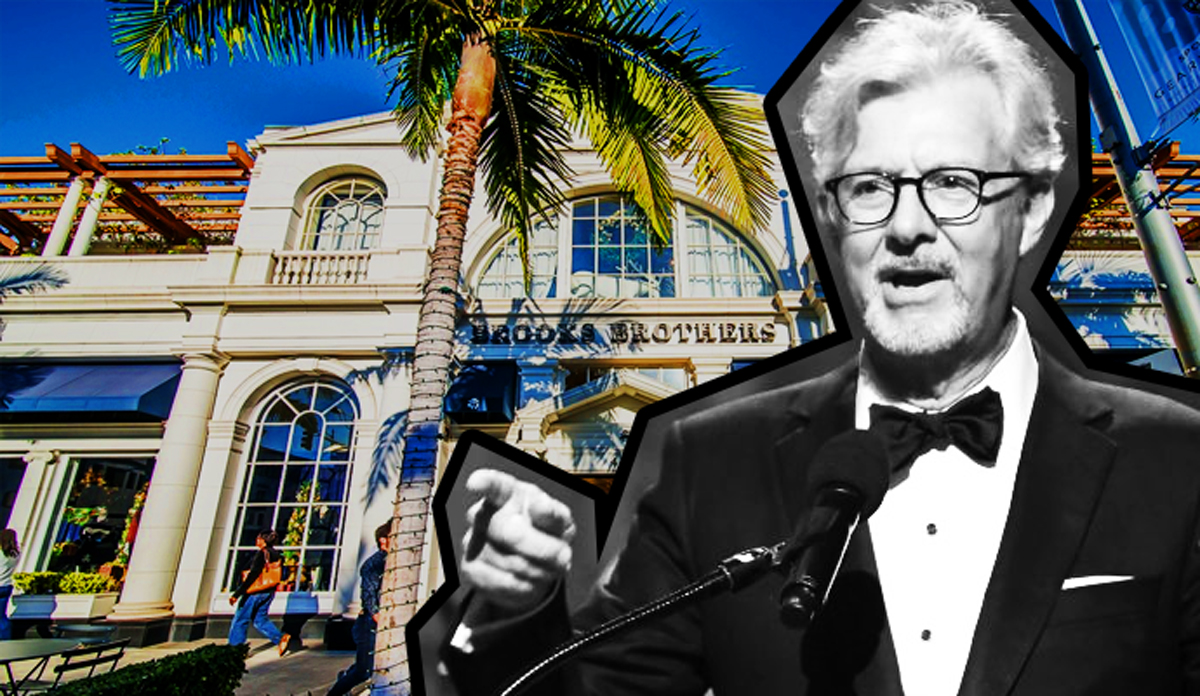

Everything must go: Brooks Brothers shutters Rodeo Drive storefront

The 2-story prime location is on the market for $300M

After 15 years on the corner of Rodeo Drive and Santa Monica Boulevard, Brooks Brothers is packing up its Oxford shirts and Golden Fleece logo.

The nation’s oldest men’s clothier is vacating its store at 468 N. Rodeo Drive in Beverly Hills at the end of the month, according to Los Angeles Business Journal.

The two-story building along that prime retail stretch went on the market in May, seeking a whopping $300 million. The double-lot property has been owned by a family trust for over 50 years, according to listing broker Jay Luchs of Newmark Knight Frank.

The existing building has a 12,170-square-foot ground floor and 10,100-square-foot mezzanine level. A sale at $300 million would pencil out to around $13,482 per square foot.

Brooks Brothers’ move could indicate that the owners are clearing out the building to better market it as a development opportunity. Marketing materials show the site could be redeveloped with a larger 30,000-square-foot building.

A sale of $300 million still wouldn’t eclipse some of the top trades on Rodeo Drive in recent years, in terms of price per square foot.

French fashion house Louis Vuitton recorded two higher purchases — a $19,405 per square foot buy at 420 N. Rodeo Drive and a $17,740 per square foot acquisition at 456 N. Rodeo Drive. But both of those purchases were for spaces under 6,300 square feet.

Brooks Brothers’s planned departure will leave the retailer with two other Los Angeles locations, one in Downtown and another in Torrance.

The move comes as brick and mortar retailers nationwide struggle to survive amid the rising competition from online companies. Discount retailers however, have been expanding despite the so-called “retail apocalypse.” Some investors are taking advantage of the state of the market. Companies like the Sterling Organization are acquiring shopping centers at steep discounts, with the hopes of turning them around. [LABJl] — Dennis Lynch